Page 1 :

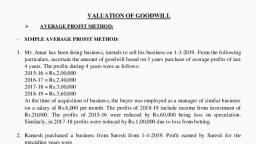

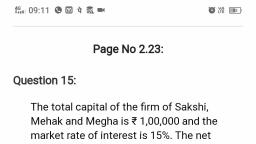

2 PRR Ee SERS Te RLY FB, , , , GOODWILL : NATURE AND VALUATION, , Ce toecmen teen, , GOODWILL : MEANING, FEATURES/CHARACTERISTICS, , Question. 1, a — _— = =, Goodwill can be sold only when:, (a) New partner is admitted (b) At the time of merger, , (c) Business carning profits (d) Entire business is sold or purchased, , Question. 2, , — a SS ——, Goodwill is recorded in the books only when:, , (a) Goodwill is self-generated (6) Money or money's worth is paid for it, , (c) A partner retires (d) None of these, , Question. 3, , Total Assets (excluding goodwill) - outside liabilities will be:, (@) Average profits (b) Net assets (c) Super profit (d) None of these, Question. 4, , = —_—— — — — — —, , Self-generated Goodwill is calculated when:, (a) Amalgamation takes place, (b) At the time of change in profit sharing ratio among the existing partners, (c) At the time of Admission Retirement/death of a partner, (d) All of the above, , , , , , , , , , Question. 5, , , , , , , , —_, The Goodwill of the firm is not affected by the:, (a) Better Customer Service (b) After Sale Services, (c) Location of the firm (d) Abnormal Gain (non recurring), 241

Page 2 :

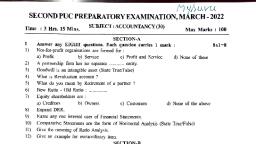

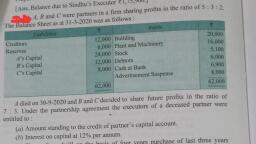

Be #, , 22 VINESH Target Ultimate Accountancy_yy,, , Question. 6 ea, — ———————— SS, Weighted Average Method of calculating Goodwill is used when:, (a) Profits are almost same every year (including loss in one year only), (b) Profits are not equal (increasing in one year and decreasing in other year), (c) Profits are showing increasing trends/decreasing trends, , (d) There are regular losses in the business, Question. 7, , iy, , , , , , — —, , Total Asset 5,00,000; liabilities 2,00,000; and purchase consideration 3,$0,000. Goodwill of the firm will be;, , (a) 3,00,000 (b) 50,000 (& 5,00,000 (d) 2,00,000, , Question. 8, Goodwill of the firm is valued at 3 years purchase of simple average profit of last 4 years. Goodwill was, calculated % 1,68,000. Total profit of last four years were:, (a) 56,000 (b) 2,24,000 (c) 1,68,000 (d) 1,26,000, , —————, , AVERAGE PROFIT METHOD 7", , Question. 9, , Profit of last 3 years were as follows : 2018-19 : 50,000 ; 2019-20 : 80,000 ; 2020-21 : 1,00,000 Weighted, average profit will be (if weight assigned 1,2,3):, (a) 1,10,000 (b) 1,70,000 (e) 90,000 (d) 85,000, , Question. 10, , ae. |, |, j, , , , , , ‘The net profits for the last 3 years were: 2018-19 % 40,000; 2019-20 ¥ 46,000 and 2020-21 % 52,000. There, was an abnormal loss of ¢ 3,000 included in the profit of 2019-20, Adjusted average profit will be:, (a) 40,000 (b) 45,000 (c) 47,000 (d) 46,000, Question. 11, , The net profits for the last 5 years were: 2016-17 % 1,36,000; 2017-18 @ 1,70,000; 2018-19 % 1,90,000; 201920 Z 2,00,000 and 2020-21 ¢ 2,49,000. There was an abnormal loss of % 20,000 included in the profit of 2017-18, and an abnormal gain of 10,000 included in the profit of 2019-20. Adjusted average profit will be:, (a) 1,89,000 (6) 1,91,000 (oe) 1,15,000 (d) 1,99,000

Page 3 :

Goodwill ; Nature And Valuation 23, , Question. 12, —— er, The net profits for the last 3 years were: 2018-19 & 70,000; 2019-20 € 60,000 and 2020-21 % 80,000, There, was an abnormal loss of Rs.15,000 included in the year 2019-20, Profit of the year 2020-21 includes loss on sale, of furniture (Furniture whose book value was 10,000 sold for 7,000), Adjusted average profit will be:, (a) 67,333 (b) 52,000 (©) 70,000 (a) 76,000, , Question. 13, The net profits for the last 3 years were: 2018-19 % 1,10,000; 2019-20 % 1,20,000 and 2020-21 % 130,000. There, , was an abnormal gain of ® 6,000 included in the profit of 2018-19 and profit of the year 2020-21 includes gain, , on sale furniture (furniture book value 10,000 was sold for 13,000). Adjusted average profit will be:, , (a) 1,17,000 (b) 1,20,000 (©) 1,29,000 (d) 1,23,000, , Question. 14, __ a, The net profits for the last 3 years were: 2018-19 % 80,000; 2019-20 % 1,20,000 and 2020-21 & 1,50,000., Included in the profit, there was an abnormal gain of % 20,000 and closing stock was overvalued at 7 10,000 in, 2019-20. Adjusted average profit will be:, , (a) 1,16,667 (b) 1,06,667 (c) 110,000 (d) 1,13,333, , Question, 15, —_— ne ae, ‘The net profits for the last 3 years were: 2018-19 % 1,80,000; 2019-20 % 1,50,000 and 2020-21 % 2,10,000,, Included in the profit,there was an abnormal loss of € 40,000 and closing stock was overvalued by % 10,000 in, 2019-20 but it is correctly brought forward in 2020-21. Adjusted average profit will be:, {a) 1,90,000 (6) 1,93,333 (c) 1,66,667 (d) 1,80,000, , Question. 16, SSS VY, The net profits for the last 3 years were: 2018-19 % 150,000; 2019-20 % 1,50,000 and 2020-21 % 1,50,000., There was an abnormal loss of ® 30,000 in 2019-20 and closing stock is to be undervalued at % 10,000 in, 2018-19. Adjusted average profit will be:, , (a) 1,60,000 (6) 1,50,000 (ce) 1,63,333 (d) 1,56,667, , Question. 17, Oo —————ee, ‘The net profits for the last 3 years were: 2018-19 % 50,000; 2019-20 % 90,000 and 2020-21 ¥ 70,000, On Ist, April, 2020, furniture costing % 30,000 was purchased and wrongly debited as Travelling Expenses Account,, Depreciation on furniture was to be charged @ 20% p.a. on straight line method. Adjusted average profit will, be:, , (a) 62,000 (b) 78,000 (c) 70,000 (d) 80,000

Page 4 :

VINESH Target Ultimate Accountaney_yj_, , Question. 18 eee, es i SSS, , profits r vo 400 and 2020-21 © 70,000, On 1, The + 2018-19 € 82,000; 2019-20 € 66,, rt pele debited as office Expenses Accouny,, , October 2019, furniture costing % 30,000 was purchased and wrongly, Depreciation on furniture was to be charged @ 20% p.a. on written down value method. Adjusted averap,, profit will be:, (a) 66,000 (b) 78,000 () 71,000 (d) 80,000, Question. 19, —— i "Ceres, The net profits for the last 3 years were: 2018-19 © 70,000; 2019-20 % 52,000 and 2020-21 7 60,000. There, was an abnormal loss of ¢ 28,000 included in the profit of 2019-20. To cover management cost an annual, charge of Rs.4,800 should be made for the purpose of goodwill valuation. Adjusted average profit will be:, (a) 55,200 (6) 70,200 (c) 65,200 (d) 69,200, Question. 20, , ——— —— ——, , 24, , , , , , , , , , X and Y are partners. Following information is available on the admission of Z : Profit on 31.03.2019 =, 10,00,000, Profit on 31.03.2020 = 15,00,000, Profit on 31.03.2021 = 20,00,000, On 30.09.2019 a major repair, took place for Plant and Machinery amounting to % 5,00,000 which was by mistake treated as expense,, Depreciation on Plant and Machinery is charged at the rate of 10% p.a. on Original cost. Adjusted total profits:, , (a) 45,00,000 (6) 40,75,000 (co) 49,25,000 (d) 50,00,000, , Question. 21, , |, , , , , , Vinod and Rishi are partners. They admit Kamlesh as a new partner for 1/5" share. For this purpose, The, Goodwill of the firm to be calculated on the basis of 3 years purchase of last 5 years profits. The profits/loss for, the last five years were:, , , , , , , , , , , , , , , , Year 2016-17 2017-18 2018-19 2019-20 2020-21, Profit 50,000 40,000 75,000 (25,000) 50,000, Profit Profit Profit loss Profit, , , , , , , , The Profit of 2017-18 was calculated after charging % 10,000 for abnormal loss of goods by fire. The Goodwill, of the firm will be:, , (a) 40,000 (b) 80,000 (ec) 1,20,000 (d) 1,50,000, Question. 22, ——:2.D Xn nk " ———————_—__, Vinod and Divij are partners. They admit Kanay as new partner, Goodwill of the firm is to be calculated., The profits/loss for last 5 years to be considered are:

Page 5 :

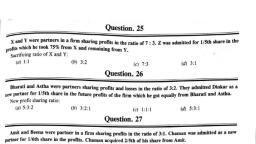

Goodwill : Nature And Valuation 25, , , , , , , , , , , , , , , , , , , , , , , , Year 2016-17 2017-18 2018-19 2019-20 2020-21, Profit 40,000 80,000 95,000 (35,000) 20,000, Profit Profit Profit loss Profit, The Goodwill of the firm was calculated € 1,00,000. Find out the ‘Number of years Purchase’:, (a) 3 years (b) 2 years (©) 2.5 years (a) 3.5 years, Question. 23, , , , PP, , At the time of Change in partnership agreement due to admission of a new partner, the Goodwill of the, , firm was to be valued at two years purchase of the average profit of the last three years. The profits were as, under:, , 2018-19 : Rs.40,000 (Excluding an abnormal gain of Rs. 10,000), 2019-20: Rs.40,000 (afler charging an abnormal loss of Rs. 10,000), 2020-21: Rs.20,000 (including an abnormal gain of Rs.5,000), , The Goodwill of the firm will be :, , (a) 76,667 (b) 55,000 (0) 63,333 (@) 70,000, Question. 24, , , , VK and GN are partners, They admit KK as new partner and goodwill of the firm was to be calculated at, two years purchase of the average profits of last 4 years. The profits/loss of last 5 years were as follows (to be, used last four years only) :, , , , , , , , , , , , , , , , , , , , , , Year 2016-17 2017-18 2018-19 2019-20 2020-21, Profit 10,000 70,000 90,000 ? 50,000, Profit Profit Profit Profit, Goodwill of the firm was Rs.90,000. Profit/loss for the year 2019-20 was:, (a) 40,000 Loss (6) 30,000 Loss (c) 30,000 Profit (@) 40,000 Profit, Question. 25, , , , , , X and Y are partners. On Ist April, 2021 they decided to admit Z into partnership. For this purpose,, goodwill was valued at 80% of the average annual profits of the previous four years. The profits of the last four, , years were:, , , , , 31.3.2018 « 1,67,000, 31,3.2019.... . 1,56,000, 31.3.2020.... 1,92,000, BY,3.2021 cosccccsessecsessesssesvesneccsesnecnsecencaneanensonscsvessnennnnnnannngnnenntengy® (10,000), Value of Firm's goodwill:, , (a) 1,01,000 (6) 1,00,000 (©) 90,000 (@) 1,10,000