Page 1 :

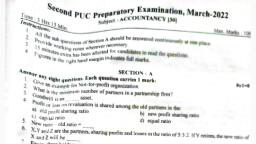

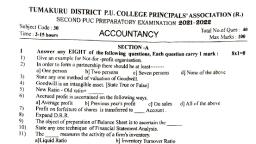

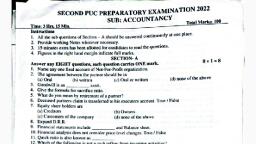

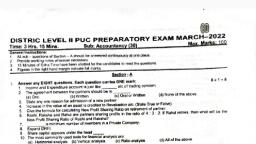

II P.U.C. PREPARATORY EXAMINATION, JAN. -2020, Time : 3.15 Hours, lnstructions, , ACCOUNTANCY, , @, , Max. Marks: 100, , : 1", 2., , All sub questions of section- A should be answered continuously at one place., Provide working notes where ever necessary., SECTION . A, l. Answer any ETGHT questions Each question carries oNE marks:, 8x1=g, 1. lncome and Expenditure account is just like a, 2. Partnership deed contains,, [a] Name of the firm, [b] Name and address of the partners, Profit, and, loss, sharing, ratio, [c], [d] All of the above, 3. Say whether the following formulae is True / False. Share sacrificed = Old share - New share., 4. How do you close the executors account at the time of death of a partner ?, 5. Shares can be for forfeited for :, [a] Non- payment of call money, [b] F ailure to attend meeting, [c] Failure to repay the loan to the bank [d] The pledging of shares as a security, 6. Expand D.R.R., 7. Give an example for non-current asset., 8. Common size statement is also known as, 9. Give the meaning of ratio Analysis., 10. What are operating activities?, SECTION . B, ll. Answer any FIVE questions, Each question carries 2 marks :, 5xZ=10, 11. State any two features of not-for-profit organization., 12. V/hat is fixed capital method?, 13. What is revaluation account? How do you close revaluation account on the admission of a partner?, 14. Give the journal entry for the transfer of profit on realization at the time of dissolution of partnership Firm., 15. What is calls-in Arrears?, 16. How will you disclose the following items in the balance sheet of a company?, [A] Loose tools [B] proposed dividend, 17 " Give absolute increase and percentage increase for following, Particulars, Previous vear {, Current year {, Revenue from operations, 60,000, 75,000, 18. What is cash flow statement?, ., , SECTION - C, lll. Answer any FOUR questions. Each question carries six marks., 4x6= 24, 19. Sahana and Saniya are partners in firm. Sahana's drawings for the year 2016 - 17 Given as under:, < 4,000 on 01 .06.2016., , < 6,000 on 30.09.2016., < 2,000 on 30.11.2016., , < 3,000 on 01.01 .2017., , 20., 21., , Calculate interest on Sahana's drawings @ 8% P,a for the year ending on 31.03.2017., Under product method., Vani, Rani and Soni are partners in a firm sharing profits and losses in the ratio of 4:3:2. Soni retires from, the firm. Vani and Rani agreed to share equally in future. Calculate Gain ratio of Vani and Rani., Akash, Anil and Adarsha are the partners sharing profit and losses in the ratio of 3:2.1, their capitals as on, 01 .04.2017 were { 70,000 , < 90,000 and t 60,000 respectively. Akash died on 31.12.2017 and the partnership, deed provided the following:, [A] Interest on Akash's capital @ 8% P.a, [B] Akash's salary ( 2,000 P.m, ., , (P.r.o.), , Use E-Papers, Save Trees, Above line hide when print out

Page 2 :

[C], , 22, , -2-, , His share of accrued profit up to the date of death based on previous Year's Profit., , Firm's profit for 2016-17 < 24,000, by, [D] His share of Goodwill < 12,000 Ascertain the amount payable to Akash's Executors, Preparing Akash's caPital A/C, Thunga Co Ltd., issued 12,000 12% debenture of RsIOO each at a premium of Rs 10 each, Payable as under., , t 20 on application, ( 50 on allotment (including {, ,, , 10 premium.), , T 40 on first and final call., , 23., , All the debentures were subscribed and the money duly received. Pass the journal entries up, to the stage of first arrd final call money due', Frorn the following information prepare statement of prcfit and loss for the year ended 31/03/2018 as, Per schedule lll of companies Act ,2013., , Particulars, Revenue from operation, Purchase of goods, Salaries to employees, Leave encashment, Rent and taxes, Repairs to machinery, Tax, , 24., , 25., , 5,00 00c, 3,00 000, 40,000, 10,000, 30,000, 20,000, 10o/o, , Calculate current ratio and quick ratio from the following information, < 25.000, Stock, { 20.000., Debtors, < 5,000., Bills receivable, < 2,000., Advance tax, <, 15,000., Cash, <, 30,000., Creditors, < 20.000, Bills payable, < 2,000., Bank over draft, RnanO ttO., arrived at a net income of t 5,00,000 for the year ended 31-03-2017. Depreciation for the, year was 2,00,000. There was a profit of { 50,000 on assets sold which was transferred to statement, tf profit and loss. Trade receivables increased during the year < 40,000 and trade payables also, increased by t 60,000 Compute the cash flow from operating activities by the indirect method., , SECTION .D, lV. Answer any FOUR of the fotlowing Questions. Each question carries TWELVE marks:, 26. Followingare the balance sheet and Receipts and payments Account of Sharada Education, society, Mangaluru., Balance sheet as 31-3-2017, LIABILITIES, Capitalfund, Audit fees, , 36,400, 2,500, , ASSETS, Cash in hand, Maps and charts, 5 % Govt. Bonds, Subscriptions o/s, Furniture, , To Balance b/d, To Subscriptions, To Donation, , {, 2,050, 20,500, 2,500, , 2,050, 1,600, 31,000, 1,000, 3,250, 38,900, , 38,900, , Receipts, , t, , tevqe4s_, By Audit fees, , By Rent, By Maps and charts, , Use E-Papers, Save Trees, Above line hide when print out, , 2,500, 1,800, 3,400, , 4x12= 48

Page 3 :

To lnterest on Govt. Bonds, , 850, , By Stationary & Postage, By Salary, , 250, 8,000, 1,050, 8,900, , By Functions, By Balance c/d, 25,900, , 25,900, , Adjustmenfs; 1. Audit fees { 2.500 still due., 2. Charge { 250 as depreciation on furniture., Prepare;, , 27, , 3. Half of the donation is considered as revenue., 4. Outstanding subscription f 2.000 and subscriptions received in advance { 1,500, 1. lncome and expenditure Account and 2. Balance sheet as on 31-3-2018, , Pujari and Purohit are equal partners. Their Balance sheet as on 31.03.2017 was as follows, T, , Assets, , {, , 6,600, 12,844, , Cash, Stock, Sundry, , 1,800, 23,600, , Liabilities, Bills payable, , Sundry Creditors, Capital accounts, Pujari 40,000, Purohit 30,000, , Less:, , Debtors, , PDD, , 25,000, 5.000, , ., , 20,000, , 70,000, , Furniture, Buildings, , 4,000, 40,000, , 89,400, , 89,400, On 01 .04.2017. They admit Pandit as a new partner and offered him l/4th share in the profits on, the Following terms, He should bring in < 30,000 as capital and { 18,000 towards goodwill., Half of the goodwill should be withdrawn by the old partners., Stock and furniture to be depreciated by 1A% each., PDD is reduced by t 3,000., Prepare: (1) Revaluation Account (2) Partners capital Account and (3) New Balance sheet., :, , Aj, Bl, Cl, Dl, 28., , Suvama and sunanda are partners sharing profits and losses equally. Their Balance sheet as on, 31 .03.2018 was as follows, Balance sheet as on 3f .03.2018, , LIABILITIES, Bills payable, Creditors, , 10.000, 50,000, , Debators, Less, , Sunanda's loan, Reserve fund, Capitals:, Suvama, Sunanda, PIL alc, , 25.000, 15,000, 60 000, 80.000, 12,040, , t, , ASSETS, Cashat bank, , 15,000, , P.B.D, , 55,000, 3,000, , Stock, Furniture, Machinery, Buildings, , 52,000, 40,000, 15,000, 25,000, 81,000, , 2,40,000, , 2,40,000, , On the above date the firm was dissolved. The following information is available, , :, , [a] The assets realize as following:, Debtors { 52,0G0, stock T 39,000. Machinery < 24,000 Buildings < 5,000 and furniture (13,000, lbl Creators and bills payable were paid @ 5% discount., [c] Dissolution expenses amount to { 4000., Prepare: 1l Realization Account. 2l Partner's capital Account. 3] Bank Account, , 29., , Mandya sugar co.ltd. issued < 4O.OOO equity shares of, The amount was payable as follows:, , t, , 10 each at a premium of T 2 per share., , Use E-Papers, Save Trees, Above line hide when print out

Page 4 :

{ 2 on application, { 6 on allotment [including, { 4 on first and final call., , -4premium], , All the share were subscribed and money duly received except the first and final call on 2,000, Equity shares. The directors forfeited these shares and re-issued them as fully paid up at 8 per share., Pass the necessary journal entries., , 30., , Pass the journal entries for the following:, , [a], tb], , [c], Idl, 31., , issue of < 50,000, 8% debentures of { 100 each at a discount of 10% and redeemable at a par., issue of < 50.000, 8% debentures of T C0 each at a premium of 10% and redeemable at a par., issue of { 50.000, 8% debentures of { 100 each at a premium of 10o/o and xedeemable at a premium of 10%, issue of < 50,000, 8% debentures of { 100 each at a discount of 10% and redeemable at a premium of 10o/o, , The following was the balance sheet of Alpha Ltd., as at March 31st 2016 and 2017., , Particulars, , March 31st 2016, , Equity and liabilities, Equity'share capital, Reserves and surplus, Long- term loans, I, , t, , March 31st 2017 7, , :, , 2,00,000, , 4,00,000, , 1,00,000, , '1,50,000, , 2,00,000, , 3,00,000, , Current Liabilities, , 1,20,000, , 1,70,000, , Total, , 6,20,000, , 10,20,000, , Fixed Assets, , 2,00,000, , 5,00,000, , Non- current lnvestment, , 1,00,000, , 1,25,000, , Current Assets, , 2,55,000, , 3,25,000, , llAssets, , Term loans anc. advances, Total, , 65,000, , 70,000, , 6,20,000, , 10,20,000, , You are required to prepare a comparative Balance sheet., 32. From the following information calculate, 1. lnventoryturnoverratio., 3. Working capital ratio., 5. Book value per share., , :, , 2., 4., 6., , Fixed assets turnover ratio., Earnings per share., Dividend payout ratio., , Particulars, 6,00,000., 1,00,000., 1,00,000., 2,00,000., 3,00,000., 7,00,000., 1,75,000, , Sales [revenue from operation], Gross profit, Stock l1-1-20171, Working capital, Fixed Assets, 10,000 equity shares of 10 each, Net profit after tax but before dividend, Market price of a share, Dividend declared @ 15%, , <13, SEGTION, , ., , E, , t Practical Oriented Questionsl, V. Answer any TWO of the following questions. Each question carries FIVE, , 33. Write two partners, , Y., , 35., , marks:, , capital accounts under fluctuating capital system with 5 imaginary figures., Write the pro-forma of a balance sheet of a company with main heads only., Write the pro-forma of cash flows from operating activities under direct method., , Use E-Papers, Save Trees, Above line hide when print out, , 2X5=10