Question 1 :

Towards goodwill a new partner at the time of admission contributes _________________.

Question 2 :

X,Y and Z are partner sharing profits in the ratio of $5:3:2$. If $Y$ retires then the new ratio will be______.

Question 3 :

In the absences of an agreement, Interest on loan advanced by the partner to the firm is allowed at the rate of _____.

Question 4 :

General Reserve at the time of admission of a partner is transferred to ____________ .

Question 5 :

Unrecorded liability paid at the time of dissolution of a firm is debited to which of these accounts.

Question 6 :

C, M and Y are partners in the ratio of $1/2 : 2/5 : 1/10$. What will be new ratio of the remaining partners if C retires?<span><br/></span>

Question 8 :

A, B & C share profits and losses in the ratio of $1:1:1$. B retired from business and his share is purchased by A & C in $40:60$ ratio. New profit sharing ratio between A & C would be ________.

Question 9 :

Tom and Ban are partners in a Firm for 2 : 1 ratio.<br/>They admitted Jay as new partner for 1/5 share. calculate new ratio ?<br/>

Question 10 :

Which of these rights are not available to a transferee under the Partnership Act.<br><span><br></span>

Question 11 :

X, Y and Z share in the ratio of $9:6:4$. Y retires. X and Z decide to share the future profits in the same ratio in which Y and Z shared. The gaining ratio will be _______.

Question 12 :

Which of these rights are not available to a transferee under the Partnership Act

Question 13 :

R admitted as a new partner for one-fourth share of future profits, fails to bring in cash of <span>5,000 towards goodwill but the existing (old) partners S and T, sharing profits in the ratio of 3 : 2, raise the goodwill account at its full value. Therefore the partners will be credited for goodwill as:</span>

Question 14 :

A and B are partners sharing profits in the ratio of $1 : 2$. They admit C for $1/5$th share and decide to share future profits equally. The new profit sharing ratio will be _______.

Question 15 :

A & B are partners shating profit & losses in the ratio of $3:2$. They take C as a partner for $1/4$th share. Calculate future profit sharing ratio.

Question 16 :

The rate of underwriting commission payable on the issue of shares should not be more than _____.

Question 18 :

A,B & C Care sharing profits in $4:3:2$ ratio. B retires. In A & C shares profits of B in $5:3$, then find the new profit sharing ratio.

Question 19 :

As a general rule, an incoming partner is not liable for the debts incurred, however, he may liable for past debts if it is agreed between.

Question 20 :

In the case of downward revaluation of an asset which is for the first time revalued, the account to be debited is ________________.

Question 21 :

A, B and C are partners in the ratio of $3: 2: 1$. W is admitted with a $1/6$th share in profits. C would retain his original share. The new profit sharing ratio will be ______.

Question 22 :

When goodwill account is written off after admission of a new partner, Capital A/c of

Question 23 :

Which of these is an essential qualification to be a partner of a firm?

Question 24 :

A, B and C share profits as $1/2$ to A,$1/3$ to B, $1/6$ to C. B retires, and his share is taken up by A and C in the ratio of $1 : 3$. The new profit sharing ratio will be ________.

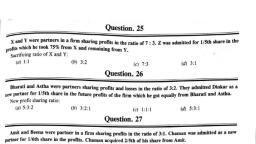

Question 25 :

A partnership contract was revised and due to this revision it was found that the distribution of profit amongst the partners is required to be changed after true closure of accounts. This will affect which account?<br/><span><br/></span>

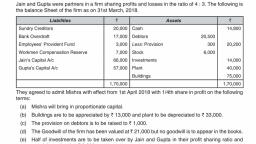

Question 26 :

A and B are two partners sharing profit and loss equally. Their capital A/c stood at Rs.30,000 and Rs.25,000 respectively on 31st March, 2013. On 1st April C is admitted for 1/3rd share of profit for which he brings Rs.12,000 as his share of goodwill. On the date of his admission, stock was appreciated by Rs.11,000 and provisions for bad debts also increased by Rs.2,000. Old partners decided that C's capital should be in accordance with his share of profit and capital of old partners. What amount C should brings as his share of capital in the firm?

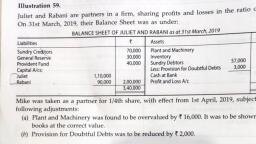

Question 27 :

Mr.X is admitted into a partnership firm for 1/4th share of profit. The total capital of the old partners stood at Rs. 45,000 after carrying adjustment of goodwill, revaluation of assets and liabilities and transfer of reserves and surplus. If X pays Rs.15,000 as his share of goodwill to the existing partner privately, what would be accounting treatment?

Question 29 :

A and B are partners sharing profits in the ratio of <span class="MathJax_Preview"></span><span class="MathJax"><span class="math"><span><span><span class="mrow"><span class="mn">2</span><span class="mo">:</span><span class="mn">1</span></span><span></span></span></span><span></span></span><span class="MJX_Assistive_MathML">2:1</span></span>. C is admitted for $1/5$th share. The new profit sharing ratio will be _________.<span><br/></span>