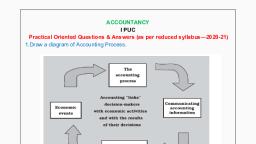

Page 1 :

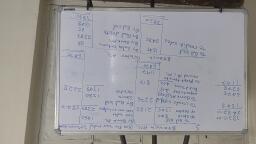

Branch Accounting, Branch Accounting- Accounting method, Transaction between Head office & Branch, Minakshi Sarees, Pune (Head Office) -HO, Chakan, Rajgurunagar (Branches) – BR.– Agent, Branches works as middleman of Head Office, HO – Branch, 500 – 700+100=800 300, Chakan branch wants to returned to HO -Pune, Rajgurunagar branch wants goods from HO, Chakan goods transferred goods to Rajgurunagar, Receiver branch = Rajgurunagar, debit rcvr, Giver branch = Chakan, gvr- cr, Rajgurunagar Br. A/c …Dr, To Chakan Br, Head office Pune A/c…..Dr, To Chakan Br. A/c, Rajgurunagar Br. A/c …Dr, To Head office Pune A/c, Inter branch transaction - Loading, Goods Purchase, Goods Sold, Expenses of branch, Opening Stock, Closing Stock, Returns, HO ---→ Goods to be sent -> Branch, Branch -> sales -> Customers -> Cash / credit/BR?Cheque, Branch -> sent cash to HO, Branch returns goods to HO, Customers returns goods to Branch, Customers directly returns goods to HO, HO => Br => Customer, Customer returned to BR, Branch ret good s to HO, Br..A/c….Dr, To Customer A/c, HO A/c …Dr, To Branch A/c., HO A/c …Dr, To Customer A/c, Expenses => Petty Expenses किरिोळ खर्च & Branch Expenses, Petty cash, Loading, 100 – 120 = 20 profit (Branch), 80 + 20 = 100 percentage, Original price (cost)

Page 2 :

80, 100, , 20, ????, , 25%(On original Cost), , What is loading on recorded value 20%(On recorded Cost), Head office sent goods to branch by charging 25% loading on Original cost, Profit = Selling price – Actual / Original cost, Profit = 120, 80 (HO) = 40, Loading charge, cancel the loading, Pen 4 Rs. SP 5 (what is the percentage of profit), Rs. 1, Value Profit, 5, 1, 100, ???, 20% on Selling Price, Pen 4 Rs. SP 5 (what is the percentage of profit on its original cost/actual price), Rs. 1, Value Profit, 4, 1, 100, ???, 25% on Original Cost, Original Cost + Loading = selling Price, Loading is 20% on OC, 100 + 20 = 120 =, SP 16.66%, Loading is 20% on SP, 80 + 20 = 100, , OC – 25%, , Only on transaction between HO & Branch related to goods, Particulars, , Recorded, Value (Br), Open Stock, 60000, Closing Stock, 40000, Goods sent to branch, 120000, Branch returns goods to HO 2000, , Rec, , OC, , 100, 100, 100, 100, , 80, 80, 80, 80, , Independent Branches स्वतंत्र शाखा (transaction- barnches A/c – Br), open Mkt -, , Dependent Branches, Those branches which are totally dependent on Head office for every transaction, • Entire goods will be purchased from HO (can’t purchase from Open Market), • Cash/Fund realized from sales of goods will be immediately transferred / sent to HO, • Entire Expenses of Branch will be paid by HO (Cheque will be sent), • Petty cash balance will be maintained for small/petty expenses at branch level., Accounts to be prepared by Ho, Branch Account, Debtors A/c, Petty Cash A/c

Page 3 :

Accounting 3 method, 1. Debtors method recorded value (opposite side loading), 2. Stock & Debtors method (separate account), 3. Trading & Profit Loss A/c Method (Trading – net value) – recorded value (-) Loading, Debtors method recorded value (opposite side loading) – 3 Accounts, 1. Branch A/c,, 2. Debtors A/c, 3. Petty Cash A/c, Trading And Profit & Loss A/c method – Net price / original cost (Inv.Price (–) load.) – 2 Accounts, 1. Trading A/c,, 2. Profit & Loss A/c, Stock & Debtors method (separate account), A/c, Stock A/c, Goods Sent to Branch A/c (GSTB), Branch adjustment A/c, Stock Reserve A/c, Branch Expenses A/c, Debtors A/c, Petty cash A/c, Cash A/c, , Purpose, Deficit/Surplus, Goods recd from Ho, returned to Ho, transfer made, trn.rcvd, For loding on Goods, GP, Loading on Open St. / Clos Stock, All exp paid by Head Office, Petty exp, Debtors exp (total tran to P &L), Cr sales, open bal, cls, bal , bad debts, Petty exp, op bal, cl bal cash recd, , Trading & profit & loss (net values – Original cost = recorded value (-) Loading, Branch transfer goods to branch Inter branch transaction, Hints Entries in Branch a/c, Asset Open bal Dr, Asset Clos bal Cr, Liability Open bal Cr, Liability Clos bal Dr, Goods recd from HO -Dr, Goods returned to HO -Cr, Cash/Fund recd from HO -Dr, Cash/Fund sent/remitted to HO -Cr, Calculation on Loading on, 1. Open Stock, 2. Clos Stock, 3. Goods recd from HO -Dr, 4. Goods returned to HO -Cr, 5. Transfer to other our Branch Cr, 6. Transfer recd. From other Branch Dr, 7. Surplus (Stock A/c Dr), 8. Deficit (Stock A/c Cr), , Loading - Cr, Loading - Dr, Loading - Cr, Loading – Dr, Loading – Dr, Loading – Cr

Page 5 :

Debtors Method - Branch A/c, Debtors a/c, Petty Cash A/c, Calculation of Loading (CHECK LOADING IS ON ORIGINAL COST/ ACTUAL COST, 25% ON COST PRICE, LET US ASSUME CP TO BE 100, CP + LOADING = INVOICE PRICE, 100 + 25, = 125(200000), 25% ON INVOICE PRICE, LET US ASSUME IP TO BE 100, CP + LOADING = INVOICE PRICE, 75 + 25 = 100, 25/125 = 1/5 20%(Invoice price), Sales = CASH SALES + CREDIT SALES, 300000 = 50000 + 250000, , , Cost Price= 25% 1/4, , SP/ INVOICE PRICE/Recorded)

Page 6 :

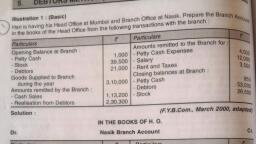

Particulars, , Debtors method, In the books of Bharat Traders, Baroda (Head Office), Surat Branch A/c, Debit Amt Particulars, , Asset Opening balance, • Open Stock, • Debtors, • Petty Cash, • Furniture, To Cash received from HO, Salaries, Rent, Advt., Petty Cash, Transfer goods recd., To Goods sent to Branch (recd, fr HO, To loading on Clos stock, (57600 *1/5 (20%), Loading on goods ret to Ho, Liability Closing balance, • Creditors, • B/P, • O/s Exp, • Income recd in Adv., To Manager Commission 10%, on profit, (3,35,750- 415750) =80000, 80000*10/100, To Net profit, , 100000, 10000, 100, , 9530, 2400, 1200, 1000, , By loading on Open stock, (1,00,000 *1/5 (20%), Liability Opening balance, • Creditors, • B/P, • O/s Exp, • Income recd in Adv., BY Cash sent to head office, Cash sales, 50000, Cash Received from Debtors 1,90,000, B/R recd from Debtors, 4000, , Our branch Transfer/sent goods to other branch, 200000 By Goods sent to Branch (Loading on goods recd fr, HO) 200000*20/100, 11520, ----- By Goods sent to Br (Return to head office), Asset Closing Balance, • Closing Stock, • Debtors, • Petty Cash (Missing info), • Furniture, , CrrAmt, 20000, , 244000, , 40000, , ----57600, 54000, 150, , 8000, 72000, , 4,15,750, , Total, , 4,15,750, Debtors A/c, , ज्याने उधारी वाढे ल, , To Open Bal, To Credit Sales (Br. Stock), (Missing information/Bal Figure), , ज्याने उधारी िमी होईल, , 10000 By cash recd, ????? By B/R (cheque), , 190000, 4000, , 250000, , To B/R Dis…, To interest charge/penalty for dues, , By sales return by drs, By discount given to drs, By bad debts, By allowance given to drs, By bal c/d, , 2,60,000, , 2000, 4000, 4000, 2000, 54000, , 2,60,000, , Petty Cash A/c, आलेले पैसे, , To bal b/d (Open Bal), To Cash recd from head office, , गेलेले/ खर्च पैसे, , 100 By petty expenses paid by branch, 1000 By bal c/d (closing balance), (Missing information/Bal Figure), 1100, , 950, ??????, 150, 1100

Page 7 :

Trading & P&L A/c method, , Particulars, To Open St, 100000*100/125 4/5, , To Purchases, 200000*100/125 160000, Less: Pur. return -------To Gross profit tran to P&L, To G/P c.d, , In the books of Bharat Traders, Baroda (Head Office), Trading A/c, Debit Particulars, Amt, 80000 By Sales, Cash, 50000, Credit, 250000, 300000, Less: Sales ret -2000, 160000, , 1,04,080 By Clos St, 57600*100/125 4/5, , 3,44,080, , Crr, Amt, , 298000, , 46,080, , 3,44,080, P & L A/c, , To discount given to drs, To bad debts, To allowance given to drs, To Expences paid by HO, Salaries, Rent, Advt., To actual petty expenses paid by BR, To Comm to mgr 10%, 80000 * 10/100, (total Income 1,04,080 total exp 24,080), 80000 rough profit -80000, (80000 -8000) = 72000, To net Profit, , 4000 By Gross profit tran from Tr, By G/P b.d, 4000, 2000, , 1,04,080, , 9530, 2400, 1200, 950, 8000, , 72000, 1,04,080, , 1,04,080

Page 8 :

Particulars (In), To bal b/d, , Stock & Debtors Method, In the books of Bharat Traders, Baroda (Head Office), Stock A/c, Debit Particulars (Out), Amt, 100000 By Branch Cash(Cash sales), , To goods sent to Br, To Br Debtors(Sales ret), To Surplus Stock, • Profit & Loss 44,480, • Br. Adj A/c (load)11120, , 200000 By Branch Debtors (Cr. Sale), 2000, 55600 By bal c/d, , 3,57,600, Particulars (In), To branch adj A/c, To net Purchase, (after returns / loading, (balancing figure), , Crr, Amt, 50000, 250000, 57600, , 3,57,600, , Goods Sent to Br A/c, Debit Particulars (Out), Amt, 40000 By branch stock A/c, , Crr, Amt, 200000, , 160000, , 200000, , 200000, , Debtors A/c & br, To Open Bal, To Credit Sales (Br. Stock), (Missing information/Bal Figure), , 10000 By Br Cash (cash recd), ????? By B/R (cheque), , 190000, 4000, , 250000, , To B/R Dis…, , ---- By Br stock (sales return by drs), By Branch expences, ----• Discount given to drs, • Bad debts, • Allowance given to drs, By bal c/d, , To interest charge/penalty for dues, , 2,60,000, , 2000, 4000, 4000, 2000, 54000, , 2,60,000, , Branch expences A/c, Particulars (In), To Br. Debtors, Discount 4000, Bad debts 4000, Allowances 2000, To Br. Cash (Exp paid by HO), (salary 9530, rent 2400, Advt, 1200, To petty cash (actual exp), , Debit Particulars (Out), Amt, 10000 By P & L A/c, (all expences transferred, To P&L a/c), , Crr, Amt, , 24,080, , 13130, , 950, , 24,080, , 24,080

Page 9 :

Particulars (In), To open bal, To Br. Stock Cash sales, 50000, Cash Received from Debtors 1,90,000, B/R fro Drs, 4000, To Cash/Cheque recd for exep, , Branch Cash A/c, Debit Particulars (Out), Amt, --------244000 By cash sent to HO, , 13130 By Br Expences a/c (expenses paid, (salary 9530+, rent 2400 +, Advt, 1200, By bal c/d, , 257130, , Crr, Amt, 244000, , 13130, , ------, , 257130, , Petty Cash A/c, आलेले पैसे, , To bal b/d (Open Bal), To Cash recd from head office, , To stock reserve A/c (load on Clos. st), To Gross profit c/d to P&L, , गेलेले/ खर्च पैसे, , 100 By Br exp (petty expenses paid by branch, 1000 By bal c/d (closing balance), (Missing information/Bal Figure), 1100, Branch Adjustment A/c (G.P.), By Branch stock, (loading on surplus stock), By goods sent to br (load on pur), 11520 By stock reserve A/c (load on open st), 59,600, , 71120, , 950, ??????, 150, 1100, , 11120, 40000, 20000, , 71120, P & L A/c, , To branch expenses A/c (all exp), , To Comm to manager 10%, 80000 * 10/100, (total Income 1,04,080 total exp 24,080), 80000 rough profit -80000, (80000 -8000) = 72000, To net Profit, , 24,080, , By Gross profit tran from Br adj A/c, By G/P b.d, By surplus Stock, , 59,600, 44480, , 8000, , 72000, 1,04,080, , 1,04,080