Page 1 :

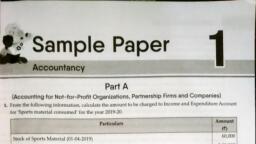

Sample Paper — 3., , Part A, , , , , , , , , , , , , , ) (Accounting for Not-for-Profit Organizations, Partnership Firms and Companies), 1. Record the following items of a Not-For-Profit Organization:, Particulars f-@ ||, Tournament Fund | 2,00,000, Tournament Expenses | 60,000, Income from Tournament Tickets | 80,000 |, 2. Distinction between ‘Retirement of a Partner’ and ‘Death of a Partner’ based on:, (i) Partner connection with the firm (ii) Treatment of due amount, , 3. A and B are partners in a firm sharing profits in the ratio of 3 : 2. Mrs A has given a loan of 220,000 to, the firm, and the firm also obtained a loan of 710,000 from B. The firm was dissolved, and its assets were, realised for 225,000. State the order of payment of Mrs A’s Loan and B’s loan with reason if there were no, , firm creditor., , 4. Receipts and Payments Account of Friends Entertainment Club showed that %68,500 were received by, way of subscriptions for the year ended on March 31, 2018., , The additional information was as under:, , () Subscription Outstanding as on March 31, 2017 were 26,500., , (ii) Subscription received in advance on March 31, 2017 were %4,100., (iii) Subscription Outstanding as on March 31, 2018 were 25,400., , (iv) Subscription received in advance as on March 31, 2018 were %2,500., , Show how the above information would appear in the Income and Expenditure for the year ended on, March 31, 2018 of Friends Entertainment Club., , , , , , , , , , , , OR, Show how will you deal with the following items in the final accounts of a club., r Particulars @, Sports Fund 35,000, Sports Fund Investments 35,000, Income from Sports Fund Investment 4,000, Donations for Sports Fund 15,000, Sports Prizes Awarded 10,000, [Expenses on Sports Events __ es 4.000, , , , , , , , Kayi, Rayi, Kumar and Guru were partners in a firm sharing profits in the ratio of 3:2; 2: 1, On 1.2.2018,, Guru retired and the new profit sharing ratio decided between Kavi, Ravi and Kumar was 3:1: 1. On, Guru’s retirement the goodwill of the firm was valued at %3,60,000., , Showing your working notes clearly, pass necessary journal entry for the treatment of goodwill on Guru's, retirement., , 6. ICICI Bank Ltd. issued 20,000 6% debentures of %25 each at a premium of 8% on July 31, 2010 redeemable, on July 31, 2018. The issue was fully subscribed. Record necessary entries for the issue and redemption of, debentures.

Page 2 :

CBSE Accountancy - xil, , , , Bees OR, on Ltd. issued 8,000, 7% debentures of 2100 each at a discount of 10% total amount being, i. application. The issue was subscribed and allotment made. The company decided to write of, Discount on Issue of Debentures in the year when debentures are issued. Pass the journal entries,, 7, Pannalal, Babulal and Hiralal were partner's sharing profits and losses in the proportion of 2:2.4|, following is their Balance Sheet as on 31" March 2018. |, , , , , , , , , , , , , , , , Balance Sheet, (as on 31% March 2018), Liabilities — Assets, , , his a, Capital Accounts: Machinery 25,000, , Pannalal 30,000 | Stock = | 10,000, , Babulal 10,000 | Debtors 27,500, , Hiralal 10,000 | Less: R.D:D. 1,500 | 26,000, General Reserve 3,000 | Investment 12,000, Creditors 20,000 | Profit and Loss A/c 9,000, Pannalal’s Loan A/c 4,000 | Bank 2,000, Bills Payabl | 7,000 | |, , th | ia |, r 4, _ oe =, , , , , , On the above date, the partners decided to dissolve the firm:, (i) Assets were realised: Machinery %22,500, Stock 79,000, Investment 710,500, Debtors 222,500., (ii) Dissolution expenses were 21,500., (iii) Goodwill of the firm realised 712,000, Pass the necessary Journal entries in the books of the firm., OR, Gautam, Viral and Ashwin were partners sharing profits and losses equally. Their Balance Sheet as on, , 31* March, 2021 was as follows:, , , , Balance Sheet, (as on 31* March, 2021), , , , , , , , , , , , Amount, | ; Liabilities ®) Assets <a, | Capital Accounts: Building 73,900, Gautam 75,000 | Furniture 44,100, Virat 45,000 | Stock 25,400, thse Feind 27,000 | Debtors 33,600, Eaeditons 48,500 | Cash 15,000, Bank Loan 11,500_| Ashwin's Capital 15,000, 2,07,000 2,07,000, , , , , , , , , , , , , , , , , , The firm was dissolved due to the insolvency of Ashwin, and the following was the result., , @ The realisation of assets were as follows:, (a) The stock was completely damaged and could realise worth 716,500 only., (b) Building was sold for ®49,800., bei ‘The firm realised furniture at %23,100 less than the book value., ‘A customer who owes %14,400 became insolvent, and nothing could be recovered from

Page 3 :

_ Creditors were paid for £36,900 in full settlement, and Bank Loan was discharged fully., of realisation %4,100, , (iv) Ashwin became insolvent, and the firm could recover only %4,000 from his private estate., , Prepare Realisation A/c, Partner's Capital A/c and Cash A/c to close the books of the firm., , 8. Geetanjali Hotels Co. engaged in business of hotels, having chain of hotels in Maharashtra decided to, , expand their business in other states also. For that the board of directors decided to open their hotels in, nearby states viz. Karnataka and Goa., , For their underway hotels in Karnataka, Geetanjali Hotels, the Company. purchased furniture of, %88,00,000 from Royal Furniture Mart., , Geetanjali Hotels Co. paid 50% of the amount by accepting a bill of exchange in favour of Royal Furniture, Mart payable after two months. For the balance amount the company issued 10% Debentures of 2100, each at a premium of 10% in favour of Royal Furniture Mart., , You are required to answer the following questions :, , (i) Pass journal entry which will be passed at the time of purchase of furniture in the books of Geetanjali, Hotels Co., , (ii) Pass journal entry for the payment made through bill of exchange., , (iii) Calculate the number of debentures issued to Royal Furniture Mart., , {iv) Calculate the amount to be transferred to Securities Premium Reserve Account., (v) Pass journal entry for the allotment of debentures., , 9. The Receipts and Payments Account for the year ending 31% December, 2018 of the Pandit Nehru Club is, as follows:, , Receipts And Payments Account, , , , , , , , , , , , , , , , , , , , , , , , , , , , (i) The number of members of the club was 500 and the membership subscription was %20 per month., (ii) The rent of the club house was ®1,500 per month., (iii) At the end of the year, prepaid salary was %2,000., , (iv) In 2017, %50,000 were deposited in Fixed Deposit Account for three years in a bank, carrying 6%, interest p.a,, , ___¥) The other assets on Ist January, 2018 were as follows; Furniture 80,000 and Sports Equipments, , b 240,000,, , (vi) Depreciation is to be provided @ 10% p.a. on furniture and sports equipments., , 3 forsee Inone eal ixpendiben hoon fe the yaar ending Sat Dest IMB RA Weenen Segoe, _ on that date,, , 4 Amount Amount |, ah, Receipts ® Payments ® |, To Opening Cash Balance 50,000 | By Salaries 20,000, To Membership Subscription: z= By Rent | 15,000), 2017 10,000 By Printing and Stationery | 8,000, 2018 1,00,000 By Water and Power | 15,000, 2019 5,000 | 1,15,000 | By Newspapers and Periodicals 18,000, | To Income from Entertainment 2,000 | By Furniture } 50,000, | To Interest 1,500 | By Repairs to Furniture 2,000, | By Refreshments 10,000, | By Closing Cash Balance, . 1,68,500 1,68,500

Page 4 :

CBSE Accountancy - XIl, Part B, , Statement:, (@ Debentures were issued on 1* April, 2020., (ii) Preference Shares was redeemed at a Premium of 15%., , 11. Prepare a comparative, , 10, State whether the following transactions will result in inflow,, , (Analysis of Financial Statements), outflow no flow of cash in Cash, , ann ae, , statement of profit and loss for the year ended 31st March, 2019 from the “tng, , , , , , , , , , , , , , , information: j, 31 March, 2019 31" March, 24, , =), Revenue from Operations 10,00,000 5,00,000, Purchase of stock-in-trade 6,50,000 2,00,000, ‘Change in Inventories of Stock 60,000 50,000, , Other Expenses 10% of cost of revenue | 20% of cost of revenyg, , from operations from operations, Tax Rate 40% 30% |, as |, , , , , , , , OR, , From the following Balance Sheets of Udyog Ltd., as on 31" March, 2017 and 31* March, 2018 prepare, , ‘Comparative Balance Sheet of Udyog Ltd., Balance Sheet, , (as at 31" March, 2018 and 2017), , , , , , , , , , , , , , , , , , , , , , , et, paiticil Note | 313.2018 | 31.3.2018, : No. ®) ® a, L EQUITY AND LIABILITIES:, 1. Shareholder’s Funds:, (a) Share Capital 20,00,000 15,00,000, 2, ae csetees on a, 3 ep enitiaa sro ia, Ti, (a) Trade Payable 3,00,000 2,00,000, ——_ Total 35,00,000 | _ 27,00/000, 1, Non-current Assets:, (a) Fixed Assets:, (i) Tangible Assets, 20,00,000 15), 4 Lele Anns 9,00,000] 6,004, (a) Inventories, (b) Cash and Cash Equivalents soon, mn 3,00,000 2, otal 35,00,000] 27, riot, , , , 12. From the following Balance Sheets of Akshya Ltd. as on 31.03.2018 and 31.03,, , Statement., 7, , .2019, prepare a Cash F

Page 5 :

Sample Paper-3 191, , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , , Note | 31.03.2019 | 31.03.2018, Particulars No. ® ®@, J. EQUITY AND LIABILITIES, 1. Shareholder’s Funds:, (a) Share Capital 65,000 45,000, (b) Reserve and Surplus 7 42,500 24,000, 2. Current Liabilities: 11,000 8,700, (a) Trade Payables (Creditors) |, ’ Total 1,18,500 77,700, Il, ASSETS, 1, Non-Current Assets:, (a) Fixed Assets 83,000 46,700, 2. Current Assets:, (a) Inventories (Stock) 13,000 11,000, (b) Trade Receivables (Debtors) | 19,500 18,000, (©) Cash and Cash Equivalents (Cash) | | 3,000 2,000, Total | | 118,500 77,700, Notes to Accounts:, iad Pesticidacs 31° a 2019 =|31* a 2018, Reserves and Surplus, General Reserves 27,500 15,000, Balance in Statement of Profit and Loss 15,000 10,000, Preliminary Expenses = (1,000), Total 42,500 24,000, , , , , , , , , , Additional Information:, (i) Depreciation on Fixed Assets for the year 2018-19 was 14,700., (ii) An interim dividend 7,000 has been paid to the shareholders during the year., aa