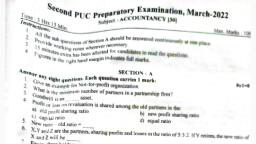

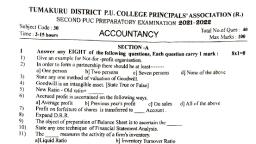

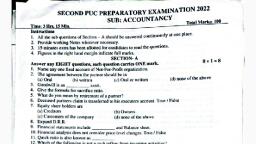

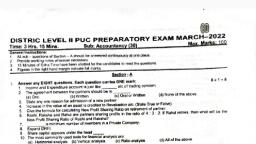

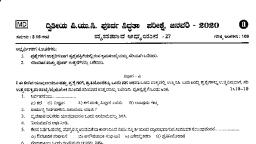

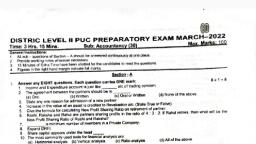

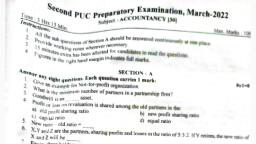

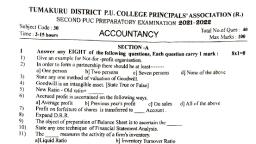

Page 1 :

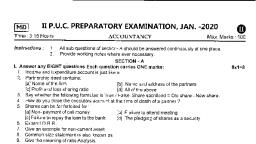

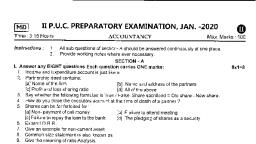

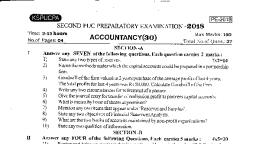

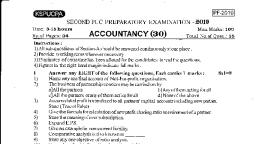

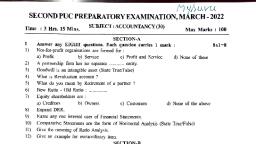

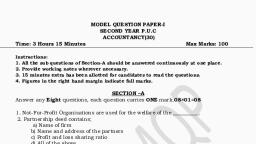

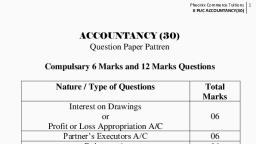

il PUC PREPARATORY EXAMINATION, JAN-2O17, Time : 3.15, , ACCOUNTANCY - 30, , Hours, , (D, , Max. Marks : 100, , SECTION.A, , I Answer any Seven questions , each carrying two, , 1., , marks., , What is Depreciation ?, , 2. State the methods of maintaining Capital accounts of partners., 3. What is Gain ratio ?, 4. Give the Journal Entry for the assets taken over by a partner on dissolution, 5. What is Revaluation Account ?, 6. What is forfeiture of Shares?, 7. Mention two objectives of Financial Statements., 8. What do you mean by ratio analysis ?, , g., , 10., , 7x2=14, , of a firm., , State any two differences between Receipts and payments Account and lncome and Expenditure Account., Give the meaning of information., , SECTION. B, , 4x5=20, ll Answer any four questions , each question carries five marks., '1., 1, Anand and Bhaskar are Partners in a firm. Anand's drawings for the year 2015-16 are given as under., , (, , 12., , 13., , 8,000 on 01-06-2015, < 12,000 on 30-09-2015, < 4,000 on 30-1 1-2015, < 6,000 on 01-01-2016, Calculate interesl on Anand's drawings atEo/o p.a forthe year ending on 31-03-2016 under product method., A, B and C, are partners in a firm sharing profits and Losses in the ratio of 4:3:2. C retires from the firm., A and B agreed to share equally in future., Calculate Gain ratio of A and B, X Y and Z are partners Sharing profits and losses in the ratio of 2:2:1. Their Capital balances on 01- 04' 2016, Stood at { 80,000, < 60,000 and ( 4O,OO0 respectively. Mr. Y. died on 31-12-2016. Partnership deed provides, the following:a) His Capital, , 14., , 15., , b) lnterest on Capital at 10% p.a., c) Salary to Mr. Y.<2,000 P.M., d) Y'S share of goodwill. Total goodwill of the firm is (60,000, e) His share of profit upto the date of the firm for the year 2015-16 is { 30,000., prepare Y'S Capital Account., BPL co Ltd issued 1O,O0O, 10% debentures of ( 100 each at premium of t 20 each, payable as follows:, ( 20 on application., ( 50 on allotment ( lncluding Premium), Balance on first and final calls., All the debentures were subscribed and the money duly received upto the stage of allotment., Pass the Journal entries related to the above informatlon., Calculate trend percentages from the following figures of Bharathi co.Ltd taking 31st march,2013 as base, year., , Year, , 16., , Sales, , 31-3-13 1 ,50,000, 31-3-14 2,14pA0, 31-3-15 2,36,500, 31-3-16 3,02,000, , Stock, 70,000, 78,000, 82,000, 93,000, , Profit before tax, , 30,000, 45,000, 48,000, 53,000, ledger, on, balances as, 01-04-16, From the following, Find out Capital Fund., Buildings < 1,50,000, Fumiture { 30,000, lnvestment t 60,000, Outstanding Expenses {, , 3,000, , Use E-Papers, Save Trees, above line hide when print out, , (P'T'o')

Page 2 :

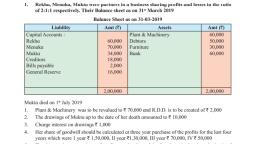

17., , Outstanding SubscriPtion { 2,000, Prepaid lnsurance < 1,000, Cash in hand t 5,000, Cash at Bank t 6,500, Subscription Received in Advance < 3,500., Explain the stages of data processing cycle., , -2-, , SECTION.C, , lll Answer any four questions, each question carries fourteen, , 1g., , 1g., , marks., , 4x14=56, , years ending, From the following information prepare machinery account and Depreciation Account for 4, 91-03-2016 under diminishing balance method. Depreciation is being 10o/o per annurn', a) Machine 'X' was purchased on 01-04-12 for (1 ,00,000, b) Machine 'Y' was purchased on 01-07-13 for ( 1 ,20,000, c) Machine'X'was Sold on O1-10'14 for T 75,000, Ganga, yamuna and Sangama were partners, sharing profit and losses in the ratio of 5:2:1 respectively., Their Balance Sheet as on 31-03-2016 was as under., Balance Sheet as on 31'03'2016, , (, , Liabilities, , Cash at Bank, Bills Receivable, , 15,000, 9,000, 16,000, , Creditors, Bills payable, Reserve Fund, Capital, Ganga, Yamuna, Sangama, Total, , Assets, , Debtor, , 30,000, Less:-Reserve 1,600, Stock, Machinery, Motor Car, P&L a /c, Total, , 50,000, 30,000, 10,000, 1,30,000, , (, , 5,000, 4,600, 28,400, 20,000, 50,000, 14,000, 8,000, 1,30,00(, , Sangama retired. The following adjustments are to be made :a) Stock is revalued at { 28,000, b) Beserve for doubtful debts to be brought upto 10o/o on debtors, c) Machinery and motor car depreciated by 5% and 10% respectively, d) Outstanding rent (1,100., e) Goodwill of the firm was raised for ( 40,000 and it is to be retained in the books., Prepare.- a) Bevaluation a/c, b) Partners CaPital a/c and, c) New Balance Sheet of the firm, as, ZO. Jyothi , preethi and Keerthi are partners sharing profit and losses in the ratio of 5: 3: 2' Their Balance sheet, on 31-03-20'16 was as follows:Balance Sheet as on 31-03'2016, , t, , Liabilities, Creditors, Bills payable, Bank loan, Jyothi's loan, Beserve Fund, Profit and loss a/c, Capitals : Jyothi -20,000, Preethi - 20,000, Keerthi - 10,000, Total, , 15,000, 10,000, , 8,000, 5,000, 12,000, 10,000, , Assets, Cash in hand, Bills Receivables, , 21,000, 5,000, , lnvestrnent, Machinery, , 25,000, 19,000, 25,000, 16,000, , Debtors 26,000, Less:-RBD 1,000, Furniture, , 50,000, 1,10,000, , Total, , Use E-Papers, Save Trees, above line hide when print out, , 1,10,000

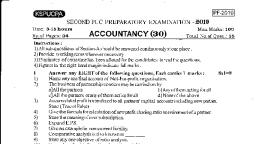

Page 3 :

-3On the above date firm was dissolved, a) The assets were realized as under, Debtors < 24,000, Bills Receivable ( 4,000, lnvestments ( 15,000 and machinery 7 22,000, b) Preethi took over Furniture for ( 10,000, c) Creditors and Bills payable are discharged at 5% discount, d) Unrecorded lnvestment realized for { 4,000, e) Realization Expenses paid < 1,250, a) Realization Account, Prepare, b) Partners Capital Account and, c) Cash Account, Harsha co. Ltd lssued 1O,OO0 Equity Shares of { 100 each at premium of ( 10 per share payable as follows :, { 10, on application, ( 45 on Allotment ( lncluding premium), ( 35 on First call, ( 20 on Final call, Allthe Shares were subscribed and the money duly received except on final call for 500 shares . The directors, forfeited these shares and re- issued at ( 90 each fully paid., Pass the necessary Journal Entries related to the above information., , :-, , 21., , 22., , Following is the trial balance of Moonlight Company Limited as on 31' 03' 2016, , Particulars, , Sl No, , Trial Balance as on 31'03'2016, Debit ?, , 2, 3, , 4, , 50,o;;, , Furniture, Trade Payable, Plant and Machinery, Trade Receivables, Eq, Share Capital(40000 Sh.of, 10% Debentures, lnterest on Debentures, Fixed Deposits (6months term), Staff Welfare Expenses, Surplus (opening balance), Cash in hand and at Bank, Buildings, Flates and taxes, Salaries, Goodwill, General Reserve, , 5, 6, , 7, , I, I, , 10, 11, , 12, 13, 14, 15, 16, 17, 1B, , 19, , 20, , {, , 5,50,000, , Sale of Goods, Office Rent, Opening lnventories, Purchase of goods, , 1, , Credit, , 35,000, 1,70,000, 1,85,000, , 85,O::, 1,00,000, 1,60,00-0, 1, , 4,00,000, , 0each), , 1,00,00-0, , 10,000, , 70,000, 12,00_0, , 10,0;;, 63,000, 90,000, 25,000, 55,000, 1,25,000, 5,000, Total, , 11,5o,ooo, , 11,50,000, , Adjustments:- a) Closing inventories < 45,000, , Prepare, , ;-, , b) Create provision for taxation at 30%, c) Transfer to General Reserve { 5,000, d) Directors proposed on Plant and machinery at 10% P.a and Building at 5% p-a,, i) Statement of profit or loss for the year ended on 31-03-2016, ii) Barance sheet as on, , 31-03-2016, , Use E-Papers, Save Trees, above line hide when print out, , (p.T.o.)

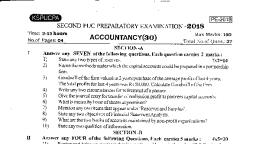

Page 4 :

-423 From the following information, prepare comparative position statement, Particulars, Share capital, General Reserve, Secured loan, Unsecured loan, Sundry Creditors, Building, Machinery, Stock, Debtors, Cash at Bank, , 24., , 31-03-2014, , 31-03-2015, 5,00,000, 60,000, 2,00,000, 5000, 50,000, 2,50,000, 2,00,000, 90,000, 75,000, 20,000, , 4,00000, 50,000, 15,000., 10,000, 40,000, 2,00,000, 1,50,000, 1,00,000, 50,000, 15,000, , Cricket club of mandya was started on 01-04-2015., Its Receipts and payments account for the year ending 31-03-2016 was as follows,, Receipts and payments A/c for the year ending 31-03-2016, , (, , payments, , Receipts, To Donations, To Tournment Fund, To Life membership fee, To Entrance fee, To Fee from function, To Subscriptions, , Total, , 60,000, 22,000, 5,000, 1,000, 24,000, 10,000, , 1,22,004, , By Tournament expenses, , By Furniture, By Sports equipments, By Honorarium, By other expenses, By Printing, By Rent, By Salaries, By Postage, By Fixed Deposit in Bank, By Cash balance, , Total, , 10,300, 15,800, 30,100, 14,000, 6,000, 1,200, 2,500, 7,000, 330, 30,000, 4,770, 1,22,000, , Adjustments:a) Expenses outstanding :- Salaries < 2,500 , printing < 1,000, b) Subscriptions due for 2015-16 for < 2,000., c) Sports equipments on 31-03-2016 were valued at T 25,100 and postage stamps on hand, d) Entrance fees and life membership fee are to be Capitalized., , Prepare:- a) lncome and Expenditure Account., , t, , 100., , b) Balance sheet as on 31-03'2016', , SECTION - D, , (Practical Oriented Questions), lV Answer any two questions, each carrying five, 25. How do you treat the following in absence of partnership deed., a) lnterest on Capital of partners, b) lnterost on Drawings of partners, c) lnterest on loan from partners, d) Distribution of profit or loss, e) Salary to partners., , marks., , 26., , Write the pro-form of vertical Balance sheet of a joint stock company with appropriate heads., , 27., , prepare the tree diagram of hierarchical data base Model., , Use E-Papers, Save Trees, above line hide when print out, , 2x5=10