Page 1 :

Government of India, Ministry of Communications, Department of Posts, , Manual of Internal Audit Questionnaire, (For internal use in Circle Postal Accounts Offices only), , Edition- 2021, , Issued under the Authority of Secretary, Posts.

Page 2 :

Government of India, , MINISTRY OF COMMUNICATIONS, DEPARTMENT OF POSTS, , Manual of Internal Audit Questionnaire, (For internal use in Circle Postal Accounts Offices only), , Edition- 2021, , Issued under the Authority of Secretary, Posts.

Page 3 :

© Department of Posts, No part of this publication may be reproduced in any material form, (including photocopying or storing in any medium of electronic means, and whether or not transiently or incidentally to some other use of this, publication) without the express permission in writing of Department of, Posts., Committing an unauthorized act in relation to a copy-right work may, result in both a civil claim for damages and criminal prosecution., No person can export this book outside India except with the written, permission of the Department of Posts.

Page 4 :

PREFACE, The responsibility of the Internal Audit functions of the Postal Accounting Units vests with the, Postal Accounts offices, the first manual of Internal Audit questionnaire for conducting the, Inspection by Circle Postal Accounts Offices was brought out during the year 1988. The same, was revised in the year 2002 and further in 2010., Since then there have been vast changes in the functioning of the Department due to, modernization and introduction of technology. Consequent upon roll out of ERP application in, the department, several procedural changes have also been there. Various new products and, schemes were also introduced and the way of activities performed has also been changed over, the period of time., In order to keep the pace with technology changes, a committee consisting of Sh, Abhishek Singh Director (Accounts) Sh Pratap Singh Ex Director (IA), Sh K.N.R.Bhatta now, Director (IA),Sh C.S.Guleria,Ex ADG and Sh B.P.Pattanayak Ex Dy DDAP,Kolkatta and coopted member Sh A Saravanan Director, CEPT Chennai under the chairmanship of Shri.M., Sampath, the then Chief Postmaster General, Tamilnadu Circle , Chennai 600002 for revision of, Inspection Questionnaire for Internal Audit of Postal Field Units to be conducted by Postal, Accounts Offices in post CSI scenario vide Directorate letter No. 4-1/2019 - PA(IA) / 2066-77, dated 26.06.2019 and accordingly adopted ., This revised questionnaire (Edition-2021) has been brought out in accordance to, technological changes, changed procedures and additions/alterations as of now wherever, necessary. Every care has been taken to include the changes in this questionnaire as per changed, procedure on account of introduction of new product and services as well as ERP application,, yet, any error/omission, if noticed, may kindly be brought to the notice of Internal Audit Division, of Directorate . General guidelines/procedures for the inspection of field units are brought out in, the succeeding Chapters. These guidelines are only illustrative in nature and not exhaustive., They depend on the overall working and intelligence of the Inspection Party which is supposed, to be well conversant with the rules/orders., , Vineet Pandey, Secretary (Posts), New Delhi-110001, Dated 15th August,.2021.

Page 5 :

FOREWORD, , This manual of Internal Audit is intended to guide the officials of the Internal, Audit Section in inspecting various Offices in the Circles. The last Internal Audit, questionnaire was issued in the Year 2010. Since then there have been a lot of changes in, the functioning of the Department due to modernization and introduction of technology, which necessitated the revision of questionnaire. Appropriate changes have been, incorporated in this manual wherever necessary., The procedures and guidelines included in this manual will improve the, organization’s operations and add value. The purpose is to provide reasonable assurance, that processes are functioning as intended and will enable the objectives and goals to be, met and also to provide recommendations for improving the operations of the office in, terms of both efficient and effective performance. It will help to accomplish its objectives, by bringing a systematic, disciplined approach to evaluate and improve the effectiveness, of risk management, control and governance processes., , (Anil Kumar Nayak), Additional Secretary & Financial Adviser, New Delhi-110001, Dated: 15th August, 2021.

Page 6 :

INTRODUCTORY AND GENERAL GUIDELINES, The scheme of departmentalization of Union Government accounts provides for setting up of, an efficient internal audit organization to ensure accuracy in accounts and efficiency in the, operation of the accounts set up. An internal Audit organization has accordingly been set up, in DoP. The scope and function of the internal audit organization depends on the nature of, work, the number of subordinate offices, the strength of establishment, nature and quantum of, expenditure etc. As per the scheme, each Ministry will draw up a Manual of Internal Audit, specifying the duties and functions of the organization, with particular reference to the, prevailing conditions in the Ministry/Department. The guidelines contained in this chapter, will regulate the working of these organizations. The scope of Internal Audit in the, Department of Posts has been defined in the Chapter XVII of Postal Accounts Manual Vol.I., As per the new charter of duties and responsibilities of Chief Controllers of Accounts issued, by the Secretary, Department of Expenditure, Ministry of Finance, the following functions, will be carried out as per the guidelines issued by the Controller General of Accounts from, time to time., (i). The appraisal, monitoring and evaluation of individual schemes;, (ii). Assessment of adequacy and effectiveness of internal controls in general, and soundness, of Financial systems and reliability of financial and accounting reports in particular;, (iii). Identification and monitoring of risk factors including those contained in the Outcome, Budget;, (iv). Critical assessment of economy, efficiency and effectiveness of service delivery, mechanism to ensure value for money; and, (v). Providing an effective monitoring system to facilitate mid course corrections., 2. QUANTUM OF AUDIT:-An internal audit party should conduct a general review of all, the accounts records maintained by an office since the last inspection or in case of new units,, since the formation of that office. Apart from the general review, it should also conduct a, detailed check of accounts records of at least one month in a year, selected by the respective, GM(Finance) DAsP or in charge of internal audit. The percentage of bills/vouchers/cases etc., other than the month selected for detailed check will be left to the discretion of the Head of, , [I]

Page 7 :

the internal audit unit/team. The extent and nature of the checking has been described in the, Internal Audit questionnaire in the respective chapters., , 3. PERIODICITY OF INTERNAL AUDIT INSPECTIONs :- Considering the complexity of, transactions and accounting under accrual based accounting and also to increase the quality &, effectiveness of the internal Audit , the periodicity of inspection would be once in a year, corresponding to executive inspection periodicity (calendar Year)., 4. INTERNAL AUDIT TEAM: It is recommended that to maintain quality and effectiveness, of internal audit, a well-defined IA team within the existing establishment may be formed and, personnel posted to such IA unit with two-year tenure and headquarters would be of, respective PAO. The duty of such team would be from planning IA to process for settlement, of paras. This would improve quality and continuity of personnel in IA for better, understanding and audit., , 5. COMPOSITION OF PARTY: The present strength of Internal Audit team for various units, by Postal Accounts Office consists one ACAO/Sr.AO/AO, two AAOs and two SA/JA., Considering the availability of data centrally in the system and such checks can be exercised, centrally, the existing strength may be kept at five with the following composition:Unit, , Total, strength, Postal, Directorate/Circle 4 (four), office/Region, Office/, PTC/CEPT/, RAKNPA/, DPLI, &, Investment, division, Kolkata/ Offices, headed by independent, Directors, , Headed by, , Remarks, , 1-JAG level officer, 1-ACAO/ Sr. AO /, AO, 2- AAOs, 1-SA/JA, , This composition, is for PAO headed, by, GMs., Wherever,, JAG, level officer not, available, one STS, officer may head, the IA team., , 1-STS level officer, 1-ACAO/ Sr. AO /, AO, 2- AAOs, 1-SA/JA, , [II], , This composition, is for PAO headed, by, JAGs., Wherever,, STS, level officer not, available, one JTS, officer may head

Page 8 :

the IA team., , PSD/CSD/MMS/PED/PCD/ 4 (four), Foreign post/, GPO/Gazetted Head post, , 1-STS level officer, 1-ACAO/ Sr. AO /, AO, 2- AAOs, 1-SA/JA, , Wherever,, STS, level officer not, available, one JTS, officer may head, the IA team., , Head post offices/ canteen /, Divisions & other units, , 3- AAOs, 2- SA/JA, , The IA team led, by Senior most, AAO., , 4 (four), , 6. DURATION OF INSPECTION:-The duration of Internal Audit would be as under:, Unit, Duration, Postal, Directorate/Circle 3 Three days, office/Region Office/ PTC/CEPT/, RAKNPA/ DPLI & Investment, division, Kolkata/ Offices headed by, independent Directors, PSD/CSD/MMS/PED/PCD/ Foreign 3 Three days, post, General post office, 12 days, , Head post offices & Divisions, , 10 days, , Remarks, Three working days, , Three working days., 12 days for GPO Delhi/, Kolkata/ Chenai/ Mumbai, and 10 days for other, Nodal, HPOs, like, Bengaluru, GPOs,Sansad, Marg HPOs etc ., 8 days for Head post, Offices and two days for, Divisional office. This, includes inspection of units, attached to HPO and, Divisions., During, the, period, one SO and one BO, to be inspected., , 7. PROCEDURE FOR CONDUCTING INTERNAL AUDIT:-The work relating to internal, audit should normally be conducted by inspecting various units and offices and "on the-spot", verification of accounts records. The work of the inspection parties may be coordinated, , [III]

Page 9 :

through internal audit cell at the headquarters (PAOs), depending upon the nature, number, and size of the internal audit set up., (I). As a step further, considering the merger of Postal Accounts sections with Internal Audit, as well as Internal Check Organization (SB) situated at Circle office/Region offices as a, whole in Circle Postal Account offices, the questionnaire issued by the Inspection unit of this, Directorate for Internal check of SB and SBCO branches at Head Post offices is also annexed, to the manual., Considering the data availability in the system centrally the concurrent audit of the, transactions can be done at PAO level. Each SA/JA should be allotted minimum 3 DDOs in, Postal Accounts section of PAOs. At least 12 SA/JAs should be supervised by a AAO. Every, wrong booking/misclassification should be reported and get rectified from the DDO, concerned. In case, the error or omission is not rectified, should be passed on to the Internal, Audit which may further raise an audit memo as per usual process., (II). Similarly, considering the deployment of AOs and AAOs in regional offices, it should be, ensured that a tab on the transactions of all such sub post offices should be kept whose, monthly business is Rs 1 crore or above. Such sub post offices should be audited by the AO, or AAO posted in the regions once in a year with a periodicity of 1 day per week.The tour, programme shall be designed for internal Audit, , of sub post offices for a continuous, , minimum period of 15 working days duration. Any irregularities noticed should be got, rectified in consultation with Region Head or DPS concerned and still persists may be, conveyed to Internal Audit section of the Circle Postal Accounts offices., 8. SUBMISSION OF INTERNAL AUDIT REPORTS & RESULTS ETC:The Supervising Officer would try to settle on spot maximum number of items raised by the, Inspection Party after going through the relative records/ information supplied and personal, discussions with the officers of the unit concerned. The IA reports should contain only those, paras which could not be settled, and have to be perused centrally. These reports would be, submitted to Internal Audit Section of the Circle Postal Accounts Office which will scrutinize, and sent it to the unit(s) concerned for compliance. The relevant extracts from the Report, would also be sent to the concerned Executive authorities (viz SSPOs, DPS, and PMG etc), [IV]

Page 10 :

where necessary. A Report containing important points or serious irregularities, if any, should, be submitted to Director, IA Division at Headquarter along with action taken report for their, speedy settlements for onward transmission to AS & FA/ Secretary (Posts)., 9. The extant of Internal Audit in respect of various items of work in the accounting units and, the questionnaire to be used by the Internal Audit Parties is brought in the succeeding, chapters. The instructions contained in the relevant chapters are only illustrative and not, exhaustive. The success of internal audit solely depends upon the intellectual capacity and, presence of mind of the Internal Audit Parties which are supposed to be well conversant with, the Government Rules/ Orders., ***, , [V]

Page 11 :

QUESTIONNAIRE FOR INTERNAL AUDIT OF POSTAL FIELD UNITS TO, BE CONDUCTED BY POSTAL ACCOUNTS OFFICES, IN CSI ENVIRONMENT, , Chapter, , Subject, , Page No., , I., , Postal and RMS Units, , 2, , II., , Circle Office and Regional Offices, , 69, , III., , Postal Stores Depot, , 88, , IV., , Mail Motor Service, , 99, , V., , Postal Life Insurance, , 146, , VI., , Circle Stamp Depot, , 177, , VII., , Returned Letter Office, , 183, , VIII., , Commission paid to authorised agents, , 186, , IX., , Circle/ Regional Welfare Fund, , 187, , X., , Departmental Canteens & Tiffin Rooms, , 200, , XI., , Foreign Post, , 207, , XII., , Civil & Electrical Wing, , 224, , XIII., , Philatelic Exhibition, , 256, , XIV, , India Post Payment Bank, , 259, , XV, , ATM,National Accounting Unit, Payment, Channel Division, Bengaluru, , 261, , Appendix, , Questionnaire for inspection of SB and SBCO, branches by AO (ICO)SB., [1]

Page 12 :

CHAPTER – 1, Postal and RMS Units, 1., , The inspection of Post Offices should be carried out by the inspecting, officer and his staff intelligently. The last Inspection Report by the Audit, Officer I.A. Officers as well as the Report of Executive Inspecting, Officer should be reviewed personally by the I.A. Inspection Officer to, see that the irregularities in accounts noticed in them have been settled., The failure to rectify all or any of them should be commented on., , 2. With regard to the cash arrangements, custody of DOP cash, cheque books,, issue of cheques. All accountable items, upkeep and balancing of DOP cash, and availability of days’ accounts with vouchers etc., it should be seen that, the procedure, Rules laid down in the Postal Financial Hand Book Volume, I, are observed. No physical verification of balances of cash or stamps, need be undertaken. The arrangements for the obtaining cash from Bank, and for its safe custody, payment and accounting should also be examined, to see that they are in conformity with the Rules. Test check for the marked, month including the 3 days of inspection be done., , 3. Check whether CDDO has taken any view right of the Bank Account on, personal/corporate and ensure that it is meant only for view of daily, transactions to ensure its incorporation in DOP Books of account. CDDO, may take the hard copy of the bank statement month to month basis and, ensure correctness with reference to his accounts. All the balances lying, unlinked (PO unlinked and Bank unlinked) be highlighted., , 4. The Inspection Officer should also ascertain and record the following facts, in the Inspection Report:, , [2]

Page 13 :

i. By whom and on what date the cash, etc., were last physically counted, and whether previous day’s Closing Balance as verified on that, occasion was recorded in the relevant inspection report., , ii. If any discrepancy is found on that occasion between the physical cash, and the book balance, how it was accounted for., , 5. A test check over the cash balance of the first and the last working days of, the month, the accounts of which are test checked and of one week apart, from these dates should be carried out to see if the cash balances are within, the authorised limits. It should also be seen whether the limits so fixed are, excessive or not. If the actual cash balance in hand is in excess of the, authorised limit, the reasons should be investigated and recorded in the, Inspection Report., , 6. It should be seen whether the accounting of due on unpaid articles in the, DPMS module is correctly getting accounted in the respective GL and, comment on the system put in place to identify such unpaid articles before, delivery. Check with reference to daily transaction report., , 7. That the Sub and Branch Office Cash Balances kept within the prescribed, limits. In cases of excess balance, it should be seen that the reasons given, in the excess cash balance Memo justify the excess. The Inspecting Officer, should examine generally to ascertain that the prescribed limits of the cash, balance are not excessive. The cash transfer report may be extracted and, checked with SO/BO remittances and vice versa for the test check month., a. That there was no abnormal delay on the part of the treasurer in, admitting transactions on account of remittances. The daily transaction, report of Sub and Branch Offices for several months should be selected, at random to see whether there were any unauthorised remittances from, [3]

Page 14 :

one Post Office to another and the Postmaster specifically asked, whether there were any such remittances., Check the transactions of reversals done in the system and ensure the, correctness as well as the justification of such reversals., Comment on the frequent usage of reversals for correction of mistakes., Reversal requests raised and pending at PAO may be listed., , b. that the figures of the Sub Postmasters or Branch Postmasters in the, Daily Accounts are not altered by the Sub Account Clerk or any other, official of the Head Office, , 8. Check Cash In transit, Cheque in transit for the selected months and dates, and ensure that there are no open items pending for acknowledgements, Check for the correctness of transfer of material from Head post Office to, Sub Post office Storage Locations in case of Stamps and other Stationeries, including IPO, Pass book etc., Cash and cheque in transit from and to profit, centres may be verified with respective 10-digit SAP GL codes., , 9. Check the totals of respective GL of Reports in case of POS transactions, with reference to POS Abstract Report for the selected days and ensure that, the corresponding figures has been flown to F&A and is correct., 10. The entries against items “Savings Bank Deposits”, “Savings Bank, Withdrawal”, “iMO”, “e-MO”, “Money Orders issued” and “Money Orders, paid”, etc., and all other GLs should be compared with the DTR of the, Profit Centres for selected days., 11. The entries against items “Drawn from treasuries Clearing Account and, Drawn from Bank Clearing Account and remittance to Bank Clearing, Account and Remittance to Treasuries Clearing Account should be, compared with the Register of Cheques received and Cleared Data., [4]

Page 15 :

12. The entries against items like 1201 Other Receipts, Other Items and 8553, Payments and Check the correctness of Postings to the respective GL, accounts., , 13. Check the availability and correctness of Bills received from other Units as, CDDOs while making payments to such units against the bills as DDOs., , 14. Whether the closing balance as in DTR matches with the DOP closing, balance as in Treasurer’s Cash Book be checked and also with the physical, cash balance held by the office. No physical check of cash is necessary., , 15. Check the Postman Issue GL is settled for each Day and net balance is Zero, at the close of the day., , 16. Ensure that the amount settled towards VPP Clearing accounts has been, correctly accounted and disposed of by booking e-MO on the same day., , 17. While reviewing various GL reports of Field Units 15% of the entries of, grant of short term advances such as TA, LTC, Medical Leave Salary, advances etc. should be picked up with reference to the HR schedule and, ensure its settlement and adjustment in the final bill/ recovery., , 18. The Inventory of Stamp balances for each day should be checked and the, difference between opening balance and closing balance including receipts, for the day is tallied as Sale of Postage Stamps/ Commemorative Stamps., The balance as in MB52 report be referred to., , 19. In the case of RMS Offices, it should be seen that the DTR is generated in, the System and verify the correctness of reversals with the supporting, [5]

Page 16 :

documents. Verify the correctness of Cash Remittance/ Cash Receipts, from the concerned Cash/ Account office., , 20. It should be seen whether the figures shown in the Test Checked CGA, report for the month brought for Test Check against the several Heads, under receipts and payments agree with those shown in the respective GLs, for a month., , 21. It should be seen that the Statement of Physical Cash balance with, DDO(HO+SO+BO) tallies with the System Closing DOP Cash Balance GL, at the Opening and Closing day of the accounting month. It should be seen, that the HO daily transaction reports are duly signed by the Postmaster., Any discrepancy in cash in transit. Cheque in transit, POS balance ,VPP, clearing GL, one time customer GL report for the day be identified and, acted upon., , 22. The amount as shown in the Remittance GLs for Inward and Outward /, POR and RSAO, corresponding Debit/Credit GLs should be checked cent, percent to ensure the accounting is genuine transaction. The checks, indicated above should be exercised in respect of the transactions of the, days / period as marked by the Head of Postal Accounts Office., , 23. Check the Register of Cheques and the corresponding Accounting entries in, the SAP F&A accounts for the days/periods as marked by the Head of, Postal Accounts office., , 24. In case of Inward and Outward Cheques, the respective data may be, obtained from Cheque Truncation System (CTS) / Grid Clearance and, corresponding accounting of the books of Profit Centre for the days/periods, as marked by the Head of Postal Accounts office be checked and verified., [6]

Page 17 :

25. The amount in the schedules of remittances ( GL reports of RSAO and, POR) received and sent should be compared with the remittance advices, and acknowledgements respectively wherever applicable., , 26. Check the generation of Acquittance Rolls wherever applicable to ensure, the corresponding Payment GL entry in the respective Profit Centre., (DDO)., , 27. The regulation of TRCA from time to time in case of BPM and ABPM for, the test check month be thoroughly checked with reference to, Establishment workload particulars., , 28. The payments made to Substitutes against the vacant post of ABPM and, BPM and also for LWA periods, Put off duty cases etc., be checked for a, test check month. The correctness of the corresponding allowances being, paid to ABPMs and BPMs as per the existing TRCA Rules be checked., , 29. The fixation of TRCA consequent on new appointments, Redeployment,, Transfers in case of ABPMs and BPMs be reviewed for the period between, the last date of inspection to the present date of inspection., , 30. Check the payment made to Part Time Casual labourers / Full Time Casual, labourers / Temporary Status Casual labourers as found in the, establishment of the DDO with reference to the Sanction/ approval of the, Competent Authority., , 31. Check the correctness of Pay Drawals with reference to HR Documents, with that of entries in the Service Records and corresponding allowances, thereon with reference to the Basic Pay. The availability of Certificates in, case of Suspension, Leave on Medical Grounds etc., be checked. Nonavailability of Rent free Quarters in support of HRA drawals be verified., [7]

Page 18 :

32. It should be seen that health certificates of Government Servants (including, Part Time Government Servants, contingency Staff, whole time or Part, Time and Extra Departmental Agents), in all cases in requisite form and are, recorded in the proper place., , 33. It should be seen that the specimen signatures of the drawing officers other, than the Postmaster himself, are properly maintained, and the same agree, with those on the Bills brought form Accounts Office., , 34. The following checks should be exercised during the Internal Audit, Inspection of Postal Units, i. Revenue Side – Whether the revenue realised on account of this service, is in accordance with the rates prescribed by the Directorate. At least, check of two months’ accounts in a year should be conducted., ii. Expenditure Side –, a. Whether payment of incentive money to Postmen and other staff, employed for the purpose of delivery is in accordance with the, standards prescribed for the purpose., b. Payment of conveyance allowance to staff should be checked., c. Employment of special means of conveyance such as taxi etc. for, ensuring timely delivery in cases of breakdown of the normal means, of transport should be scrutinised., d. Refund of special charges realised in cases of belated delivery or, non-delivery should be checked., , iii. Check the correctness of the Collection of GST on Supply of Output, Services and its payment to the respective authorities on the due dates, without fail., [8]

Page 19 :

iv. Check the accounts of all Registered BD Customers to ensure that the, Bill/ Invoice is raised on due dates and penal interest charged wherever, applicable., , v. Check the settlement process done by the respective units. In case of, Postage by Franking, ensure correctness of Revenue Accounting., , vi. Check the Ledger accounts of all the Registered Customers and ensure, proper posting is happening in the Ledger for Receipts and Payments of, the Registered Customers., , vii. Check the Open Items pending as overdue and comment on the action, taken by the Divisional Head for liquidation of outstanding dues., , viii. Check the correctness of the Security Deposit made by the different, Registered Customers and found adequate with reference to the average, sales per month, , ix. The off cycle payments and salary payments ( pay sheets) of month of, test check should be checked with reference to the sanctions. These, payments to be checked in CSI during course of inspection and found, any discrepancies or irregularities are to be recorded in the Inspection, report., , 35., , Check that whether revenue for BP COD, SP COD, SP parcel COD, EP, COD has been transferred to the revenue from 8446 GL once the liability, against the registered customer is knocked off., , 36., , A test check of Master Data as available in the PAO be compared with, the Master Data as available in the HR and check the correctness of, [9]

Page 20 :

payment such as Basic pension, Reduced Pension, Dearness Relief,, Enhanced Family Pension, Fixed Medical Allowance, Restoration of, Commutation of Pension amount and Payment of additional quantum of, Pension/ Family Pension on attaining the age of 80 years etc., , 37., , Cent percent check on availability of Life Certificates/ Jeevan Praman, Patram be conducted, , 38., , Ensure that the PPO files in case of Postal Service/Family pension cases, wherein no beneficiary available consequent on the death of the, pensioner/family pensioner is sent back to PAO and no erroneous, payments are made in the month of audit. All similar checks be made, wherever applicable in case of Telecom pension/Railway Pension, etc.,, , 39., , Test check payment of Pension through Voucher Posting any be made, and comment on the irregularity., , 40., , A check of different classes of pension payment GLs have to be carried, out for correctness; and also life time arrears, additional quantum of, pension, disbursement mode checks to be carried out and findings needs, to be noted in the Inspection Report., , 41., , Test check all Travelling Allowance Bills on Tour/ transfer as per, Supplementary Rules and ensure its correctness including advance, payment/ Adjustments, if any. In case bills are processed through PA30, instead of ESS, ensure that the amount payable as per the Sanction is the, same as entered in PA30., , 42., , The Correctness of GL booking in case of system posted documents and, in case of manual Voucher postings should be checked in particular and, any variation in mapping of GL be brought into the report for immediate, correction in the system., [10]

Page 21 :

43., , It may also be ensured that no such bills have been processed for, Sanction/ Claims submitted after the expiry of 60 days of the journey/, completion of journey., , 44., , In case of Bills preferred beyond due dates in case advance taken and, also unutilised amount of advance is not credited back immediately on, completion of journey, ensure that the penal interest is charged for the, unutilised amount and got credited to Govt. accounts., , 45. The following checks should be exercised over the overtime allowance, Bills for the month selected for Test-Check: i., , It should be seen that previous authorisation by the Head of the Office, for the performance of overtime duty exists in each case and that no, overtime is ordered without good or sufficient reasons., , ii., , The rate of pay of Part II officials shown in the Overtime Allowance, Bills brought from the Accounts Office should be verified with, reference to the relevant entries in the official’s Service Books / Rolls., , iii. The correctness of the certificates endorsed on the Overtime, Allowance Bills as required by Note (1) below Rule 323 of P& T, Financial Hand Book, Volume I should also be verified in full with, reference to the Attendance Registers and other initial records, which, can be obtaining initial records may, however, be made, when the, claims of outlying Sub-Offices are unduly heavy., iv., , In the case of RMS officials, the correctness of the claims should be, checked with reference to the statement showing particulars of duty, performed by RMS officials and the duty Register, Forms “B” and, “C” respectively maintained by the Head Record Clerks under DG, P&T’s letter No. PE-11-4/53 dated the 15th Oct., 1954., , [11]

Page 22 :

46., , The Register of Retrenchment Objections should be examined to see:-, , i., , That all the items shown in the objection statement on the, accounts for the month of test check have been included therein., , ii. That no amount of advance or disallowance has been left, outstanding for an unusually long period. In case, there is any, such items, the cause of delay should be investigated thoroughly, and the officer-in-charge advised of the action that should be, taken., iii. Ensure that the entries are not deleted at any point of time in the, system and any refund was erroneously effected to the, employee., iv. Ensure that all the Outstanding under Long term and Short Term, Loans and Advances including Audit Objection Recovery, amount is correctly brought into the System against the, Employee ID and the recovery is done correctly., 47., , The advance Registers should be scrutinised and delays in adjustment of, advances (such as the advances of Pay and TA on transfer tour TA as, well as other short term advances Festival Advances etc.) should be, commented upon in the Inspection Reports., , 48., , The items of advances and disallowances that are considered, irrecoverable and the action taken for their recovery or adjustment should, be noted in the report., , 49., , The cases of delay in the disposal of objection statements as shown in the, statement brought from the Accounts Office should be investigated and, the result of the investigation noted in the Report. It should also be seen, whether the nature of the Objection indicates careless accounting or, ignorance of rules procedure., [12]

Page 23 :

50., , Deposits relating to rent of Post Boxes and Bags should be test checked, with reference to the original documents and file of correspondence with, a view to seeing that the deposits have been credited in favour of proper, persons and that the amounts deposited have been accounted for correctly, and in full. Check whether the deposits not renewed on time got forfeited, to Government accounts., , 51., , It should be seen whether the full installed capacity of the number of Post, Boxes is rented out on the basis of demand and, if not whether the same, was due to faulty mechanism, not got rectified in time or similar other, causes, leading to potential loss of Revenue to the Department., , 52., , The following checks which should be confined to two months accounts, selected for check in respect to deposits referred to in Appendix 28 of, P&T Financial Hand Book Volume I, and also instructions issued by Dte, from time to time for maintenance of Register of Deposits should, exercise to see:, i., , Whether all Open Items and Cleared items are available in the, system along with the General Ledger Review., , ii., , That the rules and orders regarding forfeiture of deposits have been, correctly observed and transfer entry have been effected to transfer, such deposits to postal Revenue on expiry of three years., , iii., , Whether any voucher posting has been done for refund of EMD, without following proper procedure., , iv., , Whether any refund of lapsed deposit made during the period from, the last date of inspection to till date., , 53., , The initial records maintained in the Philatelic Bureau should be, examined to see that they are maintained in the manner prescribed in, the Director General P& T letter No. 31-1/65-M dated 17.06.1965 and, instructions issued by Dte from time to time with reference to the, following aspects:[13]

Page 24 :

i., , That individual accounts have been opened with a minimum deposit, as per rule, by MO or by cheque / Bank Draft encashable in India., , ii., , That supply of first day covers etc., are made to the depositors, under registered post unless the applicant desires the item to be sent, by insured post. It should be especially examined that in no case, the supplies of 1st day covers etc., have been made on postal Service, as may be verified from the entries in the ledger at Annexure “C” of, the above mentioned DG P&T, New Delhi letter dated 17.06.1965., , iii., , It should be seen whether any account has been kept operative even, though the balance of the deposit amount has fallen short of the, value of single order plus postage and packing charges, and if so, it, should be examined whether the account has been regularised either, by a fresh deposit for the required minimum amount or closing the, account, if it remains in operative for a period of three months., , iv., , It should be examined whether the amount debited against the, deposit of a individual accounts towards cost of packing works out, of 1% of the total value of the items despatched on each occasion, and brought under correct GL., , v., , Necessary verification of initial record should be made to see that, their value of the Philatelic items indented for the depositor is not, less than Rs.3 on each occasion., , vi., , Check whether the settlement accounts are made periodically to, ensure revenue inflow in the CGA Report., , vii. Check the continuity of invoices received from Supplier of, Commemorative materials and ensure its proper inventory and sales, including Posting to correct GL on expiry of Six/twelve months, from the date of release of the material., viii. Test check the ledger account of each PDA and ensure that there, should not be any debit balances., , [14]

Page 25 :

54., , The register of Refunds prescribed in Rule 76 of Postal Financial Hand, Book, Volume II, should be examined to see whether Postmasters are, exercising a wise discretion in sanctioning the refunds. Comments, if, any, should be included in the Inspection Report., , 55., , It should be seen that a Service Book or Service Roll is maintained for, every non-Gazetted Government Servant as prescribed in Supplementary, Rules 197 and 205. It should also be seen that entries of all even in the, official career of a Government Servant are duly and promptly made, therein and attested by competent authority. As Service Book is the only, document for the verification of service for Pension, adequate attention, should be paid during local Inspection to the review of Service Books., They should be checked to the extent of 25 % including therein the, Service Books of all Government Servant who are due to retire during, the next five years. Ensure that all movements of the employee including, Annual Service Verification, Recovery of CGEIS, Availing of LTC,, Recording award of Penalty etc., are available in all digitized Service, Books. Ensure the digitized Service Book contains First Page Entries, along with the digitized signature of Head of Office., , 56., , The Service Book and Rolls should be inspected with reference to the, following points :-, , i., , That the entries on the first page are re-attested every five years., , ii. That no alteration is made in the date of Birth without the sanction, of competent authority and that Date of Birth is entered both in, words and figures., iii. That thumb and finger impressions have been taken., iv. That there is no break in the continuity of entries of service, recorded in the Service Book or Roll (the instances of breaks, if, any, should be noted)., [15]

Page 26 :

v. That annual certificate of verification of service has been recorded, in Service Books and Rolls., vi. That the increments have been correctly granted., vii. Check whether the Service Books of officials on deputation/, Foreign Service are not maintained by the DDO and sent to PAO, for maintenance., viii., , Check the correctness of debiting of Earned Leave for, , encashment of LTC subject to a maximum of sixty days., ix. See whether the Cash Equivalent of Leave Salary paid to retired, employees is correct with reference to the Leave Account as on the, date of retirement., , 57., , The leave accounts should be inspected with reference to the following, points :-, , i. That the accounts are posted up to date., ii. That each entry is attested by the Head of the Office or by some, other officer in cases where the duty has been delegated to him., iii. That the entries of leave debited in the leave account agree with, the corresponding entries in the Service Books and Service, Rolls., iv. That in the case of leave granted to a Government Servant, whose services were lent to other Departments, the correct, allocation of leave salary has been noted in Column 13 of the, Service Book and that a subsidiary leave account indicating the, leave earned by such service and leave earned debited against it, is maintained and that the calculations are correct., , 58., , The leave account of the officials due to retire before the next Internal, Audit Inspection falls due should be checked thoroughly so that most of, the portions of leave account would be covered by check leaving only a, [16]

Page 27 :

small portion relating to the period after the last Internal Audit Inspection, till the date of retirement., , 59., , The claims for reimbursement of tuition fees in respect of children of, Central Government Employees should be checked to see that the, Drawing Officers and Heads of Offices or the next superior officer have, exercised the necessary check over the information and documents, furnished by the employees as prescribed in the Government of India,, Ministry of Finance, Office Memorandum No12011/ 03/ 2008 Estt., (Allowance) Dated 2nd September, 2008 and amended from time to time, and verified the admissibility of the claims for this purpose. The claims, pertaining from the date of last inspection should be checked thoroughly, by the Internal Audit Staff., , 60., , If the office is located in a Private Building, it should be seen by the, Inspection Party whether the amount of rent paid is fair and reasonable, and has been sanctioned by a competent authority., , 61., , Check whether Service Contract has been created in the system and, recurring monthly payments are happening through CSI System with, applicable statutory tax recoveries like GST etc., , 62., , In respect of land purchased, it should be seen that:i. The purpose for which the land was purchased acquired has been, fully served., ii. That the land is being fully utilised., , 63., , In respect of land belonging to the Department and lying vacant it should, be ascertained that: -, , [17]

Page 28 :

i. There has been no encroachment thereof and that adequate action, has been taken to prevent encroachment vide Rule 461 of Postal, Manual, Volume II., ii. Attempts were made by the Department to utilise the same to the, best interest of the Department and if the land is of no use, the, Department has considered desirability of disposing it off., , 64., , If the Postal Branch is the owning Branch of the office building and, portion of it is occupied (1) by another Branch or (2) by a Private body or, person, it should be seen by the Inspection Party whether the rent for that, portion has been correctly assessed by competent authority and reported, to the Head of the Circle for inter-branch adjustment by the Accountant, General in the case of (1) and for recovery in the case of (2). In the latter, case is should also be seen whether there recoveries are being made, regularly., , 65., , In cases of joint buildings of Postal and Telecom, it should be verified, that rent fixed by the joint committee along with dues (such as Rates and, Taxes including water and electricity etc.) is being recovered / adjusted, promptly., , 66., , In respect of residential Buildings, it should be seen whether extracts, from the Register of Buildings in the charge of the Officer-In-Charge of, the Post Office have been received from the Head of the Circle and all, such Buildings are occupied by persons for whom they are intended. It, should also be seen whether rent returns etc. are being sent according to, the prescribed rules to the officers to whom they are due and full amount, of rent is being realised in each case, and that other revenues of the, Department such as rent of vacant plots of land and buildings let out and, sale proceeds of compound product are being regularly realised and, communicated to the Accounts Office. While checking the rent returns,, [18]

Page 29 :

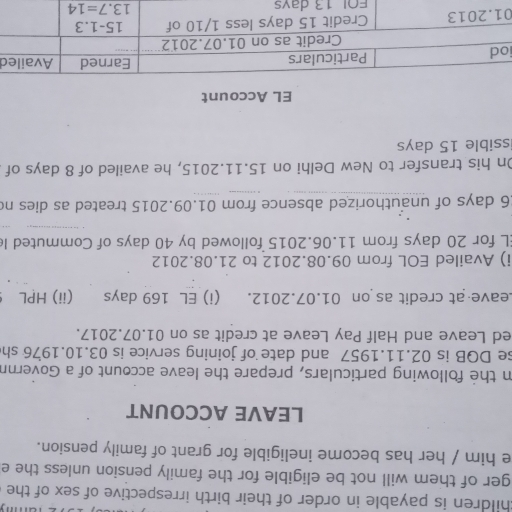

it should specifically be seen that no house rent allowance is drawn in, favour of part II officials whose names do not appear in the pay bills, submitted to Accounts Office, who are in occupation of Government, accommodation., , 67., , In cases where Departmental Quarters have been constructed, but not, occupied by staff, their reasons should be obtained and commented., Note: - A 10 % check should be exercised to see that the standard rent, to residential Buildings is being recalculated every five years or, whenever any additions or alterations are made to such Buildings as, required by Supplementary Rule 324., N.B. :- While inspecting 1st and 2nd Class Post Offices located at the, Head Quarters of the office of the Superintendent for the building files, etc. from the office of the Superintendent of Post Offices and scrutinize, them along with those, if any, available in the Head Office itself. No, scrutiny need by exercised during the inspection of the 2nd Class Post, Offices, which are not situated at the Head Quarters of the, Superintendent of Post Offices., , 68., , It should be seen that, i., , The branch wise allocation of buildings as intimated to Accounts and, indicated in the Register of Buildings is in order., , ii. The buildings intended for office use are not used for resident, purposes and vice-versa without proper authority., iii. Residential quarters are not allowed to remain vacant without, sufficient justification., iv. Adequate action has been taken to utilise buildings lying vacant or to, dispose them off if it is not possible to utilise them in the best, interest of the Department., , [19]

Page 30 :

v., , There has been no unauthorised occupation of the buildings, belonging to the Department., , vi. The allotment of buildings to private contractors is fully justified., vii. The rent recoverable from them has be a correctly arrived at., viii. Additions and alterations are not frequently made without, justification leading to dismantlement of recent additions and, alteration., , 69., , A test check of the state of accommodation of the Postal Officials should, be conducted. The following detailed checks in respect of rent returns, [ACG 71] should be exercised in addition to those already prescribed, during local inspection with reference to the pay bills taken from the, official it should be ensured: -, , (i), , That the total amount shown as recovered in each rent returns, actually been recovered either from pay bills or in cash properly, and accounted for., , (ii), , That the credits are classified properly according to the owing, Branch of the buildings as indicated in the rent return., , (iii) That there is no omission to sent the rent return by the officer in, charge of the buildings to the disbursing officer., (iv) That a rent return has been prepared in respect of every, residential building (whether owned or leased by the, Government) shown in the list of residential buildings., (v), , That the entries regarding particulars of property, authority and, rate of standard rent, etc. have been correctly shown in the, register that the emoluments shown in the rent return agree with, those shown in the pay Bills., , (vi) That the standard rent is not altered without proper sanctions., , [20]

Page 31 :

(vii) That the necessary changes in the list of rentable property are, made from time to time as new properties are acquired or, additions and improvements are made thereto., 70., , It should be seen that :-, , (a) No occupant of residential quarter is in receipt of house rent, allowance., , (b) That there is no deviation from the provision of FR 45. If, there is any case not covered by FR 45-A, it should be seen, that the rent of electric, water-supply and sanitary, installation has also been recovered at the rates mentioned in, the Rule 542 of Postal Manual Volume II., , (c) That if the rent is not recovered at the rate of full standard, rent or at 10% of the emoluments of occupants as the case, may be, the reason for charging a different rate (with, authority) in the “remark column” are quoted and that such, sanction as is necessary has been received in each case., (d) That any variation from the previous month’s return, the rate, of assessment and the authority in the remarks column for, such variation is justified., , (e) That recovery on account of Municipal and other taxes, which are not in the nature of house or property tax as also, meter hire, water consumption, electricity energy consumed, etc. has been made, (vide column 12 of the return as per, amounts indicated in column 11 of the return). It should, particularly be seen that the provisions of Rule 27 of, [21]

Page 32 :

Appendix 13 to P&T Financial Hand Book Volume I have, been correctly observed in affecting such recoveries., (f) That occupier’s share charge for Street lighting in P&T, Colonies has been recovered as per instructions contained in, DG P&T’s letter No. NB-26/4/56-28-69-55/NB and, 28/69/65/NB dated 10.06.1960, 12.01.1961 and 27.11.1961, respectively., , (g) That the recovery on account of rent of furniture is being, affected as per Rule 543 of Postal Manual Volume II in case, of officers who are actually occupying free furnished, occupation at the time of issuing the order conveyed in DG, P&T Memo No. NB-17-1/50, dated the 25th Feb., 1953 and, who continued to enjoy, even after the issue of these order,, the option of retaining the furniture supplied to them, either, in whole or in part and in all other cases at the rate of 2% of, the capital cost of the furniture (vide DG P&T Memo No., 17/2-60-NB dated 15th June 1962)., , (h) That when a building or plot has been let out to any person, not in the service of Government, full standard rent, under, FR 45-B or prevailing rent whichever is higher is recovered, in advance., , (i) That in respect of buildings shown as vacant for a, considerable period necessary re-allotment of quarters was, made to make it remunerative., , [22]

Page 33 :

(j) That all cases of failure, short and excess recoveries are, promptly brought to the notice of the officer-in-charge of the, building by the disbursing officer for necessary action., , (k) That in case of building occupied by officers under the, jurisdiction of Postal Accounts Offices, the rents are being, recovered according to the Rules., , (l) That there are not cases of officer in occupation of out of, class accommodation through an intelligent review of the, rent return, if such cases come to notice, it should be, enquired whether the accommodation of appropriate class, could not be made available to them. For this purpose a, review should be carried out by a comparison of the, standard rent of each quarter with rent paid by the officer at, 10% of emoluments., , (m) That in respect of officials on leave, details of which will be, noted in the remarks column of the rent return in pursuance, of the Director General, Posts &Telegraphs letter No. NB26-8/ dated the 31st December, 1956, rent is recovered when, they are in occupation of the quarters in excess of one month, allowed for free occupation vide Director General, Posts, &Telegraphs, letter No. 2/22/59-NB dated 10.12.1960., , (n) That in all cases of non-residential accommodation referred, to in Rule 535-A of Postal Manual Volume II let out to other, Departments, local bodies or private persons, the provisions, contained in the rules cited above and also Rule 502 of Posts, and Telegraph Financial Hand Book Volume I are satisfied, [23]

Page 34 :

and six months’ rent is recovered in advance before the, quarters are handed over for occupation., , 71., , All cases of new assessment of rent since the previous inspection will, also have to be checked by the Internal Audit Inspection Party., , 72., , The Register of Rents for Residential Buildings in From ADG (71)(c), should be verified thoroughly to see that the balances of rent, if any, are, brought forward correctly., , 73., , The register of buildings should be checked with a view to seeing that no, remissions on refunds have been allowed without proper authority., , 74., , If there are any Departmental inspection quarters attached to the Post, Office, it should be seen :-, , (a) That a Register is maintained for the purpose of realisation of rent., , (b) that no quarter has been occupied by an eligible officers / officials, for more than 10days without the permission of the Postmaster, General., , (c) That a periodical verification of the stock of furniture, crockery etc., provided in the quarters in accordance with the prescribed scale, has, been made and recorded by the Executive Officers (Postmaster, General or any other Departmental Inspecting Officer) in the Stock, Register., , 75., , A few entries in the register should be test checked to see whether rent, has been realised according to the prescribed rates and the credits traced, in the accounts of the Post Office., [24]

Page 35 :

76., , In respect of grant of any immovable property made to a local authority, for public, religious or educational purposes, it should be seen that the, conditions set forth in Rule – 455 of Postal Manual Volume II are being, fulfilled., , 77., , The files of contracts should be scrutinised to see :a., , That the tenderers as well as tenders are invariably invited in the, , most open and public manner., , b., , That sufficient earnest money is taken as security against loss, , from each tender;, , c., , I., , In scrutinising and acceptance of tender it should be seen :-, , That the particulars regarding quantity and rates are furnished, and the prices stipulated are firm. Tenders relating to contracts, providing price variation clause or provisional rates should be, specially examined., , II., , That there is no omission of any important clause eg., Inspection of stores, date and place of delivery, despatch, instructions, name of consigner, etc.,, , III., , That it is signed by an authority which is competent to enter, into the contract. In case the signature on the order is that of, an authority who is not competent to enter into the contract, a, certificate to the effect that the purpose has been approved by, the competent authority is recorded thereon mentioning also, the designation of the authority whose approval has been, obtained., [25]

Page 36 :

Note :-, , In the copies of acceptance of tender, supply orders etc., , all the sheets containing rates, prices and other important, conditions should be signed in ink by the purchasing officer, concerned., IV., , That, if the acceptance of tender provides for payment to a, party other than the contracting firm, a power of attorney is, already registered on Book of the office., , V., , The provision for the payment of sales tax, exercise duty etc., should be checked with reference to the instructions issued by, the Government from time to time. Vogue provisions, such as,, “Sales Tax will be paid, if legally leviable” should be rate, indefinite terms whether Sales / Tax exercise duty etc. are, payable and if so at what rate and on what amounts., , d., , Whether the successful tenderer has indirectly derived an, advantage over the other tenderers by the insertion of special, conditions which have the effect of raising the rate quoted by, him., , e., , That sufficient reasons exist for employing the same contractor, in the majority of the cases, if there is any such contractor,, , f., , That contracts are executed on standard forms applicable to, each case, they may , however, be modified to suit local, requirements after consultation with the legal advisers of the, Government and the Director General,, , [26]

Page 37 :

g., , That no contracts containing any unusual condition have been, entered into without the previous consent of the Ministry of, Finance (Communications). It should also be seen that the no, material variation in contracts once entered into has been made, without the previous consent of the authority competent to, enter into the contract as to varied;, , h., , That security has been taken from all contractors and, contractors lodging Government Securities have executed, agreements in Form Section 24., , i., , That in the case of contracts for conveyance of mails, amounting less than the prescribed amount, the conditions and, stipulations laid down in the agreements are being observed, and payments made on due observance of the conditions;, , j., , Whether, as so far as can be ascertained from the purchase, files, demands of other indenting officers received at the time, have been bulked together as far as possible to secure the, advantage of bulk supply rates, etc., and if so, whether the total, quantity in respect of all the individual contracts issued against, the bulked indents does not exceed and quantity of bulked, indents;, , k., , Whether purchase has been effected by single tender or, negotiation, if so, whether sanction of the Competent Authority, has been obtained and reasons recorded for resorting to this, method of purpose;, , l., , (i) whether all tenders were opened on the due date, and, numbered and initialled with date by the officer opening them;, [27]

Page 38 :

(ii) Whether the Comparative Statement is on record and has, been checked with original tenders;, , m., , Whether any delayed / late tender has been incorporated in, Comparative Statement and considered, and whether orders of, the Competent Authority have been obtained to the, consideration and acceptance of these tenders;, , n., , Whether the contract has been placed on a Registered firm and,, if not, it should be examined whether it is with or without, security and whether sanction of the Competent Authority has, been obtained;, , o., , Whether the rates accepted have changed in any case after the, conclusion of the contract and if so, whether the change in, price has whether the reasons, justifying such changes are, adequate;, , p., , Whether any supplementary contract has been negotiated for, payment authorised for any additional service required of the, contractor subsequent to the placing of the acceptances of, tenders and, if so the action taken should be examined with, regard to propriety and competency., , q., , Extract the list of all Registered Customers wherein contract is, created in the system and check the correctness of Sales and, correct, , realisation, , of, , Accounts, , Receivable, , including, , correctness of Customer Ledger and overdue open items., , r., , Extract the list of Registered Vendors wherein is contract is, created in the system and check the correctness Procurement, [28]

Page 39 :

of Goods and Services and correct payment of Accounts, Payable including correctness of Vendor Ledger and overdue, open items., , 78., , In respect of Contingent Charges, Generate Expense Report for a period /, days and check the correctness in accordance with Rule Rules 354 to 356, of Postal Financial Hand Book Volume I. The classification of GL for, each expense be verified and any wrong classification, if found be, corrected, separating from charges relating to Works Expenditure., , 79. The classification of certain charges shown in the Contingent Register, should be compared and necessary instructions given to the staff on the, spot if instances of wrong classification are found., , 80., (i) It should be seen that charges for water and electric current, consumed are regularly recovered monthly from the non-gazetted, officials of the Postal Department whose pay as defined in FR 9(21) in, respect of buildings occupied by them free of rent., , (ii) In all cases other than those falling under clause (I) above it should, be seen that all municipal (including personal) taxes and other taxes,, not being in the nature of house or property taxes, payable by the, government or by the tenant in respect of the resident or, accommodation occupied by Government Officials or private persons, bodies are recovered regularly monthly from the occupants., , 81., , It should be seen that the Register of Treasury transactions maintained by, the Postmaster himself and posting of scrolls is done up to date and list of, unlinked items is prepared in the system., [29]

Page 40 :

82., , It should be seen :-, , a. That a register of Cheque Books is maintained in the system are, correct in the system with reference to the actual Stock on Hand., (vide Rule 172, Posts and Telegraph Financial Hand Book Volume, I)., , b. That the Blank Cheque Books are kept under lock and key in the, custody of the postmaster. The stock should be verified by actual, count;, , c. That the certificate of count of cheques is signed by the Postmaster, on receipt of each Cheque Book (Rule 172, Posts and Telegraph, Financial Hand Book Volume I)., , d. That the counterfoils of cheques are initialled by the Postmaster if, any correctly or alteration is noticed therein, and if any doubt arises,, a thorough investigation should be made;, , e. That the counterfoils of used up cheque books are preserved for, three years and then destroyed;, , f. That there are no Cheque Books in the Post Office, which have, been partly used and are not likely to be used in future. All such, Cheque Books should be returned to the Issuing Officer ., , g. That the provisions of Notes 1 & 2 below Rule 128 of Posts and, Telegraph Financial Hand Book Volume I are strictly followed and, that the original copy of the Memo of remittances by Cheque [Form, ACG 11(a)] or in the case of cheques on local clearing Banks, on, copy of the list [Form ACG 11(b)] along with one copy of the, [30]

Page 41 :

Challan is duly received from the Bank / Treasury Officer signed, and receipted in token of acknowledgement of the money, represented by each cheque., , h. Whether the serial numbers of Sub Office Memo for drawing from, or remittances to treasuries or Sub Treasuries in From No. ACG –, 13 and 14 respectively kept in the Head office run in a consecutive, series, and in cases where there are gaps due to cancellation, the, original and duplicate copies or 3 copies where forms are printed in, quadruplicate i.e. for transactions in respect of cheques of the, cancelled memos are on record in the Head Office – Checks and, balances for SO transactions be carried out by CDDO and maintain, records as in the system., , i. That separate register in Form AGPT-506 in Annexure I and II to, the Director General, P& T letter No. 27-1/61-CI/B dated 19th, September, 1964 in respect of each Bank, for noting the daily, transactions of drawls / remittances from / to Banks are maintained, properly. The monthly total of the money column i.e. Column 4, under “Remittances to Bank” and “Drawing from Bank” should be, checked and the totals agreed with the corresponding amount, incorporated in the Cash Book and the relevant schedules of the, month concerned. Ensure that the amount as in the Register of, Cheques for Drawings and Remittances are daily tallied with the, figures as in Drawn from Clearing GL and Remittance to Bank, Clearing GL. Ensure once reconciliation is done that the Drawn, from Bank Clearing Account and the Remittance to Bank Clearing, Account are debited and Credited respectively with Drawn from, Bank GL and Remittance to Bank GL., , [31]

Page 42 :

j. That the daily scrolls received on the daily basis from Banks are, properly checked and filed, the unadjusted items are correctly, extracted and agreed, the statement in Annexure III to the Director, General, P& T letter No. 27-2/CT/B dated the 19th September, 1964, is sent to the Accounts Office and the abstracts duly verified by the, Accounts Office are received and kept on record. For this purpose, the copy received and retained in Accounts Office should be, furnished to Inspection Party., , k. That the pairing of schedules done with the Bank Scrolls and the, Bank Scrolls for each unit are tagged date wise and separately for, each Branch of the Bank for that unit., , l. That the entries in the foils of paid cheques brought from the, Accounts Office agree with the corresponding entries in the, counterfoils, Cash Book and Vouchers were available., , The, , endorsements and acknowledgement of the payees on cheques, should be examined intelligently wherever possible to see as to, whether they give rise to any suspicion of fraudulent payment., Note: 1. The checks indicated in this clause should be exercised for, at least 10 percent of the paid cheques of the selected month., m. The checks indicated in clauses (g) & (h) should be exercised for a, month of test check that other checks being exercised in a general, way for the entire period since the last Internal Audit Inspection, , 83., , The items which remain unlinked or the discrepancy which came to, notice in Central Check linking the remittance transactions between the, Post Offices, , and the Bank / Treasury should be investigated. For this, , purpose, the Central Check should supply to inspecting Parties a, complete list of discrepant and unlinked items with full particulars., [32]

Page 43 :

84., , Some of the fortnightly Bills issued by the Post Office for realisation of, the amounts due on articles posted without pre-payment should be test, checked as to their correctness with reference to the office copies of the, invoices of the articles posted, retained in the Post Offices. It should also, be seen that cases of delay, if any, in the payment of the Bills have been, reported promptly to the Postmaster General. For this purpose, the Bills, relating to the month of test check and also those of any other month, selected by the Heads of Postal Accounts may be examined., , 85., , The relevant files in the Post Offices relating to Registered Newspapers, licensed for posting without pre-payment should also be examined to see, that where the renewal of both the registration and the licence was not, executed in time, the concession of posting the Newspapers without prepayment was not allowed during the period of registration and or licence, was not in force., , 86., , It may be ensured that the Register of Customers who are posting, Newspapers without pre-payment are renewed their license and there, should not be any postings without any renewal., , 87., a. The register of persons holding window delivery tickets should be, examined to see whether the fees have been realised in advance at, the prescribed rate and properly accounted for, the credits being, traced in the schedule of unclassified receipts., b. It should be seen whether in any case the period up to which a ticket, was valid, has been exceeded and if so, what action has been taken., It should also be seen that no refund has been allowed in any case., c. See whether the prescribed fees for Window Delivery ticket has, been collected and credit has been made in the correct GL., [33]

Page 44 :

88., , The following checks should be exercised in respect of collection of, Postage Revenue through Franking Machines,, , a. Check all the franking machine holders list to ensure that the, license is valid and within five years of license date using, franking operations module in CSI., b. Review the Register of Meter readings and see that the, difference between the opening balance and the closing balance, for the day is credited in the Daily Transaction Report after, settlement., c. Ensure that the SOM capture is done on day to day basis for, accountable and un accountable articles., d. Check the rebate is being paid correctly and is being processed, through the System module and not by voucher posting., e. Check all the open items for settlement and comment for the, lapses if any of items pending for a long time., f. Check for any duplicate of RV document and address such, issues for rectification., g. Check the ledger of each RFMS license holder to ensure that the, closing balance tallies with the closing balance for the day as in, the SOM list., h. Ensure that the rebate paid is correct with booking under soft, copy and without soft copy., i. Check the refunds for in correct franking is done through the, system and 5% deduction made on refunds., j. Check the periodicity of connecting the machine with server on, periodic/daily basis and point out the lapse if any., k. Check the correctness of refunds against cancellation of RFMS, facility to a license holder., l. Check all the accounting entries and revenue is flown to CGA, report in case of both accountable and ordinary articles., [34]

Page 45 :

m. Check whether surcharge is collected in case the renewal is, done after expiry of five years., n. Check the ledger of license holder using fd10n t-code and, ensure that there are no debit balances at any point of time., o. Check the sanctions issued by Divisional head for refunds and, cancellation and link it with payment GLs and accounting, entries., p. Check any reversal made in the recharge document for wrong, recharge if any and how such reversals behaved in the system., q. The above checks may be done for both private and, departmental franking machines., Note :1. The above checks may be exercised in respect of transactions, of three days in the month of test check and for 3 days immediately, before commencement of the inspection. However, the review of the, Meter Register should be conducted for the entire month selected for, test check., 2., , See that a separate special error book is maintained to paste the, impressions of such mis-franked postage for which no credit is, afforded., , 3., , The following checks may be exercised in respect of the, Franking Machines fixed in the customer’s premises., i. That the Franking Machine is duly licensed and posting, is done only in the specified Post Offices., ii. It should also be seen that special error book is, maintained., , 89. Check the inventory of all saleable publications in the MM module and, check the following:, i., , Check the accuracy of accounting documents from requisition stage, to payment document as the case may be., [35]

Page 46 :

ii., , Check for any obsolete items and suggest any remedial action for its, removal from the main stock., , iii., , Check the flow of revenue in the accounting document and up to the, stage of CGA report and comment on omissions if any., , iv., , Check on the offset of cost of purchase and revenue separately such, that the cost is not figured as revenue., Note: 1. The above checks may be exercised in respect of transactions of, one week in the month of test check and for 3 days immediately before, commencement of the inspection., , v., , It should be seen that rates mentioned in the invoice are current rates, and same has been realised while selling to public. The corresponding, credits should be checked in treasurer cash book and HO daily, transaction report, GL reports concerned etc. for the test check, months., , 90., , Wherever the Department has to raise Bills for Service Charges/, Commission Charges from the various Customers for the Business done, by the DOP like e-Payment/ e-Biller etc.,, it may be ensured that the, Nodal Office has raised the Bills for realisation of revenue and such, revenue has been got credited to the Government Accounts (Collection of, Electricity Bills for which the Service charges is receivable against the, bills raised by the DOP.), , 91., , It should be seen: a) That all miscellaneous receipts are issued and collected in the POS for, various kinds of transactions and its mapping of GL is correct., b) Wherever manual receipts are used, they are in the safe custody of the, Head of the Office and stock are in commensurate with the, requirements., c) That counterfoils are available for the prescribed periodicity of, preservation period as prescribed., [36]

Page 47 :

d) Stock of Receipt Books should be physically counted and see the same, agrees as per Stock Register., e) Check on the receipt through system in case of insured articles and, uninsured registered parcels etc. Including VP articles, , 92., , It should be seen that important books and Registers as may be notified, by the Director General from time to time are periodically reviewed by, the Head of the Office., , 93., , The procedure of work in the Post Office should be generally reviewed, with a view to seeing whether any suggestions can be made for reducing, work that is superfluous or simplifying the procedure regarding any, particular work., , 94., , It should be ascertained whether any officials other than the Postmasterin-Charge reside in the office premises and, if so, whether any rent is, being recovered and how it has been assessed. The Electric / Water, charges are also to be recoverable at the prescribed rates where no, separate meter has been provided., , 95., , If there is any Departmental Car, Lorry or Boat, the Log Book and Petrol, Account should be examined., Ceiling fixed for the consumption of diesel / petrol should be seen. If, excess consumption found, reasons should be obtained, examined and, commented., N.B.: - The monthly closing entries in the Log Book and the recoveries, made for non-duty journey performed should be test checked., , 96., , Record of sanction to expenditure to an aggregate annual limit should be, examined to see that the annual limit has not been exceeded during any, year Rule 348, Posts and Telegraph Financial Hand Book Volume I., [37]

Page 48 :

N.B.: - In order to have better budgetary control in the Divisional, Office and it should be seen that the monthly expenditure under each, head is not exceeded with reference to the allotted budget for a DDO, using Budcon report in the system. Ceiling items should specially be, examined so as to see the overall expenditure is kept within the ceiling, fixed., 97., , The following records should also be examined generally: -, , a. History sheet of all goods having the nature of asset and also, stackable items., , b. Check the annual verification of furniture and physical verification, report conducted once a year by the Head of the Office and any, variation if any., , 98., a. The annual statement showing losses of Government property, received in the Accounts Office (vide Rule 269-C of the Postal, Manual, Volume II) to see if they have been correctly prepared with, reference to the deduction entries (other than those of issues) made, in the inventory under the several headings shown in Rule 11 of, Appendix 12 to the Postal Manual, Volume II, together with full, particulars of the articles and the reason for removing them from, stock., , b. It should be seen that: (i) All articles of stock purchases or received have been accounted, for in the Stock Registers in the CSI system., (ii) The quantity is correct;, [38]

Page 49 :

(iii) Price charges are reasonable and suitable, notes of payment, have been made on indents or orders; and, 99., , Unserviceable articles have been written in the Stock Register and have, been sold under the sanction of the competent authority., , The sale, , proceeds should be compared with credits afforded in the accounts and it, should be seen that proper records of sale are preserved. It should also be, seen whether stock is verified periodically by an independent officer., , 100. Check that the money orders issued are credited to the respective GLs, and commission is correctly configured in the system and service money, orders are issued for a genuine reason with the approval of the head of, the office., a. Check that Money orders are issued only after realisation of cheque, in case of booking of e-MO by Cheque., b. In case of registered bulk customers, check the ledger and ensure, there is no debit balance against any individual bulk customer., c. Check the unpaid money orders list for a office against receipts and, ensure that such money orders are not kept unduly for a long time, without returning to the sender., d. Ensure that the MO vouchers are available for each payment of MO, for the test check month as marked by the Head of Postal Accounts, Office., e. In case of bulk money order customer ensure that the return to, sender- money orders are processed through the system only and, payment action done through system process as designed in the CSI, and payment is matching with the actual amount as in the system, generated liability document and it is credited to the correct bulk, customer., , [39]

Page 50 :

f. Ensure that the unpaid money orders over a period of three calendar, years are transferred to revenue as forfeited Money orders at the end, of the respective third financial year., g. Ensure that the Void e-MOs are not paid without the release of PAO, and they are not in the custody of Postmaster. Ensure the unpaid, money order printed copy is sent to PAO for preservation and, release when requisitioned by Postmaster., h. Ensure that there are no balances in the Postman issue GL and it is, zero at the end of each day., i. Ensure that the VPP clearing GL is also cleared at the end of day, and residual balance left at the end of each day., j. Check the open items and comment on the functionality of open, item management GL as MO GL is built under the functionality of, open item management. Check the open items as the MO GL is, configured as open item GL and system should reconcile debit, against corresponding credit., , Note: -, , It will be sufficient if the test check is applied for a week, , for the period of marked month by Head of Postal Accounts Office,, wherever applicable in case of all above points., 101. It should be seen that no void Money Order is kept in deposit in the Post, Office after the period allowed under Rules of Postal Manual Volume VI, (Part II)., , 102. It should be seen whether the entries in the journals of value payable, articles are regularly disposed of by note of value payable Money Orders, received, and in case of delay, whether calls have been issued on due, dates as required under Rule of Postal Manual Volume VI (Part II)., , 103. Ensure that all VPP articles are booked and the liability for a day is, cleared and liability exists and carried forward., [40]

Page 51 :

104. It should be investigated whether it was ever found necessary to stop, issue or payment of a value payable Money Order on account of fraud or, similar course. If so, particulars may be noted., , 105. Check the correctness of movement of IPO stock from plant to plant and, plant to storage location and ensure that the inventory of IPOs in the MM, module. Ensure that the sale value along with commission is accounted, in the accounts correctly matching with the depletion of stock in the, stock register according to sales., , 106. Ensure that the unpaid IPOs over a period of three calendar years are, transferred to revenue as forfeited IPOs at the end of the respective third, financial year., , 107. Check the open items as the IPO GL is configured as open item GL and, system should reconcile debit against corresponding credit., , 108. Check the NSC/KVP/IVP etc. discharged accounting entries for the, marked dates and ensure the corresponding credits in the original, application and migrated record in the CBS system. In case non migrated, certificates, any certificates discharged through voucher posting has to be, checked cent percent and corresponding credit is verified. Check the, correctness of amount as charged in the system with reference to the, original hard copy of certificate brought from PAO. This check has to be, done for one week during the marked month., , 109. It may be ensured that no employee who entered in the Government, Service on 01.01.2004 and after whichever is earlier, subscribing the, GPF., [41]

Page 52 :