Page 1 :

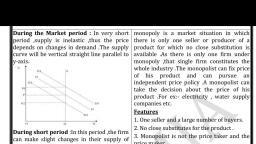

€ G&, , , , Basic Principles of Managerial Economics, Principles of opportunity cost, , 2. Principle of incremental cos, 3.Principle of time perspective., , 4. Principle of discounting, , 5.Equi marginal principle, , 6. Principle of risk and uncertainty., , and revenue., , , , Principle of contribution., , Principles of opportunity cost :, Opportunity cost is the cost of the next best alternative which is given up. Itis the, earnings that would be realised if the available resources were put to some other use., This concept helps in selecting the best possible alternative from among various, alternatives available to solve a particular problem ., crementalism:, , , , , , 2.Principle of, © Incremental cost is a change in total cost resulting from a decision., * Incremental revenue means the change in total revenue resulting from a, decision,, A decision is profitable only if it increases revenue more than cost., 3.Principle of time perspective, Marshall conceived four market forms based on time.They are very short period,, short period, long period and secular period., A decision should be taken only after studying the short run and long run effects, on cost and revenue., 4-Principle of discounting :, The core of the discounting principle is that a rupee in hand tode, than a rupee to be received tomorrow. This means that money has, , , , , , y is worth more, , , , a time value. This, , , , further means that the value of money depreciates with time., , When a firm makes a capital investment, it spends money now and it can earn, profits in the future. To decide whether the investment is profitable, the firm, calculates the present value of future returns by discounting them., , Thus, the discounting principle helps to determine whether the investment, proposal is profitable or not. In short, the discounting principle is very useful in capital, budgeting decisions., 5.Equi marginal principle 6, , , , (Principle of maximum satisfaction ):, , The equi marginal principle can be applied in different areas of management. It is, used in budgeting, The objective is to allocate resources where, productive. The management can accept investments with higher rates, to ensure optimum allocation of capital resources. The equi marginal, also be applied in allocating research expenditures, Further, it can b, eliminating waste in useless activities., , II O <