Page 1 :

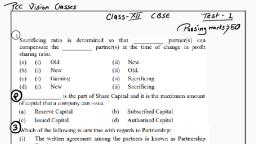

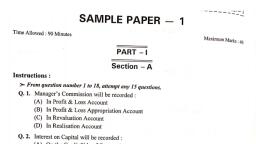

Time Allowed : 90 Minutes, , SAMPLE PAPER — 6, , Maximum Marks . 4p, , , , , , PART -|, , Section - A, , Instructions ;, , > From question number |, , QL, , Q. 2., , Q. 3., , Q. 6., , . During the year, A withdrew 25,0, , to 18, attempt any 15 questions., Interest on Partner's Loan will be recorded in, , (A) Partner’s Current Account (B) Partner’s Capital Account, (C) Partner's Loan Account (D) Profit & Loss Appropriation Account, Which of the following is charge against profit?, , (A) Rent Payable to Partner (B) Interest on Partner’s Loan, (C) Salary Payable to Partner (D) Interest on Capital, Interest on Capital will be recorded, , (A) On the Credit side of Capital Accounts, (B) On the Credit Side of Profit & Loss Appropriation Account, (C) On the Credit side of Current Accounts, (D) On the Debit side of Current Accounts, , ,000 per month in the begi, B withdrew 215,000 per quarte:, charged @ 10% p.a., Interest on Drawings will amount to :, (A) A 23,250 and B %2,750, , (B) A %3,750 and B %2,250, , (C) A %3,250 and B 3,750 (D) 4 %3,250 and B 22,250, . In the Balance Sheet of a Company, amount of Securities Premium Reserve will a, (A) Added to Issued Capital :, , (B) Added to Subscribed and Full Paid Capital, (C) Added to Subscribed but not Fully Paid Capital, (D) Shown under Reserve and Surplus, Ifa share of €100 issued at a premium of 20 on which full amount, 780 (including premium) paid is forfeited, Share Capital Acca mainte been called and, (A) = 60 (B) = 80 debited with, (C) 7100 (D) %120, i i 73:4. IFC's share of, A, B and C are partners in the ratio of 2:3 : 4 Profit at, amounted to %3,60,000, what will be B’s share of profits? the eng Of the year, (A) %3,20,000 (B) %1,60,000, (C) %2,70,000 (D) 180,000, , a

Page 2 :

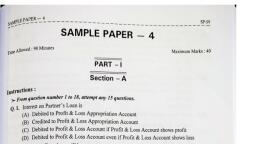

ae for valuing goodwill, Se pe formula under the Capitaligati, @ (4) Super profit made by the firm mutiptieg si the a Of Super Profits method is:, ) Capital Employed by the firm multiplied yt lormal rate of return, ) Capitalised profit of the firm divided by the seeihies rate of return, 0) Super profit made by the firm divided by the fiteaiee f, which of the following is not a feature of a partnership firm : of return, a Es carrying common business under a, (B) They are sharing profits and losses in the fixed ratio. amet, C) Business is carried by all or any of them acting f, (p) Limited liability eine and, ; and Ridhi are partners in partnership fi i, gle. a Joan of %1,00,000 to the firm. At the ana attarba ie ©4000 9 rend, business. Following interest may be paid to Shruti by the firm : Pastis, (A) @5% Per Annum, (B) @6% Per Annum, (C) @ 6% Per Month, (D) As there is a loss in the business, interest can’t be paid, Qu. X and ¥ are partners in the ratio of 3 : 2. Their capitals are %4,00,000 and %2,00,000, respectively. Interest on capitals is allowed @ 8% p.a. Firm earned a profit of %30,000 for, the year ended 31st March 2019. As per partnership agreement, interest on capital is, treated a charge on profits. Interest on Capital will be :, , (A) X 732,000; ¥ 716,000 (B) X %18,000; ¥ 712,000, (C) X%20,000; Y 10,000 (D) No Interest will be allowed, Q.12. ALtd. forfeited 2,000 shares of 710 each, %8 paid, for non-payment of final call of 2 per, , share, Out of these, 800 shares were re-issued as fully paid-up in such a way that 24,000, , were transferred to capital reserve. Shares were re-issued for, , (A) ©3 per share (B) €10 per share, (©) %7 per share (D) &8 per share, r 2,00,000 shares of %10 each ata, , Q.13. Ravi Ltd, issued a prospectus inviting applications fo, premium of 10 per share, payable as follows :, , , , , On Application 25 (including €3 permium), , On Allotment 26 (including 2 premium), , iad Call 23 (including €1 premium), , Second & Final Call Balance Amount, A sharcholder holding 1,500 shares failed to pay the alent first call and second &, call money and his shares were forfeited after the final ca. ; ;, , fs, an entry for forfeiture of shares, securities premium reserve account will be debited, , (A) %9,000 (B) %15,000, , ©) 26,000 (p) £10,500

Page 3 :

Qo17,, , Q. 18., , des for the payment of interest on capital but there was A ly, he year 2015-2016. At what rate will the interest on capita :, , . A partnership deed provi, instead of profits during t, allowed? (B) 12%, , c Hi k Rate eini, ank Ra Phy ;, 3 : case capitals are fixed, pick the odd one out for Capital Alc:, me (B) Drawings, (A) Capital introduced Ethe Above, (C) Withdrawal of Capital lee imal . ;, , . Raghu Ltd. forfeited, 3,000 shares of 710 each, issued at 30% premium for NON-Payme., , of allotment money of %5 per share (including premium) and first call of %2 per share. Th, , second and final call of 2 has not yet been called. Out of these, 1,000 shares Wer, re-issued as fully paid up for 712 per share., , Amount transferred to Capital Reserve will be :, , (A) %7,000 (B) 23,000, , (C) %6,000 (D) 4,000, , Y Ltd. forfeited 500 shares of 2100 each (875 called-up) issued at a premium of 5% t, , which %45 per share has been paid. Out of these 200 shares were re-issued to Z as %75 pi, , up for %60 per share. What is the amount to be transferred to Capital Reserve?, , (A) %19,500 (B) & 7,000, , (C) & 6,000 (D) %22,000, , Which of the following is not shown under the heading ‘Share Capital’ in a Compan;, Balance Sheet : *, , , , (A) Subscribed Capital (B) Forfeited Shares Account, (C) Calls in Arrears (D) Calls in Advance, =———_, PART -|, =——_____, , —_————S—, Section -B, , Instructions :, > From question number 19 to 36, attempt any 15 questions,, , Q. 19. A and B were partners with capitals of %6,00,000 and &4, admitted for 1/Sth share in profits. The journal entry recorded oe TesPectively. C82, brought in by C is given below :, , Premium for good!

Page 4 :

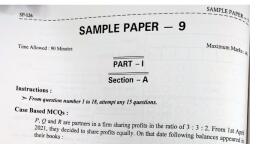

Pom new profit sharing ratiowillbe: 9 SSS === sP.89, £19: 10 7, (A) we (B) 19:21:49, @ Nee": (D) 13:7:5, , , and R are partners sharing profits j 4, Q. 2. Sel books at & 1,80,000. They Seided ‘rks 13:2.6, rs do not want to distribute the general rier fi Profits in the ratio of 2:3: 5., A) Cr. P by 290,000; Q by 54,000 and R by 736 “ si ¢ Journal entry :, (p) Cr. P by €36,000; O by 854,000 and R by 290,000, (C) Dr. Rby €54,000 and Cr. P by 54,000, (p) CrR by %54,000 and Dr, P by %54,000, il. CandD contribute %5,00,000 and 3,00,000 respectivel, capital on which they agree to allow interest @ 6% P.a. Their profit or loss shari i0 i, 2:3. The profit at the end of the year was 716,000 before allowing ae aring ratio is, there is a clear agreement that interest on capital will be paid even in case of aaa a, , y ina partntership firm by way of, , share will be :, (A) Profit 10,000 (B) Profit %6,000, (C) Loss 219,200 (D) Loss 712,800, , Q.2. According to ‘‘Super Profit Method’’, goodwill is calculated by :, (A) Number of Years’ Purchase x Average Profit, (B) Number of Years’ Purchase x Super Profit, (C) Super Profit + Normal Profit, (D) Super Profit + Normal Rate of Return, , Q.23, ¥ Ltd. invited applications for issuing 50,000 equity shares of 710 each at a premium of, %8 per share. The amount was payable as follows :, On Application : 4 per share (including 2 premium), On Allotment + %6 per share (including %3 premium), On First and Final Call : Balance Amount, Akash, a shareholder holding 500 shares, did not pay the allotment money and Gaurav, a, holder of 800 shares, paid his entire share money alongwith the allotment money., , On Allotment, Bank Account will be debited with, , (A) %3,04,900 (B) %3,03,400, (©) %3,08,200 (D) %3,09,700, Qa, Modern Ltd. invited applications for issuing §,00,000 shares of 710 each at par. The, amount was payable as follows :, On Application %, On Allotment S, On " ., First and Final Call 5 and pro-rata allotment was made to all the, , ions were received for 6,00,000 share

Page 5 :

Q. 25,, , Q. 26,, , Q. 27., , Q. 28., , Q. 29,, , ~~~ Ady, , ase == ly received except first and f,., >>, ye calls were made and were duly re forfeited. nal cay, erotica Ry Jlotted 1,000 shares. Her shares we: ., Siya who was a ’ : ber, rae” ited to Share Forfeiture Account I os, Amount Credi (B) %6,, Wo ) te, , V Ltd. forfeited 5,000 shares of $10 each issued at a premium of th, < » tortert :, , i ot Shite, non 1 of final call of €5 per share (including premium %2), Of the forfeitey a, payment ‘ ,, 4,000 were reissued at a discount of 20% as fully paid up., Amount Credited to Capital Reserve will be : ye, (A) 212,000 (B) %44,, (C) %36,000 (D) %20,000, , Revaluation Account or Profit and Loss Adjustment A/c is a, , (A) Real Account (B) Personal Account, (C) Nominal Account, , 000 per month., , 10% per annum,, The Profit-sharing ratio of Partners was 2: ],, , Interest on Capitals will be , (A) Aditi 744,000 and Chanda %24,909, , (B) Aditi z, {C) Aditi 740,000 and Chanda 25.000 (D) agin ed and Chanda 214,000, , va eee : and Chanda 726,000, alue of goodwill of a firm at times of super i :, firm are %60,000 (after an abnormal loss of 88,000) Non 000, Average profits a, invested in the firm will be : THe of retum is 10%, Capi, , (A) %3,40,000 (B) %5,00,099, , (C) %4,20,000 (D) %8,60,009, , A1'snd 2 are partners in a frm with Capitals of gs, 000 ang |, They share profits in the ratio of 2:1. Cig admitted as q *2,00,000 respective, , or | 1;, Cea Tatts thaeo in four of C. Cis to tiga a 0d B surrender _ i, cash, The goodwill of the firm is estimated, , at 760,000, ‘Premium, 8's Capital Account will show a balance of ,, , (A) %2,15,000 (B) %2,10,000, (C) %2,30,000 (D) 22,20,009