Page 1 :

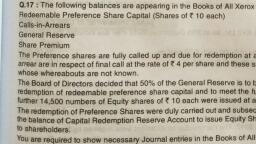

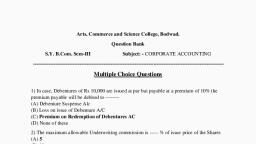

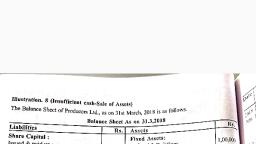

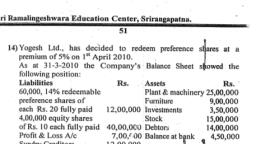

Meaning:-, Redemption of preference share means to discharge or returns of the amount of preference share capital to the preference shareholders., The process of repayment of redeemable preference share capital to the shareholders either at the option of company or at the expiry of fixed period of time., Definition, According to sec 100 Indian companies act of 1956, “A company cannot refund any of its paid up capital except with the permission of the court but no court permission is required in case of preference shares being the Company’s prohibited to issue the irredeemable preference shares.”, Different types of preference shares., 1. Redeemable preference shares, 2. Irredeemable preference shares., 3. Participating preference shares, 4. Non- participating preference shares., 5. Cumulative preference shares., 6. Non- Cumulative preference shares., Following are used for redemption of preferences shares., 1. General reserve /Reserve Fund, 2. Dividend Equalizations fund, 3. Workmen’s compensation fund, 4. Insurance fund, 5. Profit and loss account., Following are not to be used for redemption, 1. Balance of for forfeited shares account, 2. Balance of security premium account, 3. Balance of capital reserve account, 4. Profit prior to incorporation., Capital Redemption Reserve (CRR), Where the preference shares are to be redeemed out of profit an amount equivalent to the nominal value of the shares so redeemed must be transferred out of the companies, disable profits to special reserve called the Capital Redemption Reserve account., The amount of CRR cannot be used for other propose except for the bonus shares to the equity share holders., Premium on Redemption-, If the company option that to redeemed to preference shares at premium or at par., According to companies act shares are to be redeemed at premium then payment must be arranged either out of profit of the company or out of companies security premium, Conditions according to sec 80 of companies act of 1956 redemption of preference shares., 1. No redeemable preference shares can be redeemed unless they are fully paid preference shares can redeemed., 2. They are can be redeemed only out of the proceeds of the fresh issue of shares., 3. They can be redeemed either or par or at premium but not at discount., 4. If they are to be redeemed at a premium the premium payable on redemption must be provided for out of the profit available for dividend or out of securities premium., 5. The capital redemption reveres can be utilized by the company only for the purpose of issuing fully paid bonus shares to the members., 6. The redemption of preference shares by a company should not be taken of redemption in its authorized capital., 7. When a company has redeemed its preference shares it should prepare to issue shares up to the nominal amount of shares redeemed., Rule for Journal Entries, QUESTIONS, Golden company Ltd redeemed 10,000 preference shares at 100 each with a premium of 10% through the company had sufficient balance in Reserve fund. It’is decided to make fresh issue of 6,000 Equity shares at 100 each with a premium of 25%., Pass necessary journal entries., Gleams company Ltd redeemed 7,000 preference shares at 100 each with a premium of 5% for this purpose the company issued 5,000 Equity shares at 100 each with a premium of 10%. For the redemption purpose utilize profit & loss Account balance., Pass necessary journal entries., Star company Ltd redeemed 9,000 preference shares at 100 each with a premium of 10% for this purpose the company issued 4,400 Equity shares at 100 each with a premium of 30%. For the redemption purpose utilize general reserve 3,00,000 and insurance fund 1,60,000., Pass necessary journal entries., Following are the details extracted from the books of Shine company limited., 5,000 preference shares at 100 each fully paid 5,00,000, 4,500 Eq, shares of 100 each fully paid 4,50,000, Reserve Fund 2,75,000, Profit & Loss Account 1,85,000, Workmen compensation fund 2,25,000, Preference shares redeemed at 10% premium., Pass necessary journal entries., Right company limited had 3,300 preference shares at 100 each fully paid,4,400 Eq, shares of 100 each fully paid in addition company had the following devisable profits., General Reserve 1,22,000, Profit & Loss Account 1,88,000, Insurance fund 2,20,000, The company decided to redeemed the preference shares at a premium of 10%. for this purpose company issued 5,000 Eq, shares at 10 each with a premium of 20% and the balance amount required for redemption should be utilized from devisable profits., Pass necessary journal entries., Following are the details extracted from the books of Speedway company limited., 2,800 Eq, shares at 100 each fully paid 2,80,000, 3,700 preference shares of 100 each fully paid 3,70,000, Reserve Fund 50,000, Profit & Loss Account 60,000, Workmen compensation fund 10,000, Dividend equalization fund 20,000, Insurance fund 1,80,000, The company decided to redeemed Preference shares redeemed at 10% premium. For this purpose issued 8,800 equity shares at 10,each with a premium of 10%, Pass necessary journal entries., Following is the balance sheet of Time limited for the year ended 31-3-2021 was as follows, On the above date the preference shares redeemed @ a premium of 10%. The redemption was to be made out of the devisable profits., Pass necessary journal entries and prepare balance sheet after redemption of preference shares., Following is the balance sheet of KL limited for the year ended 31-3-2020 was as follows, On the above date the preference shares redeemed @ a premium of 10%. The redemption was to be made out of the devisable profits., Pass necessary journal entries and prepare balance sheet after redemption of preference shares., Following is the balance sheet of KL limited for the year ended 31-3-2019 was as follows, On the above date the preference shares redeemed @ a premium of 10%. For this purpose the company issued 3,000 equity shares of 10 each with a premium of 20%., Pass necessary journal entries and prepare balance sheet after redemption of preference shares., Following is the balance sheet of VAISHNAV limited for the year ended 31-3-2019 was as follows, Additional information, The company decided to redeemed all the preference shares @ a premium of 10%., Issue of 1,800 equity shares of 100 each with a premium of 10%., Furniture sold at 6,000 loss and tools sold at a profit of 2,000, Brokerage charges 3,000, Bonus shares issued for every 4 shares for 1 share., Pass necessary journal entries and prepare balance sheet after redemption of preference shares.