Page 1 :

AAYUSH ACADEMY, FINANCIAL HAND BOOK VOL-01, CHAPTER IX, Establishment Sections of Establishment, Rule 199. The establishments in each office are divided into "sections". No fixed rules can be laid down, as to what constitutes a section; but the sections should be fixed by the Circle Postal Accounts Officer in, communication with the Heads of Offices on the following principles :—, , (a) The sections should be mainly divided according to the different classes of officials under each, detailed head of account in each sub-section of each Abstract of expenditure; and, (b) The establishment should ordinarily be divided into as many sections as there are different scales of, pay so that each section may represent a unit of Government servants drawing pay in the same timescale and under one Officer's control. An old scale of pay and its corresponding new scale of pay are, considered as one scale of pay for the purpose of this clause., , EXCEPTION.—In the Post Office, Postal Accounts and Sub-Postmasters, on the same timescale of pay, form one section. Similarly, Inspectors of Post Offices and Head Clerks of Superintendents of Post Offices, form one Section. Alteration of EstablishmenT., , Alteration of Establishment, , Rule 200. When the entertainment of a new establishment or a change, temporary or permanent, is, proposed in an office, a letter fully explaining the proposals and the conditions which have given rise to, them should be submitted to the authority concerned. In this letter should be set out inter alia: —, , (i), , the present cost, either of the section or sections affected, or of the total establishment as, the circumstances of the case may indicate to be necessary;

Page 2 :

(ii), , details of the number and pay of the appointments which it is proposed to add or modify;, and (iii) as accurate an estimate as possible of the extra cost involved., , Rule 201. The powers of sanction of various subordinate authorities in the Department of Posts are, specified in the Schedule of Financial Powers of Officers of the Department of Posts. All proposals for, additions to establishments, whether permanent or temporary, or for any increase in the emoluments, of existing posts, should be scrutinized with the greatest care by heads of departments and other, authorities concerned. In submitting such proposal, the instructions, contained in the following rules,, should be carefully observed., Rule 202. Besides the covering letter referred to in Rule 200, a proposition statement in the prescribed, form in duplicate should accompany all proposals for large scale revision of establishment in, complicated cases and for other general schemes which require the sanction of the Government. The, proposition statement where these are of large scale or complicated in nature should only be forwarded, through the Circle Postal Account Office. Statements connected with Temporary, Experimental and, Monsoon establishments may, however, be submitted to the Director-General or the Head of the Circle, direct., , Register of Sanctioned Establishments, , Rule 205. A register in the prescribed form [A.C.G.-19(a)], will be maintained by Heads of Offices in all, the branches of the Department of Posts showing the sanctioned establishments under them. The, Heads of Offices will be personally responsible for seeing that the register is kept corrected up to date, and that no charges, which have not been duly sanctioned, are included in the Establishment Pay Bill., , Such of the register will be maintained manually and kept up-to-date by Heads of the Circles also in, respect of all posts sanctioned in the Department’s Offices as well as Extra Department Offices under, their Jurisdiction., , Rule 206. In addition to the register of sanctioned establishments referred to in Rule 205 which will, contain details of the establishment of each office or line within the jurisdiction of the Head Post Office,, the Head Postmaster will maintain a consolidated statement containing the information in summary, form which is required for the purpose of preparing proposition statements in accordance with the, distribution by level of pay. In this consolidated statement spaces should be left between the entries, relating to the various sections so as to permit of notes being made with regard to increases and

Page 3 :

reductions that may be ordered from time to time. When a proposition statement has to be submitted it, will be necessary for the head Post Office merely to prepare, and furnish the Superintendent of Post, Offices with a copy of the consolidated statement as corrected up-to-date, or an extract from it relating, to the sections (viz.- cadres of the particular level of pay) affected by the proposals., , Date of Birth, Rule 207. Every person newly appointed to a service or a post under Government should, at the time of, the appointment, declare his date of birth by the Christian era as far as possible with confirmatory, documentary evidence such as a matriculation certificate, municipal birth certificate and so on. If the, exact date is not known, an approximate date may be given. The actual date or the assumed date, determined (vide Rule 208) should be recorded in the history of services, Service Book, or any other, record that may be kept in respect of the service under the Government of the Government servant, concerned and once recorded, it can-not be altered, except in the case of a clerical error, without the, previous orders of the Department, Central Government or of a Local Administration., No alteration in the date of birth of a Government servant should be made except with the sanction of, the Ministry/Department concerned of the Central Government, under which the Government servant, is serving provided:, (a) A request in this regard is made within five years of his entry into Government service., (b) it is clearly established that a genuine bonafide mistake has occurred; and, (c) the date of birth so altered would not make him ineligible to appear in any School or University or, UPSC examination in which he had appeared, or for entry into Government service on the date on which, he first appeared at such examination or on the date on which he entered Government service., , GOVERNMENT OF INDIA’S DECISION, Conditions for changing Date of Birth: -, , The date on which a Government servant attains the age of fifty eight years or sixty years, as the case, may be, shall be determined with reference to the date of birth declared by the Government servant at, the time of appointment and accepted by the appropriate authority on production, as far as possible, of, confirmatory documentary evidence such as High School or Higher Secondary or Secondary School, Certificate or extracts from Birth Register. The date of birth so declared by Government servant and, accepted by the appropriate authority shall not be subject to any alteration except as specified in this, note. An alternation in date of birth of a Government servant can be made, with the sanction of Ministry, or Department of the Central Government or the Comptroller and Auditor General in regards to person

Page 4 :

serving in Indian Audit and Accounts Department, or an administrator of a Union Territory under which, the Government servant is serving, if(a) a request in this regard is made within five years of his entry in the Government service;, (b) it is clearly established that a genuine bonafide mistake has occurred; and, (c) the date of birth so altered would not make him ineligible to appear in any school or university or, UPSC examinations in which he had appeared or for entry into Government service on the date on, which he entered Government service., , Rule 208. (a) If a Government servant is unable to state his exact date of birth but can state the year, or, year and month of birth, the 1st July or the 16th of the month respectively, may be treated as the date, of his birth., (b) If he is only able to state his approximate age, his date of birth may be assumed to be the, corresponding date after deducting the number of years representing his age from his date of, appointment., (c) When a person who first entered Military employ was subsequently employed in a Civil Department,, the date of birth for the purpose of the Civil employment should be the date stated by him at the time, of attestation or if at the time of attestation he stated only his age, the date of birth should be deduced, with reference to that age according to the method indicated in clause (b) above., , Service Books, , Rule 209. The detailed rules regarding the maintenance of Service Books are contained in, Supplementary Rules 197 to 203, Rule 288 of GFR-2017 and Chapter IV of CGA’s DDO Manual (Third, Edition)., , The cost of Service Books should be borne by the Government and the expenditure on this account, debited to the head “3201-Postal Services-08-102-01-04 Stationery and Forms printing, storage and, distribution.

Page 5 :

GOVERNMENT OF INDIA’S DECISION, , (1) Maintenance of Service Book in Duplicate: - The Service Book of a Government Servant shall be, maintained in duplicate., (2) First Copy shall be retained and maintained by the Head of the Office and the second copy, should be given to the Government servant for safe custody as indicated below: (a) To the existing employees: - within six months of the date on which these rules become, effective (i.e. from 1st July, 2005- vide G.I MF OM no. 8/9/E.II (A)/2003 dated the 1st July,, 2005) (b) To new Appointees: - within one month of the date of appointment [Rule 288 (2),, General Financial Rules 2017]., (2). Cost of photograph to be affixed on the first page of the revised Service Book, shall be borne by the, Government- A photograph of the Government employee has to be affixed on the first page of Part-I of, the revised Service Book. A question has been raised whether the cost of the photograph has to be, borne by the Government employee or by the Government. The matter has been considered in this, Ministry and the President is pleased to decide that the cost of the photograph shall be borne by the, Government in future. ( G.I, MoF, O.M. No. 17011/I/E.IV(A)/77, dated the 7th July, 1977)., , Rule 211. The Service Books and Service Rolls should be kept in the custody of the Head of Office. When, an employee is transferred to another office, his Service Book or Service Roll should not be sent to the, Head of the Office to which he is transferred and not made over to him, nor should it be given to him, when proceeding on leave. The Service Books of Gazetted Officers, officiating or substantive, should be, kept in the custody of the competent authority responsible for authorizing the entitlement of their pay, and allowances. If the Head of an Office is non-Gazetted Government servant, his own Service Book, should be kept in the custody of his immediate superior., , Rule 212. (a) The Service Books should be kept arranged alphabetically., , NOTE.—If the number of Service Books to be maintained in an office is not large then the Service Books, of all officials in that office, may be kept together alphabetically. If however, the number of Service, Books is large, the Service Books may be arranged cadre wise but in that case the alphabetical Index, should also be maintained cadre wise., (b) Except as provided in Rule 285 Service Books must always be kept unfolded; and whenever it is, necessary to send a book by post it should be forwarded unfolded between stiff boards large enough to, protect contents and be dispatched under registered cover.

Page 6 :

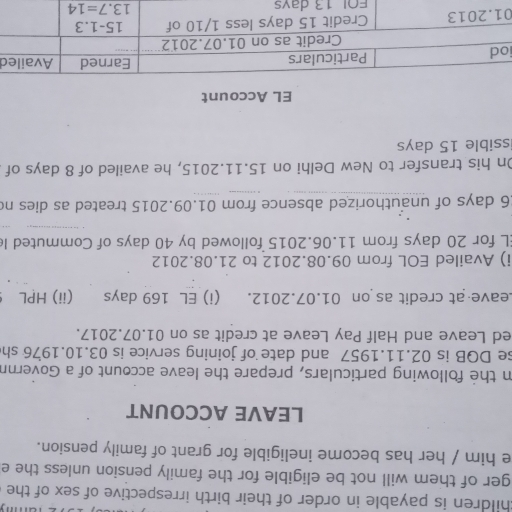

(c) On the first appointment of a Government servant for whom a Service Book is required to be, maintained under S. R. 197the necessary book should be opened by the Officer making the appointment, who should fill in and contemporaneously attest the descriptive particulars on the first page. The, particulars must be furnished from his personal knowledge of the newly appointed Government servant, at the time of appointment if possible; other- wise they should be obtained through some other, Departmental Officer named by the Officer making the appointment, the Service Book being sent to him, for the purpose. The book should then (if necessary) be forwarded for custody to the Head of the Office, concerned., (d) In cases in which the descriptive particulars are not supplied from the personal knowledge of the, Officer making the appointment, he should, when he first meets the newly appointed Government, servant in the course of his tours or inspections, make a note of those particulars with a view to, verifying and attesting, at the earliest opportunity, the entries already made in the Government, servant's Service Book., , Leave Accounts Rule 214. The Leave Account of a non-Gazetted Government servant will be kept in the, custody of the Head of the Office in which he is employed as prescribed in Supplementary Rule 215(b), and the entries in the Leave Account attested by the later. The Leave Account of a non-Gazetted, Government servant who himself is the Head of an Office should, however, be kept in the custody of his, immediate superior who will also attest the entries in the Leave ACCOUNT., , GOVERNEMENT OF INDIA ORDER’S, , Consequent upon implementation of recommendations of 7th CPC Government of India has issued, fresh orders/guidelines, specifically, in respect of the categories of the employees those would be, eligible to draw the OTA, as below: -, , 1. The Government has decided that given the rise in the pay over the years, the recommendations of, the 7th CPC to discontinue OTA for categories other than Operational Staff and industrial employees, who are governed by statutory provisions may be accepted., 2. Accordingly, it has been decided to implement the aforesaid decision of the Government on Overtime, Allowance across all the Ministries/Departments and attached and subordinate office of the, Government of India. The following definition shall be used to define Operational Staff. "All nonministerial non-Gazetted Central Government servants directly involved in smooth operation of the, office including those tasked with operation of some electrical or mechanical equipment."

Page 7 :

3. The concerned Administration Wing of the Ministries/Departments will prepare a list of operational, Staff with full justification based on the above parameters for inclusion of a particular category of staff, in the list of operational staff with the approval of JS (Admn.) and Financial Adviser of the concerned, Ministry / Department., 4. The grant of OTA may be linked to biometric attendance subject to the conditions mentioned below., a) OTA should be paid only when his/her senior officer directs the concerned employee(s) in writing for, staying back in office to attend urgent nature of work., b) The OTA will be calculated on the basis of biometric attendance., c) The OTA for Staff Car Drivers should be linked with biometric system as normally, the designated, parking is allotted in the office building., However, in cases where the parking lot is provided far from office, the Staff Car Driver would mark, his/her attendance while leaving from his office and a grace time of not exceeding 2 hours should be, allowed to cover the distance travelled after leaving office, including the time to drop the officer and, then reaching the parking lot. In such cases, calculation can be done from log books, duly verified by the, officer concerned., d) The OTA to field officials should be calculated on the basis of biometric attendance, as normally, such, officers are given facility of official transport to attend the field work. Such officers are supposed to, report in office before proceeding to field. In cases, where officials are required to attend the field work, directly from home, they may be extended facility of official transport from home in lieu of transport, allowance and OTA may be given on the basis of the log book of that vehicle, duly verified by their, senior officers., , 5. Since, the Government has decided not to revise the rates of OTA, the rates as prescribed in this, Department's OM dated 19th March, 1991 for Office Staff, Staff Car Drivers and Operative Staff will, continue to operate subject to their fulfillment of the above conditions., 6. All the existing instructions, except to the extent superseded by this O.M., will continue to remain in, force., 7. These instructions will be applicable with effect from 01 July, 2017., Note: Necessary action for allowing the OTA to the eligible staff shall be determined strictly as per the, list specified by the Department in compliance to Para. 3 of above order. Ministry of Personnel, Public, Grievances and Pensions, Department of Personnel &Training OM No.A-27016/ 03/ 2017-Estt.(AL) dated, 19th June, 2018.

Page 8 :

CHAPTER X, Contingent Charges, Introductory, Rule 241. The term 'Contingent Charges' or 'Contingencies' used in this Chapter means and includes all, incidental and other expenses, which are incurred for the management of an office as an office or for, the technical working of a department, other than those which under prescribed rules of classification of, expenditure fall under such other heads as 'works', 'repairs’, 'stock', or ‘tools and plants', etc., , A list of important items, to be classified under 'Other Contingencies' as well as a list showing the names, of important articles in common use in all the branches of the Department of Posts, cost of which should, be debited to the detailed heads, 'Liveries and Uniforms' and 'Purchase and Repair of Furniture’ below, the Head 'contingencies' is given in AppeNDIX-13A., , All items of contingent expenditure which do not find a place in the list of contingent expenditure, detailed in Appendix-13-A to this Handbook and those items for which no specific financial powers have, been delegated to any of the authorities in the Department should be treated as ‘Other Miscellaneous, Expenditure’. The term will also exclude all items falling within the category of pay and allowances to, Government Servants, leave salary, pensions, Grant-in-Aid, Contributions works, stocks, tools and plant, and the like., , Classification of Charges, , Rule 243. Contingent charges incurred on the public service may be divided into the following classes:—, (i) Contract Contingencies—Those for which a lump sum is placed annually at the disposal of a, Disbursing Officer for expenditure without further sanction of any kind. They generally consist of, charges the annual incidence of which can be averaged with reasonable accuracy., (ii) Special Contingencies—To include such contingent charges, whether recurring or nonrecurring and, cannot be incurred without the previous sanction of a superior authority.

Page 9 :

(iii), , Countersigned Contingencies—To include such contingent charges as may require the, approval of some controlling authority before they can be admitted as legitimate, expenditure against the Government, such approval usually taking the form of counter, signature after payment on a detailed bill submitted to the Account Officer., , (iv), , (iv) Full Vouched Contingencies—To comprise contingent charges, which require neither, special sanction countersignature, but may be incurred by the Head of the Office on his own, authority subject to the necessity of accounting for them. These may be passed on fully, vouched bills without countersignature., , GENERAL RULES, General matter, Rule 244. (1) The financial powers of subordinate authorities to sanction contingent expenditure are, regulated generally by the orders embodied in the Schedule of Financial Powers of Officers of the, Department of Posts and such other general or special orders as may be issued by the Government in, this behalf., Subject as aforesaid, the Head of an Office may incur or sanction expenditure on contingencies within, the amount of appropriation placed at his disposal for the purpose,, provided that— (i) In cases where any special rule, restriction, limit or scale has been prescribed by, Competent Authority regarding any particular item or class of contingent expenditure, it should be, strictly observed., , Rule 245. Persons on daily wages (casual workers) should not be engaged for a work of regular nature., Casual Labourers cannot be deployed/engaged for a work of regular nature, casual which stands, assigned to the MTS vide Postal Directorate OM dated 24.09.2010 while adopting a common, designation for the erstwhile Group 'D’ as Multi Tasking Staff (MTS) Group 'C'. Some additional duties, were assigned to MTS Cadre in addition to their existing duties like watch and ward, caretaker duties,, opening and closing of rooms, general cleanliness and upkeep of section, Unit/office including dusting of, furniture, cleaning of building, rooms, fixtures; upkeep of parks, lawns, potted plants etc., , Rule 246. (i) Where the nature of work entrusted to the casual workers and regular employees is the, same, the casual workers may be paid at the rate of 1/30th of the pay at the minimum of the relevant, pay scale plus dearness allowance for work of 8 hours a day., (ii) In cases where the work done by a casual worker is different from the work done by a regular, employee, the casual worker may be paid only the minimum wages notified by the Ministry of Labour, &Employment of the State Government/Union Territory Administration, whichever is higher, as per the

Page 10 :

Minimum Wages Act 1948. (iii) Persons on daily wages (casual workers) should not be recruited for work, of regular nature., , Rule 247. All charges actually incurred must be paid and drawn at once, and under no circumstances, may they be allowed to stand over to be paid from the grant of another year., Rule 248. No money should be drawn unless it is required for immediate disbursement. It is not, permissible to draw money in anticipation of demands, or to prevent the lapse of budget grants., Rule 249. Contingent charges are to be recorded and treated in the accounts as charges of the month in, which they are actually disbursed., , Responsibility of Drawing Officers, Rule 250. Every Government Officer shall exercise the same vigilance in respect to petty contingent, expenses as a person of ordinary prudence may be expected to exercise in spending his own money. The, Drawing Officer is further responsible for seeing that the rules regarding the preparation of bills are, observed, that the money is either required for immediate disbursement or has already been paid from, the permanent advance (or cash imprest, as the case may be), that the expenditure is within the, available appropriation and that all steps have been taken with a view to obtain an additional, appropriation, if the original appropriation has either been exceeded or is likely to be exceeded and that, in the case of contract contingencies, the proposed expenditure does not cause any access over the, contract grant., , Responsibility of Controlling Authority, Rule 251. The countersigning Officer shall be responsible for seeing (i) that the items of expenditure, included in a contingent bill are of obvious necessity, and are at fair and reasonable rates; (ii) that, previous sanction for any item requiring it is attached; (iii) that the requisite vouchers are all received, and in order, and that the calculations are correct and; specially (iv) that the grants have not been, exceeded nor are they likely to be exceeded and that the Accounts Officer has been informed either by a, note on the bill or otherwise of the reason for any excess over the monthly proportion of the, appropriation. If expenditure be progressing too rapidly, he shall communicate with the Disbursing, Officer, and insist on its being checked.

Page 11 :

Permanent Advances, Rule 252. Government Officers who have to make payment for contingent expenditure, before they can, place themselves in funds by drawing contingent bills, may make such payments out of permanent, advances or imprests, which they may be permitted to hold under the orders of Competent Authority,, subject to recoupment on presentation of contingent bills. All such claims upto Rs.500 may be disbursed, out of permanent advance or imprest. The only Officers of the Department who are provided with, permanent advances are the heads of large administrative offices (e.g., Heads of Circles) and certain, Officers of the Railway Mail Service as also the managers Postal Store Depots performing the duties of, drawing and Disbursing Officers. No such advances are allowed to Postmasters who disburse the, contingent charges either from their balances or from their sanctioned imprests., , Rule 253. Head of Departments may exercise full power in consultation with their Internal Financial, Advisers, wherever Internal Financial Cells have been organized in terms of Ministry of Finance, O.M., No. F. 10 (3)-E. (Co-ord.)/67, dated 18-10-1968, to decide all matters relating to the amounts of, permanent advances in respect of offices/organizations subordinate to them. While fixing the quantum, of permanent advance, the sanctioning authority should take into account not only the remaining, conditions laid down in this rule but also the following:, , (a) the sanctioning authority should bear in mind that the advance should not be larger than absolutely, necessary;, (b) the advance should be based on the average monthly contingent expenditure of the office for the, preceding twelve months;, , Rule 253. Head of Departments may exercise full power in consultation with their Internal Financial, Advisers, wherever Internal Financial Cells have been organized in terms of Ministry of Finance, O.M., No. F. 10 (3)-E. (Co-ord.)/67, dated 18-10-1968, to decide all matters relating to the amounts of, permanent advances in respect of offices/organizations subordinate to them. While fixing the quantum, of permanent advance, the sanctioning authority should take into account not only the remaining, conditions laid down in this rule but also the following:, (a) the sanctioning authority should bear in mind that the advance should not be larger than absolutely, necessary;, , (b) the advance should be based on the average monthly contingent expenditure of the office, for the preceding twelve months;

Page 12 :

Control of Contingent Expenditure, Rule 254. For purposes of control and audit, Government will issue orders specifying the nature or, object of contingent charges of particular Disbursing Officers which should be classed as countersigned, contingent charges to be drawn and accounted for in accordance with the procedure prescribed in Rule, 275 of this Handbook., , Expenditure incurred by a Disbursing Officer on objects classed as countersigned contingencies must, come under the direct supervision and scrutiny of the Head of the Department of the Controlling Officer, who will sign the detailed bills relating to them. Monthly detailed bills in respect of countersigned, contingent charges incurred by each Officer should be submitted to the Controlling authority concerned, for detailed scrutiny and transmission after countersignature to the Circle Accounts Officer. Full details, of such charges need not be entered in the abstract bills presented for payment at the disbursing office., A Competent Authority may in respect of specified items of countersigned Contingent charges require, the detailed contingent bills to be sent to the controlling authority for scrutiny and countersignature, before it is presented for payment at the disbursing office., , Rule 255. No detailed bills need be submitted to a higher authority for contingent charges which are not, classed as countersigned contingencies; each bill presented at a disbursing office, should therefore,, contain full details of the expenditure, supported by necessary subvouchers for individual payment, included in the bill., Rule 256. The duties and responsibilities of disbursing and Controlling Officers with regard to contingent, expenditure incurred on the public service are defined in Rule 250 and 251 of this Handbook. The Head, of the Department should issue such subsidiary instructions as may be necessary for the guidance of, Controlling and Disbursing Officers subordinate to him., Rule 257. The following special instructions are laid down for the control of contingent expenditure:— (i), Where the appropriation for contingent charges covers expenditure on a number of distinct and, individually important objects or class of expenditure, such appropriation should be distributed by the, Controlling authority among the important items comprised in it. If some of the items are not important, those items taken as a whole may be treated as a single important item for this purpose. The, expenditure on each important item should be watched and controlled separately against the allotment, for it, especially when the charges are of a fluctuating nature., The contingent register prescribed in Rule 263et seq. of this Handbook should be so designed that this, can be done conveniently. (ii) For countersigned contingencies, the monthly detailed bills provide all the, information required by the Controlling authority for checking the expenditure against the, appropriation. If, in any month, the expenditure exceeds the monthly proportion of the appropriation

Page 13 :

for the year, the Disbursing Officer should send a report to the Controlling authority along with the, detailed bill furnishing special reasons for incurring the excess expenditure., , Record of Sanctions to expenditure, Rule 258. In the cases in which power to sanction an expenditure is delegated to an Officer with the, restriction that the total amount of sanction accorded during a year or any other period should not, exceed a certain limit, such Officers should in order to watch that the prescribed maximum limit is not, exceeded, keep a record of all sanctions accorded by him for each such class of expenditure in a register, with the following columns:—, (1) Serial number of entry. (2) No. and date of the sanction. (3) Name of the office incurring the, expenditure with brief particular of the charge. (4) Amount of each sanction. (5) Progressive total up, to and including each entry of a new sanction. (6) Remarks., Cancellation and Destruction of Sub-vouchers, Rule 259. The following rules for the prevention of the fraudulent use of sub-vouchers shall be, observed by all Drawing and Controlling Officers in the matter of cancellation and destruction of, sub-vouchers:(i). Unless in any case it is distinctly provided otherwise by any rule or order, no sub-voucher may be, destroyed until after a lapse of three years., (ii) Every sub-voucher which is not forwarded either to the Accounts Officer or to a Controlling, Officer along with the bills but is recorded in the office to which the expenditure relates, must be, duly cancelled by means of a rubber stamp or by an endorsement in red ink across the voucher, the, cancellation being initialed by the Officer authorized to draw the contingent bills of the office. The, cancellation should be made at the time when the contingent bill, in which the sub-voucher or subvouchers are included, is actually signed. If the amount of a sub-voucher exceeds the permanent, advance, the cancellation shall be made immediately the payment is made and entered in the, contingent register., (iii) Sub-vouchers for sums exceeding Rs. 50 but not exceeding Rs. 200 submitted to a Controlling, Officer which he is not required to forward to the Accounts Officer shall be duly cancelled by him, after check and the cancellation shall be attested by the Controlling Officer at the time of, countersignature of the bill. Sub-vouchers for sums not exceeding Rs. 50 with the exception of, vouchers for wages of Mazdoors should be so defaced or mutilated that they cannot be used again., Supply of Articles for public service, Rule 260. Subject to any special rule or order on the subject, an authority which is competent to, incur contingent expenditure may sanction the purchase of stores required for use in the public, service. Such purchases are also subject to the usual restrictions regarding the existence of

Page 14 :

necessary appropriations and to any monetary limits and other conditions prescribed generally or in, regard to specific articles or classes of articles. The orders relating to the supply of articles for the, public service are contained in the Store Rules in Appendix 6 and those relating to supply of, stationery and printing stores for public service are given in Appendix 8. Instructions for the, purchase of Stores through GeM are available on GeM Portal established by the Government of, India and Government e-Marketplace (GeM) Procurement Manual February - 2019 published by, Balmer Lawrie & Co.(A Government of India Enterprise., Inter Departmental Adjustments, Rule 261. The Rules 123 to 129 as notified under GFR-2017 for which a department of Government, may make charges for services rendered or articles supplied by it and the procedure to be observed, in dealing with such charges are reproduced as below:., Rule 123: Inter-Departmental Adjustments- Save as expressly provided by any general or special, orders, a Service Department shall not charge other Departments for services rendered or supplies, made which falls within the class of duties for which the former Department is constituted., However, a commercial Department or Rule undertaking shall ordinarily charge and be charged for, any supplies made and services rendered to, or by, other departments of Government., Rule 124: Principles for division of Departments for purposes of interdepartmental payments- For, purposes of inter- Departmental payments, the Departments of a Government shall be divided into, service Departments and commercial departments according to the following principles:(i) Service Departments. -These are constituted for the discharge of those functions which either(a) Are inseparable from and form part of the idea of Government e.g. Department of, Administration of Justice, Jails, Police, Education, Medical, Public Health, Forest, Defence; or, (c) Are necessary to, and form part of, the general conduct of the business of Government e.g., Department of Survey, Government Printing, Stationery, Public Works (Building and Roads, Branch), Central Purchase Organization (Director-General of Supplies and Disposals, New, Delhi). (ii) Commercial Departments or Undertakings.-These are established mainly for the, purposes of rendering services or providing supplies, of certain special kinds, on payment, for the services rendered or for the articles supplied. They perform functions, which are not, necessarily governmental functions. They are required to work to a financial result, determined through accounts maintained on commercial principles., Rule 125: Period for preferment of claims- All claims shall ordinarily be preferred between, Departments, both commercial and non-commercial of the Central Government, within the, same financial year and not beyond three years from the date of transaction. This, limitation, however, may be waived in specific cases by mutual agreement between the, departments concerned.

Page 15 :

Rule 126: Procedure for settlement of interdepartmental adjustments. The settlement of, inter-departmental adjustments shall be regulated by the directions contained in Chapter 4, of Government Accounting Rules, 1990., Rule 127: Inter-departmental and other adjustments to be made in the account yearUnder, the directions contained in the Account Code for Accountants General, Interdepartmental, and other adjustments are not to be made in the accounts of the past year, if they could not, have been reasonably anticipated in time for funds being obtained from the proper, authority. In all cases, where the adjustment could have reasonably been anticipated as, for, example, recurring payments to another Government or department and payments which,, though not of fixed amount, are of a fixed character, etc., the Accounts Officer will, automatically make the adjustment in the accounts before they are finally closed. The onus, of proving that the adjustments could not have been reasonably anticipated should lie with, the Controlling Officer. As between different Departments of the same Government, the, recoveries effected for services rendered shall be classified as deductions from the gross, expenditure. However, recoveries made by a Commercial Department, e.g., Railways, Posts, or a departmental commercial undertaking in respect of services rendered in pursuance of, the functions for which the Commercial Department is constituted shall be treated as, receipts of the Department but where it acts as an agent for the discharge of functions not, germane to the essential purpose of the Department, the recoveries shall be taken as, reduction of expenditure. Exception.-Recoveries of fees for purchase, inspection, etc.,, effected by the Central Purchase Organizations of Government of India, are treated as, receipts of the Department concerned., SPECIAL RULES FOR THE POST AND R.M.S. OFFICES Contingent Registers, Rule 263. A register of contingent expenditure shall be kept in each office, and the initials of, the Head of the Office or of a Gazetted Officer to whom this duty has been delegated by, him, shall be entered against the date of payment of each item., NOTE 1— If during the absence of the Head of the Office and of the Gazetted Officer to, whom the duty of maintenance of contingent register has been delegated, the entries in the, contingent register have been initialed by a non-Gazetted Government Servant, the register, must be reviewed and the entries re-initialed by the Head of the Office or such gazette, Officer on return to duty in the headquarters., Rule 264. As each payment is made, entries must be made in the contingent register of the, date of payment, brief description; of each charge, number of vouchers or sub-vouchers, and the amount in the proper columns. In the case of any charge requiring explanation, the, initials of the Officer incurring it shall be taken against the description.

Page 16 :

Bills for encashment, Rule 266. When it is necessary to draw money for contingent expenses, as for example,, when the permanent advance begins to run short, or when a transfer of charge takes place,, and in any case at the end of each month, a red ink line should be drawn across the page of, register, the several columns added up and several totals posted in a separate bill in the, prescribed form against the appropriate heads. The Head of the Office or the Officer to, whom this duty has been delegated shall carefully scrutinize the entries in the register with, the sub-vouchers, initial them if this has not already been done, and sign the bill which will, then be dated and numbered and presented for payment at the Post Office., , Rule 267. (1) Subject to any order or instruction issued by the Government in this behalf, a, Contingent Bill for payment to suppliers, etc., which cannot be met from the permanent, advance, may be endorsed for payment to the party concerned. This procedure shall not, apply to cases where the Disbursing Officer is authorized to incur expenditure by drawing, cheques on the Treasury., (2) Whenever under the provisions of clause (1) of this rule a Contingent bill is endorsed to a private, party, the Drawing Officer shall, before signing the bill obtain the specimen signature of the party, on the body of the bill which he shall attest before signing the bill. The Drawing Officer shall, simultaneously issue an advice to the Postmaster or the Disbursing Officer concerned giving full, particulars of the bill. The bill must at once be entered in the Contingent Register and a note made, to the effect under the initials of the Drawing Officer that the amount has been drawn., Fully vouched contingent charges, , Rule 268. (1) Officers whose contingent bills do not require counter signature should draw money from, the Post Office by bills in Form T.R. 30 showing full details of the charge. (2) Unless in any case, the, Comptroller and Auditor General directs otherwise sub-vouchers for more than Rs. 500 shall be, submitted to the Circle Postal Account Office., , Rule 269. The cost of certain classes of articles purchased by Heads of Circles for use in their own offices, or in the offices subordinate to them, viz.. (1) Offices of Superintendents and Inspectors of Post Offices, and Railway Mail Service, (2) Post Offices, and (3) Railway Mail Service Sections and offices should be, booked separately under the relevant heads, the account classification depending in each case on the, offices to which the articles are supplied. Heads of Circles will indicate in their Contingent bills the, detailed classification of the cost incurred on the purchase of such articles. In cases where the charge, cannot be directly allocated to a particular head, the expenditure incurred should, in the first instance,, be debited to suspense head—"Stock Depot Suspense" and a monthly statement showing the debit or

Page 17 :

expenditure incurred and credit or supplies made during the month should be sent to the Accounts, Office, brief particulars of each class of charge to be transferred to the respective account head by per, contra credit to the suspense head being furnished in the statement. In the case of articles the cost of, which is paid for by book debit, a separate statement with brief particulars of the articles should be sent, to the Account Office. The statement should be superscribed "To be paid" or "By book debit" and should, contain the designation of the supplying department in addition to other particulars as to the amount to, be debited to the several heads of account and to the "suspense head". The amount shown under, suspense head should be included in the monthly statements of suspense account to be rendered by the, Heads of Circles to the Circle Postal Account Offices. All freight charges (Railway as well as Steamer), incurred by the Stock Depot of Circle Offices should be classified under the same head of account as the, stores on which they are incurred., , Rule 270. Contingent charges incurred on account of the wages of mazdoors engaged on manual labour, and paid at daily or monthly rates should be supported by vouchers containing full particulars of the, charges, viz., the number of mazdoors employed, the period for and the rate at which employed and the, work done. The Disbursing Officer should endorse a certificate on these vouchers to the effect that the, mazdoors were actually entertained and paid., , Rule 271. Contingent Bills preferring claims for municipal and local taxes, electric and water charges,, etc., incurred on account of the hire of private buildings by the Government for accommodation of, Central Government Offices should be accompanied by the following certificates signed by the, Disbursing Officer :—, , "Certified that the amount drawn on account of rates and taxes in Contingent Bill No…… dated the, …………was actually paid to the parties concerned and that:- (i) no portion of the building for which the, expenditure was incurred was utilized for residential or other purposes during the period the charges, were paid; (ii) expenditure in respect of the portion of buildings used for residential or other purposes, during the period for which the charges were paid has been recovered from the under mentioned, Government servants from whom it was due.”., , COUNTERSIGNED CONTINGENCIES Abstract Bill, Rule 275. In the case of contingencies countersigned after payment, the charges arc drawn in abstract, contingent bills in Form No. A.C.G. 19, the figures for the several detailed heads being transcribed from, the contingent register. In Post Offices the bills are prepared on the 10th and on the last working day of, the month, receipted by the Postmaster, impressed with the "paid" stamp and then sent to the Circle, PAO with the accounts for the period. The bills will not, however, be literally paid on those dates, as the

Page 18 :

amounts drawn in the bills have already been paid out of the cash balance as soon as they were incurred, and charged in the Scheduled of Bills paid on the actual dates of payment., , In Railway Mail Service offices, abstract contingent bills are prepared on the occasion prescribed inRule, 266 The Bills thus prepared are presented at the Post Office for payment and sent to the Postal, Accounts Office after encashment with the accounts for the period., In Railway Mail Service offices and Postal Foreign Post Divisions the consolidated lists of vouchers are to, be presented at the Post Office for payment which are then booked against the relevant Head of, Account/ GL Code and thereafter these are sent to Circle Postal Accounts Office after the encashment, with the accounts for the period., , Countersignatures, , Rule 278. On receipt of the monthly detailed bill in the office of the Countersigning Officer, it shall be, reviewed by him with the sub-vouchers. Any disallowance, with the number of the sub-voucher, concerned and explanation of the objection, must be noted on the bill and in the contingent register or, such other record as may be kept in the Office of the Controlling Officer. The Countersigning Officers, shall then record the date of admission under his initials, sign the bill and dispatch it to the Circle, Accounts Office direct on or before the 5th of the second month following the month to which the, charges relate in case of bills of all Head Post Offices, 15th of the second month following in the case of, GPO/HPO/MDGs and last day of the month following in the case of other offices with the sub-vouchers, required to be sent to the Circle Accounts Office, his signature to the certificate endorsed on the bill, taking the place of the sub-vouchers retained by him., , Sub-vouchers for the following items should be forwarded with the countersigned bill by the controlling, authority to the Circle Accounts Office: (a) All items for more than 200. (b) All State telegrams (Foreign);, and (c) All items of payment of Railway freight on postal stores, etc., for more than 50., , Disbursement of Extra Despatch of Mails Rule 279. The register for authorizing payment of extra, despatches of mails in Post Offices and RMS Offices may be maintained in the form given below:, , In order to have an effective control over expenditure on coolie charges for extra despatches of mails,, delivery of heavy mails, cash conveyances, etc., the Superintendents in the case of all Post Offices and

Page 19 :

Railway Mail Service Units under their control and the Heads of Circles in the case of GPOs/HPOs under, their control, may prescribe, where the charges for heavy mails are apparently too frequent and too, heavy, a monthly monetary limit which should be watched by the Postmasters concerned to ensure that, the monthly expenditure is not exceeded. If in any month there is an indication that prescribed limit is, likely to be exceeded, the Superintendent or the Head of the Circle, as the case may be, has to be, approached sufficiently in advance giving sufficient reasons for the unexpected rise in that month for, approving expenditure exceeding the limit in that month. While prescribing the monetary limits, the, Superintendent or the Head of the Circle should be guided by considerations of the traffic involved, the, importance of the office and his personal knowledge of the work in the offices concerned gained during, his periodical inspections and other factors coming to his notice. The limits so prescribed should be, watched by the Head Postmasters in case of the Sub-Offices under their control so that all unapproved, excesses are specially brought to the notice of the Superintendents., , Verification and Countersignature of Non-Payable contingent bills, , Rule 279-A. The non-payable contingent bills of the Post Offices/RMS, excluding the contingent charges, in respect of the office establishment of Superintendent should be checked at Divisional Offices and, countersigned by the Superintendent of Post Offices/RMS. The contingent charges in respect of the, office establishment of the Superintendent should be drawn in fully vouched contingent bills. The NPC, bills of the Head Office in the Gazetted grade will, however, still require countersignature of the Head of, the Circle. In respect of Post Offices under the charge of Gazetted Postmasters having under their, account jurisdiction Sub-Post Offices administered by Divisional Superintendents of Post Offices, the, expenditure incurred by these Post Offices on cooly charges for delivery and dispatch, should continue, to be compiled, as is being done now, in a statement sent to the Divisional Superintendent along with, the NPC bills. At Divisional Offices, the NPC bills thoroughly checked with reference to monetary limits, (referred to above) and care should be taken in the sanction of such charges. The Superintendent of, Post Offices should carry out an intelligent check of the contingent bills received by them from the Post, Offices, with their knowledge of the mail arrangements and the importance of the delivery area as also, the seasonal fluctuations of postal traffic. In this regard, special notes may be made by them in their, diaries for personal verification at the time of the inspection of the offices. The services of the Assistant, Superintendents, IPOs, etc., may also be requisitioned in this regard when necessary as is being done in, regard to verification of credit and unpaid postage of Post Offices., , The verification of check of such contingent charges should comprise in particular the following details:, (1) Whether each item of expenditure is prima facie admissible and covered by departmental rules and, within their powers of sanction. (2) The special monetary or quantitative limits prescribed for any item, (such as for Stationery, bicycle and typewriter repairs, purchase of glass tumblers, etc.) have been, observed. (3) Cooly charges for dispatch of mails and delivery are compared with the traffic and revenue

Page 20 :

of the Post Offices. (4) Proper arrangements exist for weighing the mails and for proper entry of the, particulars in the prescribed register in regard to cooly charges. After the prescribed verification is, carried out and the monthly statements are scrutinized, the Superintendents should countersign the, NPC bills of the Post Offices and RMS Offices other than those of his own office establishment and those, of the establishments of the Gazetted Postmasters and forward them to the Accounts Office direct., , Procedure relating to sanction of the monthly statement of Contingent Expenditure and, countersignature- NPC Bills, , Rule 279-B. In respect of contingent expenditure on Divisional establishment, a monthly statement of, such expenditure incurred on the Divisional Office itself under Major Head '3201-Postal Services-01-10103-Control and Supervision Postal Division/01-101-04 RMS Divisions' included in the Fully Vouched, Contingent bills should be submitted by him to the Circle Office along with the details of such, expenditure listed voucher-wise for scrutiny by the Circle Office of the need for such expenditure. The, pro forma statement to be submitted in this regard is shown below which would serve as a check on the, sanctions issued by the Superintendents authorizing expenditure on their own offices. As regards, expenditure incurred by Circle Offices, necessary check will be exercised by the Inspection Wing of the, Postal Directorate., , Disallowances, , Rule 280. After dispatch of the bill to the Circle Accounts Office, the countersigning Officer should, communicate any disallowance to the Drawing Officer, and its amount shall without fail be refunded by, short-drawings in the next contingent bill; therein the gross amount of each subvoucher shall be entered, and below the total shall be entered "Deduct disallowed from bill of ………………………Rs.……………………..", and the receipt given would be for the net amount only. If, after correspondence, the countersigning, Officer withdraws his objection, the amount may be redrawn; after the total of the sub-vouchers in the, next bill would be entered "Add amount of disallowance from bill of………………………….refunded by, deduction from contingent bill No………………….., dated…………………, and reallowed as per ……………………", and the receipt would be for the gross amount, and the items would be reincluded in the next monthly, contingent bill.

Page 21 :

CHAPTER XII, , Loans and Advances to Government Servants, General Rules, Rule 292. Unless the Government issues special orders in any case, no advance shall be granted except, as provided in the following rules, by the authorities specifically empowered by the Government to, grant advance., NOTE.—The powers of sanctioning advance for the purchase of conveyances (including animals are, given in the Schedule of Financial Powers of Officers of the Postal Department)., , Sanction, , Rule 293. In the case of advances of travelling allowances on transfer the sanction will specify the office, to, or under the jurisdiction of, which the Government servants transferred., , Rule 294. It is not permissible to sanction a loan or advance to a Government servant which involves a, breach of any of the basic principles laid down in Rule 60. In any case in which a cash grant would be, within the powers of sanction of a particular authority, the grant of an advance not exceeding the cash, grant will not require the sanction of a higher authority., , Rule 295. In the case of interest bearing advances to Government servants an, authority empowered to deal with an application for an advance should not issue, an order of sanction until he has satisfied himself that funds are available in the, year in which the amount of the advance is to be paid and every such sanction, must clearly indicate that funds are so available., Advances for Departmental Purposes

Page 22 :

Emergent Advances, Rule 296. (1) Advances for departmental purposes may be sanctioned by the Competent Authority in, accordance with Rule 434 of the Postal Manual Volume II. (2) Disbursing Officers should credit the, amount sanctioned direct into the Bank accounts/POSB accounts of the payees through, digital/electronic mode of payment., , Rule 297.Such advances will be held under objection in the Circle Accounts Office until adjusted, (a) by, cash recovery, or (b) by deduction from the final voucher for the completed work or contract. The, advances are payable by operating appropriate GL code., , Repairs to Rented Postal Buildings, Rule 298. The terms of agreement entered into with the land- lords of rented buildings occupied by the, Department of Posts generally permit the Department in the event of the landlord failing to carry out,, repairs, to carry out such repairs and deduct the cost of the same from the rent due. In such cases the, Director-General and Heads of Circles are authorized to sanction expenditure on repairs (including, electric installations and repairs thereto) to rented buildings occupied by Department of Posts subject to, the proviso that the same is recovered in the shortest possible time during the currency of the lease by, deduction from the rent payable to the landlords. The powers of various authorities in this regard are, given in the Schedule of financial Powers of the Officers of Department of Posts. The expenditure, incurred in connection with this repair should be treated in the accounts as “Advances recoverable” to, be booked under Major Head 8553- Postal Advances Rail Mail Services Other Accounts. The amount, thus accounted under the above head being cleared when recovery from the landlord is affected., , Advances for contingent expenditure, , Rule 299. An advance may be made to a Government servant other than an Inspecting Officer, for, himself or an Assistant or Deputy, proceeding on tour, to an amount sufficient to cover for a month his, contingent charges, such as those for the hire of conveyance or animals for the carriage of records, tents, or other Government property, subject to adjustment upon the Government servant's return to, headquarters or 31st March, which-ever is earlier. The advance is to be treated as a final contingent, charge being drawn and accounted for as such. A second advance cannot be made to a Government, servant until an account has been given of the first.

Page 23 :

Advances to Government Servants on Personal Account, GENERAL RULES, Eligibility, , Rule 300.Except as otherwise provided in this rule, advances on personal account should not ordinarily, be granted to persons who are not in permanent Government employ. As the pay of such persons does, not constitute adequate security for a loan, advances should not ordinarily be granted to them. In, special cases, however, if the circumstances admit of the provision of adequate security, advances may, be granted in accordance with the terms of these rules to officiating temporary Government servants, without any substantive appointment under general or special sanction, of the Ministry of Finance., GOVERNMENT OF INDIA'S DECISIONS, , (1) Sanctions issued / agreements executed for grant of interest-bearing should include provision for, charging penal interest – In cases of advance for purchase of Scooter/Motor Car/Bicycle, sanctions, to be issued by the Competent Authority/agreement to be executed by the Government servant at, the time of drawing of advance sanctioned to him should provide for recovery of interest at 2 ½ %, above the prescribed rate with the stipulation that if conditions attached to the sanction, including, those relating to the recovery of amount, are fulfilled completely to the satisfaction of the, Competent Authority, rebate of interest to extent of 2 ½ % will be allowed. (GID(1) below Rule 2 of, Compendium of Rules on Advances) (2) In case of advances not bearing interest.- In case of, advances not bearing interest, sanctions to be issued by the Competent Authority / agreements to, be executed at the time of drawing advance should stipulate that no interest shall be chargeable if, the conditions attached to the sanction, including those relating to the recovery of amount, are, complied with fully to the satisfaction of the Competent Authority. However, in case of default,, interest at 2% (two percent) over the interest rate which is allowed by the Government on the, Provident Fund balance of its employees shall be charged in the following cases:- (i) in cases where, the advance is not utilized fully but the adjustment bill is submitted in time, interest may be charged, as stated above on the unutilized portion of advance from the date of drawal of advance to the date, of refund.

Page 24 :

Estimates, Rule 301.Provision should be made in the Budget for all advances which can be foreseen. Heads of, Circles and other estimating authorities should, therefore, make a timely estimate both of the gross, advances and recoveries for the coming year. This applies also to non-interest-bearing advances like, advances, which should not be sanctioned unless the authority competent to sanction the advance has, satisfied that funds are available in the year in which the amount of the advance is to be paid and every, such sanction must clearly indicate that funds are so available., NOTE. —The "gross" amount of advances granted in any year should not exceed the provision in the, estimates., , Rule 302. Simple interest at the rate specifically fixed tor the purpose by the Government will be, charged on advances granted to Government servants for the purchase of motor cars, and other, conveyances (including animals) and in certain circumstances for the payment of special passage, advances made in England by the High Commissioner, and of passage over-seas. The interest will be, calculated on balances outstanding on the last day of each month., , Note (1)- Interest bearing advances relating to Motor Car Advance and Motor Cycle/ Scooter/ Moped, Advances except Personal Computer Advance will stand discontinued as per Ministry of Finance,, Department of Expenditure OM No. 12(1)/E II(A)/2016 dated 07.10.2016., Note (2):- The cases where the Advances have already been sanctioned before 07.10.2016 need not be, reopened., , Drawal, Rule 303.Advances to Government Servant on personal account may be drawn on ordinary pay or, travelling allowance bill form or on simple receipt (Form ACG 17) as may be found convenient. The, names of Government servant with their designations and the amounts of advances sanctioned for each, should be clearly indicated in the form to be used for the purpose. Disbursement, Rule 304. The Disbursing Officer shall pay the sanctioned amount by off cycle payment process, recognized for this purpose. The amount thus sanctioned should be entered against the Employee, master data in PA 30 against the wage type available for this purpose. The sanctions shall in every case is, submitted to Circle Postal Accounts Office in support of this charge., , Repayment

Page 25 :

Rule 305.All advances are subject to adjustment by the Government servants receiving them in, accordance with the rules applicable to each case. When an advance is adjustable by recovery, the, amount to be recovered monthly should not be affected by the fact of the borrowing Government, servant going on leave of any kind with leave salary or his drawing subsistence grant. The sanctioning, authority may in exceptional cases order a reduction in the amount of the monthly installment, provided, that in the case of interest bearing advances to Government servants, the whole amount due should be, completely recovered within the period originally fixed., , Rule 306.If an advance is granted to a Government servant who is due to retire or whose services are, likely to be terminated within the maximum period prescribed for its payment, the number of, installments shall be so regulated that the repayment of advance with interest, if any, is completed, before retirement or termination of the service, as the case may be., , Mode of Recovery and Accounting of Loans and Advances, Rule 307.In case of long term advances paid to Government servants viz., Motor Car Advances, other, conveyance advances etc. and House Building Advances paid under HBA rules the Heads 198 of Office, will effect recovery in accordance with the provision of the Rules contained in the Chapter and HBA, rules respectively, the accounts in respect of which will be maintained by the Pay and Accounts Office, concerned., , Sending of monthly schedules to PAO is now not necessary as the same is available as eschedules in the, system., , Recovery of Advances of Travelling Allowances, Rule 310. An advance of travelling allowance should be recovered in full on submission of the, Government servant's travelling allowance bill.

Page 26 :

Recovery of Special Advances Advance on Tour, , Rule 311. In all cases of journeys in respect of which travelling allowance as for a journey on tour is, admissible, an advance may be granted: — (i) To a Government Servant, proceeding on tour, of an, amount sufficient to cover his personal travelling expenses for a month. The amount of advance granted, under Rule 51 of Compendium of Rules on Advances to Government Servants shall be adjusted within, 15 days from the completion of tour or the date on which the Government servant resumes duty after, completion of tour., , Government of India’s Decision, Second advance may be granted to undertake the journey soon after the completion of earlier one- In, cases where a Government servant is required to proceed on tour frequently at short notice and under, emergent circumstances, necessitating the undertaking of journey soon after completion of earlier one,, thus leaving little time for the official to prefer his TA Bill, a second TA advance may be sanctioned by, the Competent Authority subject to the following conditions being fulfilled-, , (i), , The second journey is required to be undertaken soon after the first one, i.e. within a week, after completion of the first tour; (ii) The bills for the advances drawn should be submitted, latest within a week after completion of the second journey; (iii) In any case, not more than, two advances should be allowed to remain outstanding at a time., , Rule 312. Superintendents of Post Offices and first class Post masters may sanction the grant of, advances for the payment of motor bus fares to cash overseers for daily journeys whenever this is, necessary in the interest of the public service subject to the condition that the motor bus fare does not, exceed the railway fare admissible under Rule 64 of the Supplementary Rules., , Rule 313. The powers of Competent Authority under Rule 317 and318may be exercised by Heads of, Local Administrative Departments of the Central Government and Heads of Departments in the case of, Officers serving under them., , Rule 314.An advance for the purchase of a Personal computer shall not be granted to a Government, servant who is under suspension and, if an advance had already been sanctioned to him before he was

Page 27 :

placed under suspension, he shall not be permitted to draw such advance during the period of his, suspension., , Rule 314-A. The recovery of the amount of an advance shall commence with the first issue of pay, leave, salary or subsistence allowance, as the case may be, after the advance is drawn., Rule 314-B.Recovery of interest- The amount of interest calculated under Rule 315 shall be recovered in, the minimum number of monthly installments; the amount of each such installment being not greater, than the amount of the installment fixed for repayment for the principal amount of advance., Rule 314-C. The recovery of the amount of interest shall commence from the month immediately, following that in which the repayment of the advance for the purchase of a motor car is completed., , Rule 314-D. Charging penal interest when purchase not effected within the period - Where the amount, of advance is retained beyond one month in contravention of Rule 316 only the normal rate of interest, leviable under Rule 315 or notified by the Government from time to time should be charged for the first, month and that for the period in excess of one month penal rate of compound interest should be, charged in the manner indicated below:, (i), (ii), , (iii), , (iv), (v), (vi), (vii), , the period of one month, laid down in Rule 316, should be a calendar month from the date, of drawal of the advance., (ii) the penal rate of interest should be calculated on the balances outstanding for the actual, period in excess of one month (including fraction of a month) and not on the monthly, balances as in the case of recovery of advance under Rule 315., the penal rate of interest should be levied on the day following the day on which the period, of one month prescribed in Rule 316 expires, but it will not be levied on the day of, repayment of advance. The penal interest for any shorter period than complete half-year, will be calculated as:, No of days * Rate of interest/ 366, unless any other method or calculation is prescribed in any particular case or class of cases.

Page 28 :

Advance for the purchase of Personal Computer [See GID (4) below Rule 300], , Rule 315.- Recovery of Advance 1. The advance sanctioned for the purchase of a Personal Computer, shall be recovered in such number of equal monthly installments as the Government servant may elect,, but not exceeding 150. 2. Total recoveries on account of all advances including computer advance, taken, by a Government servant shall not exceed 50% of the total emoluments., , Interest 3. Simple interest at such rates as may be fixed by Government from time to time for the motor, car advance shall be charged on advances granted to Government servants for the purchase of a, Personal Computer. 4. All other conditions laid down in compendium of Rules on Advances regulating, the sanctioning of motor car advance will apply to the advance which may be sanctioned for the, purchase of a Personal Computer., , (V) Conditions at the time of transfer, superannuation, etc. (a) In case where, at the time of purchase of, device, if the residual service of the Officer is less than 5 years or in case the Officer is, transferred/deputed to State Government but with residual service of less than 5 years or the Officer, leaves the Government service within 5 years of purchase of such device, the Officer concerned will, have the option of retaining the device by paying the amount after deducting the depreciation., , Execution of Mortgage Rule 316. A Government servant who draws an advance in India for the purchase, of a motor-car or personal computer is expected to complete his negotiations, and to pay finally, for the, car, or personal computer within one month from the date on which he draws the advance; failing such, completion and payment, the full amount of the advance drawn with interest thereon for one month,, must be refunded to Government. A Government servant shall on the date on which he draws an, advance for the purchase of a motor-car/computer execute an agreement in Form II or in Form III. On, completing the purchase of the motor car/computer, he shall also execute or mortgage bond in Form IV, and/or V as the case may be, hypothecating the motor car/computer to the President as security for the, advance., , (2).When mortgage bond is not executed in time-The failure to execute a mortgage bond in time will, render the Government servant drawing the advance liable to refund forthwith the whole of the, amount of advance with interest accrued unless good and sufficient reason is shown to the contrary and

Page 29 :

the Competent Authority waives the condition prescribed in this regard. (GI MF OM No. F 16(4)-E II, (A)/64 dated the 4th January 1965)., , Rule 317.When an advance for the purchase of a motor-car is drawn, the sanctioning authority will, furnish to the Account Officer concerned a certificate that the agreement in Form II or III as the case, may be has been signed by the Government servant drawing the advance and that it has been examined, and found to be in order. The sanctioning authority should see that the motorcar/computer is, purchased, within one month from the date on which the advance is drawn and should submit every, mortgage bond promptly to the Account Officer concerned for examination before final record., , Rule 318. A Government servant shall not sell or transfer motor car /personal computer for so long as, the amount of the advance together with the interest on such amount is not completely repaid, except, with the permission of the Competent Authority., , Acknowledgment of Balance, , Rule 319. The following procedure is to be followed for facilitating prompt acceptance of balances, outstanding as on 31st March every year in respect of Loans and Advances granted to Government, servants:i), , ii), , In respect of long-term advance referred to in Rule 307, the Circle Postal Accounts Office will, verify the outstanding balance shown in the schedules of recovery that are available in HR, module. This will be verified with the information submitted by the drawing and Disbursing, Officers either in the form of schedule or in a statement. The CPAO will verify this information, and if any discrepancy is noticed the same may be communicated to the office concerned and, get the error rectified., ii) In respect of short-term advances, each Drawing Officer will record a certificate on the, monthly abstract for the month of April each year that “This total (namely Rs...) on the amounts, outstanding on 31st March 20……(excluding recoveries from pay bill for March) against, employees on the rolls of the office on that date and accepted by them individually as correct, is, equal to the closing balance indicated in the abstract for February, plus payments made minus, repayments received in cash during March of that year”.

Page 30 :

CHAPTER XVI, GENERAL PROVIDENT FUND, General Rules, Rule 412. The rules for the General Provident Funds are given in the General Provident Fund (Central, Services) Rules 1960 issued by the Government of India., Rule 413. With a view to deliver the processed accounting inputs at the point of origin and improving, the timelines, accuracy, completeness and other qualitative aspects of maintenance of GPF subscriber, accounts, has been computerized under major initiative of computerization. While major portion have, been under computerized platform only few works are to be done manually by maintenance of such, statements and registers., Rule 414.*Applications for admission to a provident fund shall be made in the prescribed form in, duplicate by the Government Servants who had joined the service under Central Government on or, prior to 31.12.2003, and forwarded through the Head of the Office to the Postal Accounts Office, together with a nomination form duly filled in., , Rule 412. The rules for the General Provident Funds are given in the General Provident Fund (Central, Services) Rules 1960 issued by the Government of India., Rule 413. With a view to deliver the processed accounting inputs at the point of origin and improving, the timelines, accuracy, completeness and other qualitative aspects of maintenance of GPF subscriber, accounts, has been computerized under major initiative of computerization. While major portion have, been under computerized platform only few works are to be done manually by maintenance of such, statements and registers., Rule 414.*Applications for admission to a provident fund shall be made in the prescribed form in, duplicate by the Government Servants who had joined the service under Central Government on or, prior to 31.12.2003, and forwarded through the Head of the Office to the Postal Accounts Office, together with a nomination form duly filled in., , (d) Any over payment or short payment of subscription to the Fund in any month may be, adjusted by deduction from or addition to the subscriptions in the subsequent months

Page 31 :

wherever possible. The subscriber, if desires, may be allowed to pay such recovery in cash, also., (e) (f) The subscriber himself is responsible for seeing that proper deduction is made from his, bills, though, for his convenience, it has been provided in, Rule 171 that the responsibility for making the necessary deduction regularly and correctly, devolves upon the drawers of the bills., Rule 416.The following instructions should be carefully observed by Heads of Offices with a, view to the correct preparation of the Fund Schedules:(i), , (ii), (iii), (iv), , A complete list of subscriber to the fund should be maintained in each disbursing, office in the form of the Schedule also available on technology platform in, computerized environment., Each new subscriber should be brought on this list and any subsequent changes, resulting from his transfer or in the rate of subscription, etc., clearly indicated., When a subscriber dies, quits the service or is transferred to another office, full, particulars should be duly recorded in the list., In the case of the transfer of a subscriber to another office, the necessary note of, transfer should be made in the list of both the offices., , GOVERNMENT OF INDIA’S DECISION, Recovery of subscription to GPF to be compulsorily discontinued during the last three months of service, on superannuation. -A Government servant due to retire on superannuation shall be exempted from, making any subscription to the GPF during the last three months of his service. The discontinuance, would be compulsory and not optional., , Rule 417. When a subscriber to Fund whose subscriptions are realised by Deduction from pay bill/Pay, sheet is transferred to another establishment, the fact that he is subscribing to the Fund shall be, certified on the Last Pay Certificate by noting there on the amount of his monthly subscription and the, number of his account or policy., Withdrawals, Rule 418. (a)The GPF subscriber on being eligible for final withdrawal, the sanctioning authority, authorize, the DDO will process the payment on the computerized platform. (b) Upon completion of, process as stated above, the final withdrawal amount will be credited to the identified Bank account of, the subscriber, the details of which have already been created in the data available in the master data in, computerized environment. (c) Disbursing Officers may make payments on account of advances or, temporary withdrawals from the General Provident Fund to the subscribers while in service on the, authority and responsibility of the officer sanctioning the advance without pre-audit or reference to the, Account Office on form GAR-42 (TR-58-A). In such cases the office copy of the bill in which the payee’s

Page 32 :

acquittance have been taken may be filed in the Disbursing Office and duplicate copies of the bills with, the certificate printed on the bills duly filled in and signed by the Disbursing officers need alone be sent, to the Accounts Office in support of the schedule of Bills paid. This rule applies only while the subscriber, is in service and no payment can, therefore, be sanctioned to a member of the fund after or, immediately before he ceases to be in service except on the authority of the Postal Accounts Office, concerned., , Rule 419. The following procedure shall be observed for the drawal and disbursement of temporary, advances from a Fund Account:— Applications for Advance/ final withdrawal for higher education,, house building purpose or marriage expenses from Provident Fund shall also be submitted through the, process on the technology driven computerized platform. Upon verification of the eligibility criterion as, required under the relevant rules of GPF (Central Services) Rules, 1960 and sanction of the competent, authority through this process the amount may be credited into the subscriber’s Bank/POSB account., Rule 420. (i)When a subscriber to a Provident Fund is about to retire and under the rules of the Fund the, money lying at his credit becomes payable to him, Head of Office will forward the last deduction, certificate to the Accounts Officer by whom his fund account is maintained. (ii) The Accounts Officer, being satisfied of the correctness of the claim and on ascertaining the date upto which the subscription, has been paid, will arrange for payment of the amount at credit of the subscriber in the account of the, fund. Based on the sanction for authorizing of the amount by Accounts Officer (GPF), the sanction, payable and not payable copy of one each will be forwarded to the Head of Office. The Head of Office, shall then send these copies to the DDO for effecting payment through technology driven computerized, process. The procedure prescribed in this rule shall apply mutatis mutandis to all other bases in which, the amount lying at credit of a subscriber in his Provident Fund account becomes payable to him on, finally quitting the service., , THE END

Learn better on this topic

Learn better on this topic

Learn better on this topic

Learn better on this topic