Page 1 :

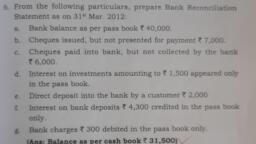

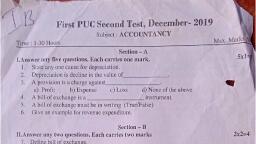

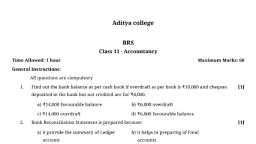

21., , (d) All of the above, , pCiiation statement from Debit by: on ¢, While preparing bank reconcili ” it balance of cash be Chequer paid inte bank, but not yet cleared are c, (a) Added (b) Deduected, is not taken inte ace count?, , In arriving at adjusted cash balance which of the following, (a) Amount deposited by our customer direct into our bank account, (b) Brrors in the Cash Book, fe) Berors in the Pass Book, , (d) All of these, When drawing up a Bank Reconciliation Statement, if you mart with a debit balance as per the Bank, , Statement, cheques issued but not presented for payment should be, (b) Deducted, , (a) Added, (©) Not required to be adjusted (d) None of the above, , A debit balance in the depositor's Cash Book will be shown as, (@) A debit balance on the Bank Statement,, , (b) A credit balance on the Bank Statement., , () An overdrawn balance on the Bank Statement., , (@) None of the above, , When the balance as per Pass Book is the starting point, direct payments by bank are (@) Added in the bank reconciliation Statement, , (b) Subtracted in the bank reconciliation statement, , (©) Not required to be adjusted in the bank reconciliation statement., , (@) Neither of the above., , When balance as per Cash Book is the starting point, uncollected cheques are (@) Added in the bank reconciliation statement, , (6) Subtracted in the bank reconciliation statement, , (©) Not required to be adjusted in the bank reconciliation statement, , (d) Neither of the above., When the balance as per Cash Book is the starting point. direct deposits by customers are, (@) Added (6) Subtracted, (©) Not required to be adjusted (d) Neither of the two., , When balance as per Pass Book is the starting point, interest allowed by Bank is, (a) Added (6) Subtracted, , (c) Not required to be adjusted (d) None of the above.