Page 1 :

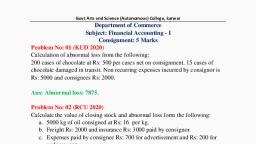

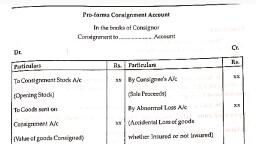

CHAPTER -10, CONSIGNMENT ACCOUNTS, MULTIPLE CHOICE QUESTIONS (MCQ), 1. What entry is required to be passed to nullify the effect of Loading :, , (a) Goods sent on consignment A/c Dr., To Trading A/c Dr., , (b) Goods sent on consignment A/c Dr., To Consignment A/c, , (c) Consignment A/c Dr., To Goods sent on consignment A/c, , (d) None, 2. The risk of stock on consignment lies with, (a) Consignor, (b) Consignee, (c) Buyer, , (d) Seller, , 3. X sends out 4000 boxes to Y costing Rs.100 each. Consignor's expenses 10,000. 1/10th of boxes, were lost in consignee's godown and treated as normal loss. 2400 boxes were sold by consignee., The value of consignment stock will be (a) Rs. 1,36,667, (b) Rs. 1,23,000, (c) Rs. 1,20,000, (d) Rs. 1,20,500, 4. If the del credere commission is 10%, cash sales is Rs.5,000 and credit sales is ,Rs. 10,000., Calculate the amount of del credere commission., (a) 1,500, (b) 1,000, (c) 500, (d) None, 5. The Stock lying unsold with the consignee belongs to, (a) Consignor, (b) Consignee as he bears the risk, (c) Both (a) and (b), , (d) None of these, , 6. J of Jaipur sends 500 radios @ Rs. 200 each to D of Delhi. All the radios are sold by D at a profit, of 25% on cost. D is entitled to a commission of Rs.25 per radio sold plus 20% of gross sale, proceeds as exceeds an amount calculated @ 20% profit on cost. Calculate commission., (a) Rs.12,500, (b) Rs.13,500, (c) Rs.11,500, (d) Rs.10,500, 7. Consignment Account is a, (a) Real Account, (c) 'Trading Account, 8. Account Sales includes, (a) Sales made, (c) Commission earned, , (b) Nominal Account, (d) Personal Account, , (b) Stock left with consignee, (d) All of above., , 9. A sends 1000 units @ Rs.56 to be sold on consignment basis. Consignor expenses amounted to

Page 2 :

Fundamentals of Financial Accounting, , CMA-CAT, , CONSIGNMENT ACCOUNTS, , Rs.1000. 50 units were cost in transit. Find the new price per unit. (Loss is unavoidable)., (a) Rs.50 per unit, (b) Rs.60 per unit, (c) Rs.58.95 per unit, , (d) Rs.57 per unit, , 10. A consigned 1000 litres of coconut oil @ Rs.50 per lt. to B. The normal loss is estimated at 5%., The profit was fixed at 14% on the total cost. What is the sale price per litre ?, (a) Rs.57, (b) Rs.60, (c) Rs.70, (d) Rs.55, 11. Consignment account is of the nature of, (a) Personal a/c (b) Nominal a/c (c) Real account (d) Profit and loss A/c, 12. Consignee account is of the nature of (a) Personal account, (b) Nominal account (c) Real account (d) Trading A/c, 13. Goods sent on consignment account is of the nature of (a) Personal a/c, (b) Nominal account, (c) Real account (d) Sales A/c, 14. Del credere commission is allowed to cover (a) Normal loss, (b) Abnormal loss, (c) Loss due to bad debts, , (d) All losses, , 15. Overriding commission is calculated on (a) Cash sales only (b) Credit sales only (c) Total sales(d) Credit sales loss cash sales, 16. When goods sent on consignment are sold by the consignee, the account to be debited is, (a) Cash account (b) Consignee's personal account, (c) Consignment account, , (d) Purchases A/c, , 17. The abnormal loss on consignment is credited to (a) Consignment account (b) Consignee's personal account, (c) Profit and loss account, , (d) Abnormal Loss A/c, , 18. Commission will be, (a) Shared between Consignor & Consignee, (c) Given only to Consignor, , (b) Given only to Consignee, (d) Given to Third Party, , 19. When the consignee receives the goods from the consignor, in the books of consignee, (a) Goods are debited to goods received on consignment account, (b) No entry is to be passed, (c) Credits consignor's personal account, (d) Debits Purchases A/c, 20. The unsold stock on consignment is valued at (a) Original cost of the goods, (b) Original cost plus non-recurring (direct) expenses incurred by both consignor and consignee, (c) Original cost plus non-recurring (direct) expenses incurred only by the consignor, (d) Original cost plus all expenses, , MOMENTUM - ACADEMY FOR ADVANCED STUDIES – COACHING CENTRE FOR CA & CMA SINCE 1992

Page 3 :

Fundamentals of Financial Accounting, , CMA-CAT, , CONSIGNMENT ACCOUNTS, , 21. Loss of stock is said to be normal when (a) It is because of bad packing, (b) It is unavoidable and natural, (c) The stock is destroyed in fire, , (d) It is loss by theft, , 22. When there are normal losses and abnormal losses at the same time, the abnormal loss is, calculated on, (a), (b), (c), (d), , The, The, The, The, , original, original, original, original, , cost, cost plus non-recurring (direct expenses) duly reduced by the normal loss, cost plus non-recurring (direct expenses), cost less normal loss plus all expenses, , 23. What is similar in the treatment of "Sales" and "Consignment", (a) Ownership transfer, (b) Money receive (c) Stock outflow, , (d) Risk., , 24. If del-credere commission is allowed for bad debt, consignee will debit the bad debt to :, (a) Commission Earned A/c (b) Consignor A/c (c) Debtors A/c (d) General P&L A/c, 25. A proforma invoice is sent by:, (a) Consignee to Consignor, (c) Debtors to Consignee, , (b) Consignor to Consignee, (d) Debtors to Consignor, , 26. Which of the following statement is correct :, (a) Consignee will pass a journal entry on receiving goods from consignor, (b) Consignee will not pass any journal entry on receiving goods from consignor, (c) The ownership of goods will be transferred to consignee at the time he receives goods, (d) Consignee will treat consignor as creditor when he receives goods, 27. If del-credere commission is allowed to consignee the treatment of bad debt (in the books of, Consignor), (a) It will not be recorded in Consignor's books, (b) It will be debited in Consignor's A/c, (c) It will be charged to General P/L A/c, (d) It will be recoverable along with credit sales, 28. Which of the following item is not credited to consignment account in the books of the consignor, (a) Cash sales by consignee, (b) Credit sales by consignee, (c) Consignment Stock, , (d) stock reserve on closing stock, , 29. In the books of consignee, the profit of consignment as shown by the Consignment A/c will be, transferred to :, (a) General Trading A/c, (b) General Profit and Loss A/c, (c) Drawings A/c, , (d) None of the above, , 30. The ownership right of the consignment stock is always with the, (a) Consignor, (b) Consignee (c) Debtors, (d) None, 31. The nature of the consignment account is:, (a) Capital A/c, (b) Revenue A/c, (c) Realisation A/c, , (d) Bank A/c, , 32. Overriding commission is an additional commission payable by consignor as per agreement, , MOMENTUM - ACADEMY FOR ADVANCED STUDIES – COACHING CENTRE FOR CA & CMA SINCE 1992

Page 4 :

Fundamentals of Financial Accounting, , CMA-CAT, , CONSIGNMENT ACCOUNTS, , (a) For protecting from loss of bad debt, (b) For making sales at above specific price or at above invoice price, (c) As good friend, (d) As loyalty payment, 33. A sends out 250 boxes to B costing Rs.400 each. Consignor's expenses Rs.10,000. 1/5th of the, boxes were still in transit. 3/4th of the goods received by consignee, were sold. The amount of, goods still in transit will be:, (a) Rs.20,000, , (b) Rs.22,000, , (c) Rs.22,200, , (d) None of these, , 34. In the books of consignor, the loss on consignment business will be debited to, (a) Consignee A/c (b) General Trading A/c (c) General P/L A/c (d) Bank A/c, 35. Which of the following statement is wrong :, (a) Consignor is the owner of the consignment stock, (b) Del-credere commission is allowed by consignor to protect himself from the loss of bad debt, (c) Proportionate consignor's expenses is added up with consignment stock, (d) All proportionate consignee's expenses will be added up for valuation of consignment stock, 36. Consignment stock will be recorded in the balance sheet of consignor on asset side at:, (a) Invoice, Value, (b) At Invoice value less stock reserve, (c) At lower than cost price, , (d) At 10% lower than invoice value, , 37. The consignment accounting is made on the following basis:, (a) Accrual Basis, (b) Realization Basis (c) Cash Basis (d) All of the above, 38. If consignor draws a bill on consignor and discounted it with the banker, the discounting charges, will be debited in:, (a) General P/L A/c (b) Consignment A/c (c) Consignee's A/c (d) Debtor A/c, 39. Which of the following statement is not true :, (a) If del-creder's commission is allowed, bad debt will not be recorded in the books of consignor, (b) If del-creder's commission is allowed, bad debt will be debited in the Consignment Account, (c) Del-creder's commission is allowed by consignor to consignor, (d) Del-creder's commission is calculated on all sales by consignee, 40. X sends out goods costing Rs.2,00,000 to Y. 3/5th of the goods were sold by consignee for, Rs.1,40,000, Commission 2% on sales plus 20% of gross sales less all commission exceeds cost, price. The amount of Commission will be:, (a) Rs.5,667, (b) Rs.5,800, (c) Rs.6000, (d) Rs.5,600, 41. X sends out 1000 bag to Y costing Rs.200 each. Consignor's expenses Rs.4000, Y's expenses, non-selling Rs.4000, selling Rs.5000, 100 bags were lost in transit. Value of loss in transit will be, (a) Rs.20,400, (b) Rs.20,800 (c) Rs.20,000, (d) Rs.21,300, 42. X sends out 100 bags to Y costing Rs. each. 60 bags were sold at 10% above cost price. Sale, value will be :, (a) Rs.66,000, (b) Rs.65,000 (c) Rs.60,000 (d) 65,500, 43. X of Kanpur sends out certain goods to Y of Mumbai at cost + 25%. 1/2 of the goods received by, Y is sold at 88000 at 10% above invoice price. Invoice value of goods send out is, (a) Rs.1,50,000, (b) Rs.1,60,000, (c) Rs.90,000 (d) Rs.1,70,000, 44. X sends out goods costing 300,000 to ,Y at cost + 20%. Consignor's expenses Rs.6000. 10% of, , MOMENTUM - ACADEMY FOR ADVANCED STUDIES – COACHING CENTRE FOR CA & CMA SINCE 1992

Page 5 :

Fundamentals of Financial Accounting, , CMA-CAT, , CONSIGNMENT ACCOUNTS, , the goods were lost in transit. Insurance claim received Rs.2000. The net loss on account of, abnormal loss is, (a) Rs.28,600, (b) Rs.26,600 (c) Rs.31,600, (d) Rs.27,000, 45. X of Kanpur sends out 1000 boxes to Y of Delhi costing Rs.200 each at an invoice price of Rs.220, each. Goods send out on consignment to be credited in general trading will be, (a) Rs.2,00,000, (b) Rs.2,40,000, (c) Rs.40,000 (d) None, , 46. X of Kanpur sends out 500 boxes to Y of Delhi, costing Rs.400 each. 1/10th of the boxes were, lost in transit. 2/3rd of the boxes received by consignee is sold at cost + 25%. The amount of, sale value will be :, (a) Rs.1,00,000, (b) Rs.1,50,000, (c) Rs.1,20,000, (d) Rs.1,40,000, 47. X sends out 500 bags to Y costing Rs.400 each at an invoice price of Rs.500 each. Consignor's, expenses Rs.4000. Consignee's expenses – carriages Rs.1000, selling Rs.2000. 400 bags were, sold., The amount of consignment stock at Cost Price will be :, (a) Rs.40,900, , (b) Rs.40,800 (c) Rs.40,000, , (d) Rs.41,000, , 48. X sends out 500 bags to Y costing Rs.400 each at an invoice price of Rs.450 each. Consignor's, expenses Rs.4000 consignee's expenses, freight Rs.1000, selling Rs.2000. 400 bags were sold., The amount of Consignment Stock Reserve will be, (a) Rs.5000(b) Nil (c) Rs.10,000, (d) Rs.10,200, 49. Goods of the invoice value of Rs.1,20,000 sent out to consignee at 20% profit on cost. The, loading amount will be, (a) Rs.20,000, (b) Rs.24,000 (c) Rs.25,000 (d) None, 50. X sent out certain goods to Y of Delhi. 1/10 of the goods were lost in transit. Invoice value of, goods lost Rs.20,000. Invoice value of goods sent out on consignment will be :, (a) Rs.1,80,000, (b) Rs.2,00,000, (c) Rs.2,20,000 (d) Rs.1,50,000, 51. A consigned goods for the value of Rs.9000 to Y of Kanpur paid freight etc. of Rs.650 and, insurance Rs.400. Drew a bill on Y at 3 months after date for Rs.3,000 as an advance against, consignment, and discounted the bill for Rs.2960. Received Account Sales from Y showing that, part of the goods had realized gross Rs.10,350 and that his expenses and commission amounted, to Rs.870. The stock unsold was valued at Rs.3000. Consignee wants to remit a draft for the, amount due. The amount of draft will be, (a) Rs.4,130, (b) Rs.7,480, (c) Rs.9,480, (d) Rs.6,480, 52. X sends out 400 bags to Y costing Rs.200 each. Consignor expenses were Rs.4000. Y expenses, non selling Rs.2000, selling 1000. 300 bags were sold by Y. Value of consignment stock will be :, (a) Rs. 20,400, (b) Rs. 20,700 (c) Rs. 22,000 (d) Rs. 21,500, 53. X of Kanpur sent out 1000 boxes costing 100 each with the instruction that sales are to be made, at cost + 45%. X draws a bill on Y for an amount equivalent to 60% of sales value. The amount, of bill will be :, (a) Rs. 87,000, (b) Rs. 1,00,000, (c) Rs. 1,45,000, (d) Rs. 60,000, 54. Goods sent to consignment at cost + 33The percentage of loading on invoice price will be, (a) 25%, (b) 33 1/3%, (c) 20%, (d) None, , MOMENTUM - ACADEMY FOR ADVANCED STUDIES – COACHING CENTRE FOR CA & CMA SINCE 1992

Page 6 :

Fundamentals of Financial Accounting, , CMA-CAT, , CONSIGNMENT ACCOUNTS, , 55. The balance of goods sent out on consignment account will be transferred to, (a) General P/L (b) General Trading (c) Balance Sheet (d) Capital A/c, 56. X purchased 1000 boxes costing Rs.100 each. 300 boxes were sent out to Y of Delhi at cost +, 25 %. 600 boxes were sold at 120 each. The amount of gross profit to be recorded in general, trading will be, (a) Rs.12,000, (b) Rs.19,500 (c) Rs.(500), (d) None, 57. 2000 kg of goods are consigned to an agent, the cost being Rs.3 per kg plus Rs.800 of freight, it, is known that a loss of 15% is unavoidable. The cost per kg will be :, (a) Rs.5, (b) Rs.4, (c) Rs.3.40, (d) Rs. 3, 58. A sends goods to B of Delhi, the goods are to be sold at 125% of cost which is invoice price., Commission is 10% on sales at invoice price and 25% of any surplus realized above IP. 10% of, the goods sent out, on consignment, invoice value of which is Rs.12,500 were destroyed. 75% of, the total consignment is sold by B at Rs.1,00,000. What will be the amount of commission, payable to B?, (a) Rs.10,937-50 (b) Rs.16,250 (c) Rs.10,000, (d) Rs.9,700, 59. Goods sent on consignment at Invoice value Rs.1,00,000. It is at cost + 331/3 %. 1/5th of the, goods were lost in transit. Insurance claim received Rs.5000. The amount of abnormal loss to be, transferred to General P/L is :, (a) Rs.15,000, (b) Rs.10,000, (c) Rs.17,500, (d) Rs.10,000, 60. X sends out 200 boxes to Y costing Rs.100 each. Consignor's expenses Rs.4000. Consignee's, expenses Rs.900, 1/10th of the boxes were lost in transit. 2/3rd of the boxes received by, consignee were sold for Rs.20,000. The amount of consignment stock will be, (a) Rs. 7200, (b) Rs. 7500, (c) Rs. 7000, (d) Rs. 6000., 61. X sent out goods costing Rs.90,000 to Y at cost + 33 1/3%. 1/10th of goods were lost in transit., 2/3rd of the received goods are sold at 20% above invoice price. 1/2 of the sales are on credit., The amount of credit sales will be:, (a) Rs.43,200, (b) Rs. 36,000 (c) Rs. 42,000 (d) Rs. 45,000, 62. X sends out goods to Y, costing Rs. 1,00,000 at cost + 25%, with the instruction to sell it at cost, + 50%. If 4/5th of the goods are sold at stipulated selling price and commission allowable 2% on, sales. What will be the profit on consignment in the books of consignor ?, (a) Rs. 43,100, (b) Rs. 35,000, (c) Rs. 37,600, (d) Rs. 38,400, 63. X sends out goods costing Rs. 1,50,000 to Y. Goods are to be sold at cost + 33 1/3%. The, consignor asked consignee to pay an advance for an amount equivalent to 60% of sales value., The amount of advance will be :, (a) Rs. 1,20,000, (b) Rs. 1,00,000, (c) Rs. 1,50,000, (d) None, 64. X sends out goods costing Rs. 80,000 to Y so as to show 20% profit on invoice value. 3/5th of the, goods received by consignee is sold at 10% above invoice price. The amount of sale value will be, (a) Rs.66,000, (b) Rs. 60,000 (c) Rs. 50,400, (d) Rs. 52,800, 65. X sends out certain goods at cost + 25%. Invoice value of goods sends out Rs. 1,00,000. 4/5th of, the goods were sold by consignee at Rs. 88,000. Commission 2% upto invoice value and 10% of, any surplus above invoice value. The amount of commission will be, (a) Rs.2,400, (b) Rs. 2,600 (c) Rs. 1,600 (d) Rs. 800, 66. C consigned goods costing Rs. 6,000 to his agent. Freight and insurance paid by consignor Rs., 200. Consignee's expenses Rs. 200. 4/5th of the goods were sold for Rs.3,000., , MOMENTUM - ACADEMY FOR ADVANCED STUDIES – COACHING CENTRE FOR CA & CMA SINCE 1992

Page 7 :

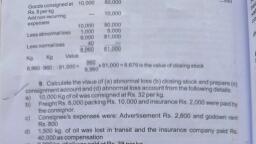

Fundamentals of Financial Accounting, , CMA-CAT, , CONSIGNMENT ACCOUNTS, , Commission 2% on sales. Consignee want to settle the balance with the help of a bank draft. The, amount of draft will be, (a) Rs.2,740, , (b) Rs. 2,800, , (c) Rs. 3,000, , (d) Rs. 1,800, , 67. X sends out 4000 boxes to Y costing Rs. 100 each. Consignor’s expenses 10,000. 1/10th of the, boxes were lost in consignee’s godown and treated as normal loss. 2400 boxes were sold by, consignee. The value of consignment stock will be :, (a) Rs.1,36,667, (b) Rs. 1,23,000, (c) Rs. 1,20,000, (d) Rs. 1,20,500, 68. Goods sent out on consignment Rs. 2,00,000. Consignor’s expenses 5,000. Consignee’s expenses, 7000. Cash sales Rs. 2,00,000, credit sales Rs. 10,000. Consignment stock Rs.45000. Ordinary, commission payable to consignee Rs. 2,000. Del-credere commission Rs. 3000. The amount, irrecoverable from customer Rs. 2,000. What will be the profit on consignment ?, (a) Rs.38,000, (b) Rs. 40,000 (c) Rs. 36,000 (d) Rs. 43,000, 69. Goods sent on consignment Rs. 7,60,000. Opening consignment stock Rs. 48,000. Cash sales Rs., 7,50,000. Consignor’s expenses Rs. 30,000. Consignee’s expenses Rs. 22,000. Commission Rs., 20,000. Closing consignment stock Rs. 2,70,000. The profit on consignment is :, (a) Rs.1,50,000, (b) Rs. 1,40,000, (c) Rs. 92,000 (d) Rs. None, 70. X sends out 50 boxes to Y of Delhi costing Rs. 200 each. Consignor’s expenses Rs. 2000., Consignees expenses on selling Rs. 1,500. 3/5th of the goods sold by consignee, 1/2 of the, balance goods were lost in consignee’s godown due to fire. The value of abnormal loss will be, (a) Rs.2,700, (b) Rs.2,400, (c) Rs.4,200, (d) None, , MOMENTUM - ACADEMY FOR ADVANCED STUDIES – COACHING CENTRE FOR CA & CMA SINCE 1992

Learn better on this topic

Learn better on this topic

Learn better on this topic

Learn better on this topic