Page 1 :

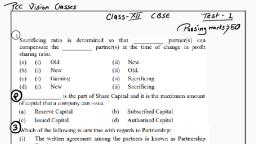

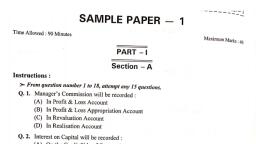

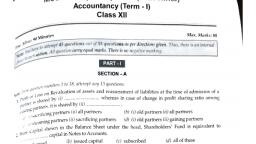

v~, , Of the, , ontal, » the, , nore, , otal, he, , ue, , CBSE xy,, ; Model Test p, , , , , , , 90 Minutes _* aper a, , , , , we instructions:, , oe soliowing instructions very carefuty ang «, and stric, suet? paper Comprises three PARTS—,, , , , tly follows then, , 1 gis compulsory for all candidates andl There are 8 que, , 5 Jysis of Financial Stater, WAnaly vent and Part, 5 MF the given OPTIONS. Mt Computerise, , , , 1d Ace,, SCOUTING Ya, 2 > YOU have to atte, , ye isar internal choice provided in 28Cch Section rh, , ‘ . parti. contains three Sections—A, B and c Section A hy,, questions from 19 to 36, you have to attempt amos, , ‘ part |, Section C has questions from 37 to 41, , from}, , - tO 1Bana, any 15 questions each in #28 Section 8 hy, , : Both the section, fou have to attempt any § , * partll, contains two Sections—A and B Section A has Questions fr, $, any five questions and Section B has Questions from 49 to $5, you, , if Partill, contains two Sections—A and B, Section A has questions from 49, any five questions and Section B has questions from 63 1069, youhave to 5, 5 Mlquestions carry equal marks. There is no negative marking 7, ific Instructions related to each Part and subdivisions (Section, questions. Candidates should read them thoroughly and attempt ac, , Our Que, , , , stions, , (OM 42 to 48, you have'to at, ; empt, ave 10 attempt ary six Question, , 62, youhaveto, , , , erat, tempt any six questions, , ) is nentioned Clearly before the, cordingly,, , Part!, Section A, , 1, Sony Ltd. issued 1,00,000 shares of % 100 each. There were no Calls-in-Arrears till, the First and Final Call made. The company received the amount on 97,500 shares on, First and Final Call. The Calls-in-Arrears amounted to % 62,500. The amount of first, and final call is, (a) % 25. (6) 730, (c) 7.35, (d) 740., , 2. Shiv and Mohan are partners with the capitals of % 37,500 and f 22,500 respectively, Interest payable on capital is 10% p.a. Find the Interest on capital credited to both, the partners when the profit earned by the firm is ® 3,600., , (a) % 3,750 and % 2,250. (b) % 1,800 and % 1,800, of these., (c) % 2,250 and f 1,350. (d) None ‘oA, i ‘ i Josses and reserves sho, & Incase of change in profit-sharing ratio, accumulated profits seat ataieden, , 2 fe a3 hr aS ee ie. in their old aaa ratio., 5 , i cs., , (a) (i) New Partner's Capital A/c i : x -¥ see Ale., , () (i) All Partners’ Capital Ales Incoming Partoer’s Capital ME, , (0 () Sacrificing Partner's Capital le (i) On ial Aes, , (@) (i) All Partners’ Capital Alcs ®

Page 2 :

An Aid to Accowntancy—CBSE x», , , , M2, 4. A company forfeited 30 equity shares of v 10 each fully called-up for non P aYMent of, ued at 7 per share fully paid. ip, , allotment money of ® 4. If these shares, , e188, , , , the amount transferred to Capital Reserve will be, (a) % 300. (b) % 60., () 790 id) © 30, , 5. Ifa shareholder does not pay the amount due on allotment, the’, nt, , re will be, , (a) Debit balance in the Shares Allotment Accou, , (6) Debit balance in the Forfeited Shares Account, , , , , , (©) Credit balance in the Forfeited Shares Account, , (@) Credit balance in the Shares Allotment Account., 2, decide to share, , jo of 5:3, , X Yand Z who are sharing profits and losses in the rat, 5 w.e.f. lat April, 2021 An extract of their, , , , , , , , , , , , 6., future profits and losses in the ratio of 2:3:, Balance Sheet as at 31st March, 2021 is as follows:, Liabilities t Assets be, Plant and Machinery 2,00,000 |, Less; Provision for Depreciation 10.000 | 190,000, If Plant and Machinery is valued at ® 1,71,000, the Journal entry will be, (a) Revaluation A/c Dr. % 19,000, To Provision for Depreciation, on Plant and Machinery A/c 7 19,000, (6) Plant and Machinery A/c De. = 19,000, To Revaluation A/c 2 19,000, (c) Revaluation A/c eal Ie 719,000, To Plant and Machinery A/c % 19,000, (d) Provision for Depreciation, on Plant and Machinery A/c es = 19,000, To Revaluation A/c % 19,000, I; dane the following is not correct regarding Manager's Commission ofa Partnership, , (a) It is a charge against the profits., (b) It is provided before making any appropriation (such as partner's salary, interest, on capital, etc.)., ( It is debited to Profit and Loss Account. é, (@) In case of loss, it is debited to Profit and Loss Appropriation Account., 8. Ram and Shyam are in partnership sharing profits and losses in the ratio of 3 : 2., They admit Mohan as a partner on 1st April, 2021. On the same date, firm's assets, liabilities are reassessed and show a loss on revaluation of € 40,000., , are revalued and, ‘The new profit/loss sharing ratio is Ram 2/5, Shyam 2/5, Mohan 1/5., , ————————

Page 3 :

_ ZZ... Wee, , ‘Yy st Papers —, Chg, yal Test, , ea we, , "Da ny, 1,, ly ba; Bt, aig, “p,, , , , , , , , , , , , , , , , , , , , , , , , , , , , How will the revaluation, rded in Pers, Ma, , , , —_—rT APITAL a., a uN t, redit t m, Credit 2 =, me, , , , Debit, , , , , , ieee ed into parte =, profits and losses in the ratio of 8 264 Mad s = hi t Oc a, share of profit would not be less than 2 20.000, onally gui ie, Sist March, 2022 were & 1,20,000. Deficienc * na r the per, (a) % 20,000. wie ae “, (c) % 30,000. ‘ty € ncn =, , 10. Kabir and Mahir are partners sharing profits and |, decide to admit Raghav as a partner for 1/4th share he profits, will be the accounting treatment of Investment Fluctuat fe = é, in the Balance Sheet, if no other information iz available for za, value of investments? 4 ', , 8 in the ratio of 3 i, , , , , , (a) Investment Fluctuation Reserve will be distributed to the old partners in their, new ratio., , wy Investment Fluctuation Reserve will be distributed to the old partners in their old rat:, , (©) Investment Fluctuation Reserve will not be distributed to the all (incl, partners in their new ratio,, , (d) Investment Fluctuation Reserve will be distributed to the old partne, , sacrificing ratio., , 11. Match List | (Provisions of Partnership Act) with List Il (Matters with wh, , the provisions are related) and select the correct answer using the codes given below, , the lists, , , , , , , , List! Lista, (a) Interest is allowed @ 6% pa. i‘ cand os, (6) Nointerest shall be charged. 2 Capital contri 2 partners., interest shall be allowed. 3... Net loss of the firm for an accounting year., oa 4 Loan given by a partner to the firm., , , , (d) Shared equelly by all the partners unless, otherwise agreed., , , , , , , , Codes:, (a), , , , , , , , , , > ), 3, b, , , , (©), , i, 2, ¢, 4 1, , , , 2, , 12. Revaluation Account is credited with, (@) increase in the value of assets., , (c) both (a) & (0)., , , , , @ None of these.

Page 4 :

M4, , 13., , 14., , 15., , 16., , 17., , 18., , 19., , Accountancy —CBSB x ——, qn Aid fe xt ; Ks, e gh SPP? 00, , , gor?”, , eta in the Bre, the normal ray, , , , , , ¢busines*, iwill by Capitalisay, , Mo’, , , , , Average Profit of the firm is € 6,00, 00. Total ta, 2 .8,00,000. In tt me, , and Ou! Liabilities are, return is 20% of the capital em), , of Super Profit Method, , , , played. Caleuls, , , , b) & 5,00,000, (dy ® 45,00,000, be, allotment 4 :, serve Alc, , Reserve, , (a) % 10,00,000, , {o) %2,50,000, account credited 4" 1, p) Share, , ) Capital Re, ies Premium f, mbers, , When shares are allotted, the, Account, , @, , (a) Share Capital Alc, about See urit, , (c) Share Application A/c, Which of the following 1 not correct, (a) It can be used to issue fully paid Bonu, , (6) It can be used to write off Preliminary I, the premium payable, , shares to the me, nses of the company, @, , expe’, on redem|, , ption of Preference St, (ce) Itcan be used to provide ar, and Debentures. G, (d) It can be used to write off capital losses., Nand ¥ are partners sharing profits in the ra!, who pays € 40,000 as Goodwill. The new profit-sha!, and Z. The amount of goodwill that will be credited to, (a) Xand Yas € 30,000 and 10,000. (by Xonly(©) Yonly. (d) None of these., Mayur Ltd. forfeited 3,200 shares of Z 100 each issued at 10% premium for non-payment 92., neluding premium) and first call of T 30 per, ed, Out of these, 1,200 shares, , of allotment money of % 4, share. The second & final call of 20 has not yet been call, were re-issued as ¢ 80 paid-up for 270 per share- The ga, (a) % 3,000. (b) % 16,000., (c) € 12,000. (d) None of these., Discount allowed on reissue of forfeited shares is debited to, (a) Discount on Issue of Shares Account., (b) Shares Forfeited Account,, (c) Statement of Profit & Loss (Other Expenses)., (d) Statement of Profit & Loss (Other Income)., , Part!, , Section B, tio of 3 ; 2. Kabir is, , for ne oy eel, 000) i ee Machinery would be appreciated by, Debtors of & eo be depreciated by 20% (Book Value, Creditors that i be brought to books. There is a liability, is not to be paid. What will be the Gain, , , , , tio of 3 1- They admit Zasa, 1: 1 amon, , ring ratio 16 2, , , , , , (0 per share (i, in on re-issue 15, , Ram and Rahim are, admitted as a partner, , 10% (Book Value % 80,, %2,00,000). Unrecorded, , sf 2,750 included in Sundry, (Profit)/Loss on revaluation? ‘, (6) Loss € 40,000., , (a) Loss ® 28,000., (c) Profit 28,000. a :, , ee

Page 5 :

OO ne, , 30. Amit and Vidya are, They admit Mohan ¢,, , ly sharing profit, , V3rd * and |e, €60,000. Mohan brings int 5 share of profit, Goodw I) of the fen,, , 0, 8 ri, , “ta »0,000 as his share of ¢ apital but, share of goodw ecessary Journal entry for th se, jh: if good e tre, , , , , , , , , , , , , , , , , , , , , , , , , , , , Partners in 8 firm, , , , (a) Mohan’s Current Ajo, To Amit’s Capital A/c, , To Vidya’s Capital Ajc —, (6) Goodwill Ave Dr. ”, To Mohan’s Capital Ajc —, (Q Amit’s Capital A/c Dr 15,000, Vidya's Capital A/c Dr, To Goodwill A/c, , (@ None of the above., , Dr, , 20,00¢, , 5,000, , 20,000, , 21. Ganesh, Harish and Anil are partners in a firm sharing profits and losses in the ratio, of 2: 2: 1. They admit Amit as a new Partner and new ratio is agreed at 2. 5 2:1, Amit brings in the necessary amount for goodwill. Goodwill of the firm is valued at, £ 4,00,000. In this case, Ganesh’s Capital Account will be credited by, , (a) % 40,000. (b) % 80,000., (o) 24,000, (d) = 60,000., , 22, Guru, Pawan and Hariare partners. They admit Aman into partnership for 14th share, On that date, General Reserve was Z 1,20,000. A liability arose towards Workmen, , Compensati % 60,000. The partners decided to transfer % 60,000 to Workmen, Bon oe cuvof Generel Reserve. Amount transferred othe credit of Capt, , Accounts of Guru, Pawan and Hari will be, , (a) 60,000, & 40,000, % 20,000 respectively. (6) % “ =, each. (d) None of these., San itals of € 3,20,000 and & 2,40,000, , $3, Anil and Sunil are partners in a firm with fixed capitals of COON har, , of the fir Charu share of capital. Calculate, in the profits m. Ch, 4 sine —o (b) © 3,50,000., . anit (@ %4,50,000., ¢) 5 ,, 24, Alia, Karan and Shilp a are partners in are a, month Soloens: lis de ecvent OO one, arr ening ofeach month Karan wits sie, wet in hdr ate nd ofeach mom. A? interest on drawings