Page 1 :

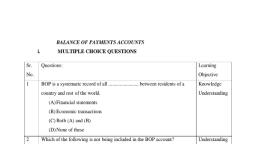

QUESTION BANK OF NEW ASSESSMENT PATERN FOR CLASS XII (ECONOMICS), , , , , , , , , , , , , , , , , , MONEY AND BANKING, SL | MULTIPLE CHOICE QUESTIONSMCQs (15) LEARNING, NO OBJECTIVE, , 1. | The system in which trade can be done by exchange of goods and KNOLEDGE, services is, a) Barter system b) Monetary system, c) Goods system d) None of the above, , 2. | Money contains: UNDERSTANDING, a) Coins b) Currency notes, c) Cheques d) All of the above, , 3. | Money supply is which concept? ANALYSIS, a} Stock b) Flow, c} Monetary d) None of the above, , 4, | What would be the total money creation in the economy if initial APPLICATION, fresh deposits with bank = Rs 50,000 and LRR=20%, (a) Rs 250,000 (b) Rs 10,00,000, (c) Rs 5,00,000 (d) Rs 12,00,000, , 5. | MI of Money supply does not include. EVALUTION, (a) Currency held by public, (b) Other deposit in RBI, (c) Demand deposit with commercial Bank, (d) Net time deposit with commercial bank, , 6. | The rate at which commercial bank borrow from central bank is KNOLEDGE, called... ..., (a) Bank Rate (b) Reverse repo rate, (c) Legal Reserve ratio (d) Cash reserve Ratio, , 7. | High powered money is produced by EVALUTION, , , , a) RBI b) Government, , , , , , Page | 1

Page 2 :

c) Commercial banks d) Both (a) and (b), , , , The money in which commodity value = money value is called, a) Credit money b) Full badied money, c) Representative money d) All of the above, , KNOLEDGE, , , , Which of the following is not the function of the Central Bank’?, (a) Banking facilities ta government (b) Lending to, commercial banks, , (c) Banking facilities to public (d) Lending to, , government, , ANALYSIS, , , , 1., , The difference between the amount of loan and market value of, security offered by borrower against the loan is called:, (a) Bank rate (b) Cash reserve ratio, , (c) Margin requirement (d) Reverse repo rate, , To soak the liquidity from the market, to control inflation, (a) Government securities should be purchased, , (b) Government securities should be sold, , (c) Repo rate should be decreased, , (d) Cash reserve ratio should be decreased, , UNDERSTANDING, , KNOLEDGE, , , , , , Who issues Rs, 1 and Rs, 2 denominations currency notes and, coins?, a) RBI b) Government, , c) Commercial banks d) Ministry of Finance, , LIC and UTI are not banks because:, , a) They do not advance loans, , b) They do not accept deposits, , c) They neither accept deposits nor advance loans, d) None of the above, , , , ANALYSIS, , UNDERSTANDING, , , , Page | 2

Page 3 :

14. is the main source of money supply in an economy. KNOLEDGE, a) Central Bank b) Commercial Banks, d) Both (a) and (b) d) Government, , 15. | India follows which system for issuing currency? UNDERSTANDING, a) Foreign exchange system b) Paper currency system, c) Minimum reserve system d) None of the above, Read the following statements—, Assertion (A) and Reason (R). Choose one of the correct, alternatives given below:, (a) Assertion and Reason both are correct, statements and Reason is, correct explanation for Assertion., (b) Assertion and Reason both are correct statements but Reason is, not correct explanation for Assertion., (c) Assertion is true but Reason is false., (d) Assertion is false but Reason is true., , 16 | Assertion(A): Commercial Bank contribute to Quantum of money, supply in the economy through credit creation, Reason(R): As they have the note issuing authority., , 17 | Assertion(A): LRR represents the minimum reserve ratio essential, to be maintained by banks., Reason: (R) Bank create deposits in the process of making loans to, their customers., , 18 | Assertion (A)- when CRR is increased, credit creation capacity of, commercial banks reduces., Reason (R)- with increase in reserve ratios, banks have less funds, available for loans., , 19 | Assertion (A)-Open market operations are used to influence money, , , , supply in the economy., , Reason: (R) Central bank sells government securities to increase the, flow of credit in the economy., , , , , , Page | 3

Page 4 :

20. | Assertion: The Central Bank is also known as the bank of issue., Reason: The Central Bank enjoys the sole monopoly of issuing, currency to ensure control over volume of currency and money, , supply., , , , CASE BASED QUESTION -1, , , , Read the following case study paragraph carefully and answer the, questions on the basis of the same. Repo (repurchase) rate also, known as the benchmark interest rate is the rate at which the RBI, lends money to the commercial banks for a short-term (a maximum, of 90 days). When the repo rate increases, borrowing from RBI, becomes more expensive. If RBI wants to make it more expensive, for the banks to borrow money, it increases the repo rate similarly,, if it wants to make it cheaper for banks to borrow money it reduces, the repo rate. If the repo rate is increased, banks can’t carry out their, business at a profit whereas the very opposite happens when the, repo rate is cut down, Generally, repo rates are cut down whenever, the country needs to progress in banking and economy. If banks, want to borrow money (for short term, usually overnight) from RBI, then banks have to charge this interest rate. Banks have to pledge, government securities as collateral. This kind of deal happens, through a re-purchase agreement. If a bank wants to borrow, it has, to provide government securities at least worth & 1 billion (could be, more because of margin requirement which is 5%-—10% of loan, amount) and agree to repurchase them at %1.07 billion (US$1S, million) at the end of harrowing period. So the hank has paid %65, , million (US$910,000) as interest. This is the reason it is called repo, rate., , , , 21. | What kind of tool Repo rate is:a) Qualitative tool b) Quantitative tool, , c) Fiscal tool c) None of these, , , , 22. | Why Repo rate is called Repurchasing rate:, a) Commercial bank has to mortgage its securities with RBI, , , , Page | 4

Page 5 :

b) Commercial bank has to make an agreement to repurchase the, securities mortgage with RBI, , c) Commercial banks have to pay interest on borrowings, , d) None of These, , , , 23. | If inflationary conditions persist in ecanomy then what should be, done with Repo rate:, , a) Repo rate should be reduced, b) Repo rate should be increased, c) Does not change Repo rate, d) None of above, , , , 24. | On which type of borrowing Repo rate is charged by RBI, a) On short term borrowings, , b) No long term borrowings, , c) Borrowings to maintain reserves, , d) Borrowings to purchase assets, , , , CASE STUDY-2, , Read the following case study paragraph carefully and answer the, questions based on the same., , The central bank of India (Reserve Bank of India) is the apex, institution that controls the entire financial market. It's one of the, major functions is to maintain the reserve of foreign exchange., Also, it intervenes in the foreign exchange market to stabilise the, excessive fluctuations in the foreign exchange rate. In other words,, it is the central bank’s job to control a country's economy through, monetary policy., , If the economy is moving slowly or going backward, there are steps, that central bank can take to boost the economy. These steps,, whether they are asset purchases or printing more money, all, involve injecting more cash into the economy. The simple supply, and demand economic projection occur and currency will devalue,, , When the opposite occurs, and the economy is growing, the central, , , , bank will use various methods to keep that growth steady and in, , , Page | 5