Page 1 :

EXERCISE, , Retirement of a Partner (New Profit-Sharing Ratio and Gaining Ratio), 1. Gita Radha and Garv were partners sharing profts in the ratio of 1/2, 2/5 and 1/10. Find the new ratio of, the remaining partners if Garv retires., (Ans.: New Profit-sharing Ratio-5:4.], , 2XYand Z are partners sharing profits in the ratio of 1/2, 3/10, and 1/5. Calculate the gaining ratio of, (Foreign 2014), remaining partners when Y retires from the firm., [Ans.: Gaining Ratio between Xand Z-5:2., 3. From the following particulars, calculate new profft-sharing ratio of the partners:, , a)Shiv,Mohan and Hari were partners in a firm sharing profits in the ratio of 5:5:4.Mohan retired and, his share was divided equally between Shiv and Hari., , b)PQand R were partners sharing profits in the ratio of 5:4:1. P retires from the firm., , [Ans.: New Profit-sharing Ratio--(a) 15:13: (b) 4: 1], 4. RS and Mare partners sharing profits in the ratio of 2/5, 2/5 and 1/5. M decides to retire from the business, and his share is taken by Rand S in the ratio of 1:2. Calculate the new profit-sharing ratio. (Delhi20110, , Profit-sharing Ratio-7:8.], , [Ans.: New, 5. Sarthak Vansh and Mansi were partners sharing profits in the ratio of 4:3:2. Sarthak retires.Vansh and Mansi, will share future profts in the ratio of 2:1. Determine the gaining ratio., 6. a) WX Y and Z are partners, , sharing profits and, , losses in the, , LAns.:Gaining Ratio-3:1.], ratio of 1/3, 1/6, 1/3 and 1/6 respectively., , Y retires and W, X and Z decide to share the profits and losses equally in future., , Calculate gaining ratio., b) A B and C are partners sharing profits and losses in the ratio of 4 3, , 2. C retires from the business., , A takes 4/9 of C's share and balance is taken by B. Calculate the new profit-sharing ratio and gaining ratio., , [Ans.: (a) Gaining Ratio of W, X and Z--0:1:1., (b) Gaining Ratio of A and B-4:5; New Profit-sharing Ratio-44:37.]

Page 2 :

apter 6 Retirement of a Partner 6., , sideceased partner are entitied to share of goodwill of, the firm?, of hich the partners share gain or loss from, , helrs, r, , a, , t, , i, , o, , revaluation of assets and liabilities., paid immedlately?, howjs, ament, how, is new proht-sharing ratio among the remaining, partners calculated?, due t0 an, , the, d m o u n td u, h, , (Delhi 2014), , whic., , in, , ount, , e, , outgoing partner dealt with in case it is not, , retirement,, , irteof, , t e, of, , (CBSE 2019), , made at the time of retirement, of a partner., hetwo, enew, 0 prot-sharinr, haring ratio of remaining partners is not given, how, is the share of the outgoing Paartner, to kbe, ts to, , adjustments, , nbted, t, , h, , unal entry, , e, J o u m, , istribute 'Workmen Compensation Reserve' of 60,000 at the time of retirement of, , to distr, , here is no claim against it. Ihe hrm has three partners Rajat, Sajjan and Kavita., a n w h e nt h e r e, , Aeductions that, , dedu, two, , any, , may have to be made from the amount, , e, , ishna, Ganga and Krish, , (Delhi 2013), , payable to a retiring partne, (Delhi2009, , are partners in a fhrm. Krishna retired from the frm. After making adjustments, , e s and Revaluation otASSetsand Liabilities the balance in Krishna's capital account was 1,20,000., ReeGanga paid? 1,80,000 in full settlement to Krishna. Identify the item for which Jamuna and, more to Krishna., (Delhi2013, d 60,000, , a m u n aa n dG a n a, , nga, paid, , sMiot: For his, , share ofGoodwill, , AnswerType, , Questions, , cedure of determining the amount payable to a retiring partner when he leaves the firm., , rt, , the accounting treatment of goodwill on retirement of a partner., , Bplainthe, , sets and abilities revalued on the retirement of a partner?, , h hetween the sacriDcing ratio and the gaining ratio among partners., Dstinguish, , HERCISE, , rement of a Partner (New Profit-Sharing Ratio and Gaining Ratio), 1/2, 2/5 and 1/10. Find the new ratio of, [Ans.: New Profit-sharing Ratio-5:4], the remaining, of, 1Yand Z are partners sharing profts in the ratio of 1/2, 3/10, and 1/5. Calculate the gaining ratio, (Foreign, 2014), the, Yretires, from, firm., when, remaining partners, , taRadha and Garv were partners sharing, , proits, , in the ratio of, , partners if Garv retires., , [Ans.: Gaining Ratio between Xand Z-5:2.], , Hon the following particulars, calculate new proft-sharing ratio of the partners, , Shiv,, Mohanand Hari were partners in firm sharing profits in the ratioof 5:5:4. Mohan retired and, his share was divided equally between Shiv and Hari., a, , D PQand Rwere partners sharing profits in the ratio of 5:4:1.P retires from the firm., Ans.: NewProft-sharing Ratio-(o) 15: 13; (b) 4:1.], RSand Marepartners sharing profits in the ratio of 2/5, 2/5 and 1/5. Mdecides to retire from the business, adhisshare is taken by R and S in the ratio of 1:2. Calculate the new profit-sharing ratio., , (Delhi 2011, , [Ans.: New Profit-sharing Ratio-7:8], arthak, Vansh and Mansi were partners sharing profits in the ratio of4:3:2.Sarthakretires.Vansh and Mansi, (Ans.: Gaining Ratio-3:1.], Share future profits in the ratio of 2:1. Determine the gaining ratio., , 0 WXYand Z are partners sharing profits and losses in the ratio of 1/3, 1/6, 1/3 and 1/6 respectively., retires and W, Xand Z decide to share the profits and losses equally in future., , Calculate gaining ratio., , 5and C are partners sharing profits and losses in the ratio of 4:3:2. C retires from the business., aes 4/9 of C's share and balance is taken by B. Calculate the new profit-sharing ratio and gaining ratio., , (Ans.:(a) Gaining Ratioof W,X, and Z--0:1:1., , (b) Gaining Ratio ofA and B--4:5 New Proñt-sharing Ratio-44:37]

Page 3 :

6.56 Double Entry Book Keeping--CBSE XII, , Lakshya, Manoj and Naresh are partners sharing profitsinthe ratio of 3:2:1: 4. Kim, Kumar,, his share is taken by Lakshya and Manoj in the ratio of 3:2. Calculate new profit-sharing rati., , rofit-sharing ratio andretirges and, remaining partners., gaining, [Ans.: New Profht-sharingRatio-19:11:20; Gaining Ratio ofLakshyagne NCEKT, be 3:2. Naresh has neither, noj wil, sacrificed, nore, 8. A, Band Cwere partners in a firm sharing profits in the ratio of 8 :4:3.Bretires and his, gained, ratio of the, , equally by A and C. Find the new profit-sharing ratio., , Delhi 2009,, , (Ans.: New Profit-sharing, , Ratio-2:2:1, , Ans.: New Proft-sharing, , Ratio--7:31, , 18, , 9. A, B and Care partners sharing profits in the ratio of 5:3:2. Cretires and his share is taken hu A r, new profit-sharing ratio of A and B., 10., , P,Q and Rare partners sharing profits in theratio of 7:5:3. P retires and it is decided that ornk, ratio between Q and R will be same as existing between P and Q. Calculate New, profit-sharin ng, and, Gaining Ratio., and R--7:5;, [Ans.: New Proft-sharing Ratio, , of Q, , 11., , 12., , Gaining Ratio-i5.1, :13, Murli retirec, surrenders 2/3rd of his share in favour, Omprakash. Calesle, alculate, new, proft-sharing ratio and gaining ratio of the remaining partners., (NCERT, [Ans.: New Profit-sharing Ratio-3 : 1; Gaining, Ratio-2:11, Om, Ram and Shanti are partners in a firm sharing profits and losses in the ratio, of 4:3:2. Ram retires from, the firm. Calculate new, profit-sharing ratio of Om and Shanti in the following circumstances:, Murli, Naveen and Omprakash are partners sharing profits in the, , ratio of 3/8, 1/2 and 1/8., of Naveen and remaining share in favour of, , (a) If Ram gives his share to Om and Shanti in the original ratio of Om and Shanti., , (b) If Ram gives his share to Om and Shanti in equal proportion., (c) If Ram gives his share to Om and Shanti in the ratio of 3 :1., , (d) If Ram gives his share, , to Om, , only., [Ans.: New Profit-sharing Ratio-(a) 2: 1; (6), , Treatment of Goodwill, 13., , 11:7;()25:11;(d)7:2], , Sunil, Shahid and David are partners sharing profits and losses in the ratio of 4:3:2. Shahid retires, , and the, goodwill is valued at ? 72,000. Calculate Shahid's share of goodwill and pass the Journal entry for Goodwil., Sunil and David decided to, share, profits and losses in the ratio of, , future, , 5:3., , Ans.: Shahid's share of Goodwill R 72,000 x 3/9=7 24,000; Dr. Sunil's, Capital A/c by~ 13,000and, David's Captal A/c by 11,000; Cr. Shahid's, Capital AWc by 24,00, =, , [Hint: Sunil gains = 5/8-4/9, 14., , 13/72; David gains = 3/8-2/9, , 11/72. Hence, Gaining Ratio = 13:11), , P,Q, Rand Swere partners in a firm sharing profits in the ratio, of 5:3:1:1.On 1st January, 2021, Sretred, from the firm. On S's retirement, goodwill of the firm, was valued at 7, New, , 4,20,000., , among P, Q and R will be 4:3:3., , Showing your working, , notes, , clearly,, , pass, , books of the firm on S's retirement., 15., , profit-sharing ra, , necessary Journal entry for the treatment of goodwir n, , (Foreign 2017, Modiñed, , [Ans.: Dr. Rs Capital A/c by 84,000; Cr. Ps, Capital AWc and S's Capital A/c by 7 42,000 eddl, , Aparna, Manisha and Sonia are partners sharing profits in the ratio, of, Manisha retired and goou, of the firm is valued at R 1,80,000. Aparna and Sonia decided to share 3:2:1., future profits in the ratio of 5, , :., , necessary Journal entries., , (NCER, , Ans.: Gaining Ratio 3:7;, =, , 16. A, B and, , Dr. Aparna's Capital A/c by, , Care partners sharing profits, , 18,000 and Sonia's Capital ACoy, , 42.000%, , Cr. Manisha's CapitalA/c by 60,00, , in the ratio, , ratio, , of 3:2:1.B, and the, between Aand Cwas 2:1.On B's retirement, the goodwill, of the firmretired, was valued, at7new, 90,000., Pas, proht-sndsat, Journal entry for the treatment of goodwill on B's, retirement., , [Ans.: Dr. A's Capital A/c and C's CapitalAlc by 15,000each, Cr. B's, , Capital A/c by, , -1:1, , 30,000; Gaining Ratio-, , 19

Page 4 :

Chapter 6, , Retirement, , of a Partner, , 6.57, , and Deepak are partners sharing profits in the ratio of 2:3: 5. The goodwill of the nir, Aman,b m a lane, , Bimal and Deepak decided to share profits equally in future., Journal entry, pain/sacrifice of Bimal and Deepak on Aman's retirement and also pass necessary, en, , alued at, , 37,500., , Aman retired., , (CBSE 2019), , Ghculate, , treatment, , ofgoodwill., , 7,500.J, [Ans.: Bimal alone gains. Dr. Bimal's Capital A/c and Cr. Aman's Capital A/c by, , rthe, , in the, , Goodwill appearing, in, Pammy and Sunny are parthers sharing profits the ratio of 3:2:1., goodwill is valued at, h t Value of R60,000. Pammy retires and at the time of Pammy's retirement, the, necessary Journal, Record, 00 Hanny and Sunny decided to share future profits in the ratio of 2:1., (NCERT), is, , b o o k s ., , 78400, e, , n, , t, , r, , e, , s, , 20,000, , Hanny's Capital A/c by 30,000, Pammy's CapitalAlc by, Dr. Hanny's Capital A/c and, and Sunny's Capital A/c by 10,000; Cr. GoodwillA/c by 60,000. (i), R 28,000.), Sunny's Capital A/c by 14,000 each; Cr. Pammy's Capital A/c by, , ., , [Ans.: Gaining, , Ratio, , =, , 1 :1;6) Dr., , siden G o o d w i l l, , after, , making, , in the ratio of 4/9:3/9: 2/9. B retires and his capital, A8and Care partners sharing profits on revaluation, him, stands at 1,39,200. A and Cagreed to pay, adiustmentsfor reserves and gain (profit), if, for adjustment of goodwill the, Journal, , of his claim., E150.000 in full settlement, , n2wprofit-sharing, , entry, , Record necessary, , ratio is decided at 5:3., , Ans.: Hidden Goodwill (B's Share):, , and, ? 10,800; Gaining Ratio-13:11;Dr. As Capital A/c by 5,850, 10,800.], Cs Capital A/c by 4,950; Cr. B's CapitalA/c by, , Partner(s) Gain, When One/Some (not all) of the Remaining, valued at, in the ratio of 3 :2:1. Goodwill has been, . M,N and Oare partners in a firm sharing profts, Journal, entry for, Pass the necessary, On N's retirement, M andO agree to share profits equally., , T60,000., , treatment of N's share of goodwill., A/c by 20,000.], N's, Only O is gaining; Dr. O's Capital A/c and Cr. Capital, the retirement of C, Goodwill, 2. AB,Cand Dare partners in a firm sharing profits, in the ratio of 2:1:2:1.On, Pass the necessary Journal entry, 1,80,000. A, B and D decide to share future profits equaly., , [Ans.:, , Wasvalued, , for the treatment of goodwill., , Capital A/c, [Ans.: Gaining Ratio of A, Band D-0:1:1., A/c, C's, Cr., Capital, by T 60,000.], D's Capital A/c by 30,000 each;, Dr. B's, , ne/some of the Remaining Partner(s), dnd were partners in a, , firm sharing, , profits in, , and, , also Sacrifice, , the ratio, , of6:5:4. Their capitals were A-7 1,00,000;, , A retired from the firm and the new, 60,000 and C-7 60,000 respectively. On 1st April, 2009,, 1:4. On A's retirement, the goodwill of the firm was, POISharing ratio between B and Cwas decided as, necessary Journal entry for the treatment, 1,80,000. Showing your calculations clearly, pass the, , Edat, oi, , (Foreign 2010, , goodwill on A's retirement., Ans.:C's, , ation of Assetsiand, , CapitalA/cby 96,00o:, Cr.A's Capital A/c by 72,000 and B's Capital A/c by 24,000.1, , Gain-8/15, B's Sacrifice-2/15; Dr. Cs, , Reassessment, , of Liabilities, , and losses in the ratio of 5:3::, ngeeta, Saroj and Shar, hanti are partners sharing profits, on the c, were agreed:, OT her retirement, following adjustments, a The, value of urniture is to be increased by 12,000., , value of stock be decreased by 10,000., , Machinery of the book valu, , of 7 50,000 is to be, , reduced, , by 10%., , Shanti retired and

Page 5 :

6.58 Double Entry Book, Keeping-CBSE, , XII, , AProvision for Doubtful Debts @ 5% is to be created on debtors of book value of ao, (e) Unrecorded, investment worth 10,000., , ()An item of 1,000 included in bills, Pass necessary Journal, , payable is, , entries., , not, , ence, should, likely to be claitmed, hence,, should ho., be, , written, , back, (Ans.: (a) Dr. Furniture A/c and Cr. Revaluation, Ale, (b) Dr. Revaluation Alc and Cr., Stock Alc byby 12,000., ?, (c) Dr. Revaluation A/c and Cr., , Machinery 10,000., 00, Revaluation A/c by, Revaluation A/c by10,000., , (d) Dr. Revaluation A/c and Cr. Provision for Doubtful Dehte A/c, A/cbyby2,000, 5, (e) Dr. Investment Acand Cr., (F) Dr. Bills Payable A/c and Cr., , 24., , 6,000; Cr. Sangeeta's, (g) Dr. Revaluation A/c by, Capital A/c, Saroj's Capital A/c by 1800 and Shar Capital A/c, , by 1,000., by11,3,200000, A, Band C were partners, sharing profits and losses in the ratio of 2:2:1.B retired on, 31st March, the date of his retirement, some of the assets and liabilities appeared in the books as follows, 2021.On, Creditors, , 70,000; Building 1,00,000; Plant and Machinery R 40,000; Stock of Raw Materialk 3, 20,00, of Finished Goods 30,000 and Debtors 20,000., Following was agreed among the partners on B's retirement:, (a) Building to be appreciated by 20%., , 28., , Stock, , (b) Plant and Machinery to be reduced by 10%., , (c)A Provision of 59% on Debtors to be created for Doubtful Debts., (d) Stock of Raw Materials to be valued at 7 18,000 and Finished Goods at, (e) An Old Computer previously written off was sold for 2,000 as scrap., , f) Firm had to pay, , 5,000 to an injured employee., , Pass necessary Journal entries to record the above, 25., , 35,000., , Punit, Ramit and Akshit were partners, , adjustments and, , prepare the Revaluation Account., , [Ans.:Gain (Profit) on Revaluation- 15,000, sharing profits equally. Akshit retired on 1st April, 2021. Punit and, , Ramit decided to continue the business and share profits in the ratio of 3:2. They also decidedtogive, effect to the change in values of assets and liabilities without changing their book values., The book values and their revised values were as follows:, , Book Values (), , Revised Values ), , Land, , 5,50,000, , 8,50,000, , Building, , 2,50,000, , Computers, , 1,00,000, , 2,10,000, 70,000, , Computer Softwares, Sundry Creditors, Workmen Compensation Claim, , 5,00,000, , 4,00,000, , 70,000, , 60,000, , Pass an adjustment entry., , 5,000, , [Ans.: Dr. Punit's Capital A/C by T 36,000 and Ramit's Capital A/c by, , 00, , Cr. Akshit's Capital A/c by 45,000, , Treatment of Reserves and Accumulated Profits/Losses, firm on, , 26. X, Yand Z are partners in a firm sharing profits and losses in the ratio of 3:2:1. Z retiredfrom the nu, 1st April, 2021. On, retirement, following balances existed in the books of the, , thedate, of Zs, 1,80,000, , fr, , General Reserve, , Profit and Loss Account (Dr.) 30,000, , Workmen, , Compensation Reserve 24,000 which was, , no more, , Fund, , required, , 20,000., Employees'Provident, Pass necessary Journal entries for the adjustment of these items on Z's retirement., , LAns.:(a), , 724,0, , A/c by, Dr. General Reserve Ac by 1,80,000 and, Workmen Compensation, cbyR, Cr. X's, 5,000, and Zs Capital, A/c by R 1,02,000, Y's, 68,000, A/c, by, by, (b) Dr. X's, Z's, Capital, by 15,000, Y's, O and, serve, , Capital, Capital A/c, , Capital, , 3400, , alAc, , Capital A/c by 10,000«, , LossAc byR3U0, Cr. Pront and, , Pre, , 29

Page 6 :

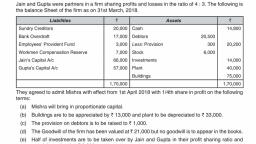

Chapter 6, , Retirement, , of a Partner, , 6.59, , and sShalini were partners in a frm sharing profits in the ratio of 5: 3:2. Goodwill appeared, and, , Naveen, , the, 40,000. Naveen decided to retire from, date of his retirement, goodwill of the firm was valued at 1,20,000. The new profit-sharing, Ash and Shalini is 2:3., among, , aks at a value ofRB0,000 and General, , Asha,, , in, their, , h i m .O n, , Reserve at, , ecided, , Tatio, decic, , ecessary, , Journal, , tries, , Recond, , (Delhi2015C), Naveen's retirement., [Ans.:(a) Dr. Asha's Capital A/c- 40,000; Naveen's Capital A/c- 24,000, and Shalinis Capital A/c- 16,000; C. Goodwill A / - 80,000., , on, , (b) Dr. General Reserve A/c, , 40,000; Cr. Asha's Capital Alc-* 20,000, , Naveen's Capital A/c- 12,000 and Shalini's Capital A/e-8,000., (C) For Adjustrment of Goodwil: Dr. Shalinis Capital A/c- 48,000;, , Cr. Naveen's Capital A/c-, , 36,000 and Asha's Capital A/c- 12,000.], , a laNman and Bharat are partners sharing profts in the ratio of3:2:1.Goodwill is appearing in the, ham,, , at, value of 1,80,000. Laxman retires and at the time of his retirement, goodwill is valued, 57 000. Ram and Bharat decided to share future profts in the ratio of2:1.The Profit for the first year, retirement amount to R 1,20,000. Give the necessary Journal entries to record goodwill and, , Lnksat a, , HerLaexman's, , arter L, , to distribute, , the proft. Show your calculations, , [Ans: To write, , (Foreign 2012), , clearly., , Dr. Rams Capital A/c by 90,000; Laxman's Capital A/c by 60,000, offExisting Goodwil: and, Bharat's CapitalA/c by 30,00; Cr. Goodwill A/c by 1,80,000;, ToAdjust, Goodwil:Gaining Ratio-1:1;Dr. Ram'sCapitalAlc and, Bharat's Capital A/c by 42,000 each; Cr. Laxman's Capital AC, , by T 84,000. To Distribute Profts: Dr. Profit and Loss Appropriation A/e, by 1,20,000; Cr. Rams Capital A/c by 80,000 and Bharat's Capital A/c by 40,000.), , Pheparation of the Capital Accounts and, , Balance Sheet, , 3 Patnership Deed of Cand D, who are equal partners, has a clause that any partner may retire from the frm, on the following terms by giving a six-month notice in writing:, The retiring, , partner shall be paid, , a) the amount standing to the eredit of his Capital Account and Current Account., b) his share of profit to the date of retirement, calculated on the basis of the average profit of the three, , preceding completed years., ) half the amount of the goodwill of the firm calculated at 1h times the average profit of the three, , preceding completed years., gave a notice on 31st March, 2020 to retire on 30th September, 2020, when the balance of his Capital, , count was 6,000 and his Current Account (Dr.,) F 500. Profits for the three preceding completed years, ended 31st March, were: 2018-7 2,800,; 2019-7 2,200 and 2020- 1,600., , Dete, and, , e, , the amount, , due to Cas per the partnership agreement., , Ans.: Amount due to C-7,700.], , Z were partners in a firm sharing profits in the ratio of 2 : 2:1. Their Balance Sheet as at, , 31st March, 2021, , ties, , was:, Assets, , Uitors, , erVe, ital Alcs, X, N, L, , 82,000, 60,000, 75,500, , 49,000, , ash, , 18,500, , Debtors, , Stock, , Building, 2,17,500, , 2,85,000, , Patents, , 8,000, , 19,000, , 42,000, 2,07,000, 9,000, , 2,85,000

Page 7 :

6.60 Double Entry Book Keeping-CBSE XII, Y retired on 1st April, 2021 on the following terms:, , (a) Goodwill of the firm was valued at T 70,000 and was not to appear in the books,, , (bBad Debts of 2,000 were to be written off., (c) Patents were considered as valueless., Prepare Revaluation Account, Partners' Capital Accounts and the Balance Sheet of, of x:, , X and 2, , Y's retirement., , after, , [Ans.: Loss on Revaluation- 11,000; X's Capital A/c- 66,333; Z's CapitalAl, Y's, 91,000; Balance Sheet, , 67;, Total- 74,67,0600,, Kanika, Disha and Kabir were partners sharing profits in the ratio of 2: 1:1. On 31st March, 201e., Loan, , 31., , their, , Balance Sheet was as under:, Liabilities, , Assets, , Trade creditors, , 53,000, , Bank, , Employees Provident Fund, , 47,000, , Debtors, Stock, Fixed Assets, Profit and Loss A/c, , Kanika's Capital, , 2,00,000, , Disha's Capital, , 1,00,000, , Kabir's Capital, , 80,000, , 60,000, 60,000, , 1,00,000, 2.40,000, 20,000, 4,80,000, , 4,80,000, Kanika retired, , on, , 1st, , April,, , 2016. For this purpose, the, , following adjustments were agreed upon:, years' purchase of average profits of three completed, , (a) Goodwill of the firm was valued at 2, preceding the date of retirement. The profits for the year:, , years, , 2013-14were 1,00,000 and for 2014-15 were 1,30,000., were to be increased to 3,00,000., , (b) Fixed Assets, , (c)Stockwas to be valued at 120%., (d) The amount, , payable to, , Kanika, , was, , transferred, , to her Loan, , Account., , Prepare Revaluation Account, Capital Accounts of the partners and the Balance Sheet of, the reconstituted, firm., Al 2017, , [Ans.: Gain (Profit) on, 32. N,, , Sand G were partners in a, , their Balance Sheet, , was as, , firm, , Revaluation-, , sharing, , under:, , 31st March, z0, , Liabilities, , Assets, , Creditors, General Reserve, , 1,65,000, 90,000, , Capitals:, N, , 4,50,000, , Cash, , 1,20,000, , Debtors, , 1,35,000, , Less: Provision, Stock, , 2,25,000, 3,75,000, , G, , 80,000; Capital A/cs: Disha-80,000; Kabir-60,000, , Kanika's Loan- 3,00,000; Balance Sheet Total-~5,40,000,, profits and losses in the ratio of 2:3:5. On, , 10,50,000, , 15,000, , 1,50,000, , Machinery, , 4,50000, , Patents, , 90,000, , Building, , 3,00,000, 75,000, , Profit and Loss Account, , 13,05,000, retired on the above date and it, was, agreed that:, (a) Debtors of R6,000 will be, written off as bad, debts and, doubtful debts will be, maintained., (b) Patents will be, completely written off and, , 1,20,000, , 13,05,000, , G, , stock,, , a, , provision of 5%, , on, , debto, , epreciated by5%, machinery and building will be aep

Page 8 :

Chapter 6, , Retirement, , of a Partner, , 6.61, , corded creditor of R 30,000 will be taken into account., , C) A nu n r e c o r d e d, , NandSwill share the future profits in 2:3 ratio., cndwill ofthe firm on Gs retirement was valued at 7 90,000., , necessary Journal entries for the above transactions in the books of the firm, , on, , G's retirement., Foreign 2017), , TAns.: Loss on Revaluation-7 1,62,450; G's Loan--{ 4,21,275.], uint: 1, For Bad Debts written off: Dr. Bad Debts A/c and Cr. Debtors A/c by T6,000.], Cr., , PROVISION FOR BAD AND DOUBTFUL DEBTS ACCoUNT, 2, , Particulars, , F r t i c u l a r s, , Debts A/c, To Bad, , 6,000, , Revaluation A/c* (Balancing Figure), , 2,550, , o, , Balancec/d [5%of{R 1,35,000-76,00o)], , 15,000, , By Balance b/d, , 6,450, , 15,000, , 15,000, Cess provision for bad and doubtful debts is credited to 'Revaluation Account], , 3. Ashok, Bhaskar and Chaman are partners in a firm, sharing profits and losses as Ashok 1/3, Bhaskar 1/2, and, , Chaman 1/6 respectively.The Balance Sheet ofthe firm as at 31st March, 2021 was:, iabilities, , Assets, , Capital A/cs:, , Building, , 5,00,000, , Ashox, , 3,00,000, , Plant and Machinery, , 4,00,000, , Bhaskar, , 4,00,000, , Furniture, , 1,00,000, , Chaman, , 2,50,000, , 9,50,000, , Stock, , 2,50,000, , 2,20,000, , Debtors, , Sundry Creditors, , 2,50,000, , Less: Provision for Doubtful Debts, , Lcan Payable, , 1,50,000, , Cash in Hand, , 85,000, , Advertisement Suspense Account, , 60,000, , General Reserve, , 15,70,000, , 1,80,000, 5,000, , 1,75,000, , 15,70,000, , Chaman retired on 1st April, 2021 subject to the following adjustments:, la) Goodwill of the firm be valued at 7 2,40,000. Chaman's share of goodwill be adjusted into the Capital, , Accounts of Ashok and Bhaskar who will share future profits in the ratio of 3 :2., 0) Plant and Machinery to be reduced by 10% and Furniture by 5%., , CStock to be increased by 15% and Building by 10%., d), , Provision for Doubtful Debts to be raised to 20,000., , epare Revaluation Account, Capital Account of Chaman and the Balance Sheet of the firm after Chaman's, , retirement., Ans.: Gain (Profit) on Revaluation--7 27,500; Chaman's Loan-* 3,21,250; Partners' Capital Accounts:, , Ashok- 2,98,500; Bhaskar- 5,17,750; Balance Sheet Total- 15,37,500.1

Page 9 :

6.62 Double Entry Book Keeping-CBSE XII|, 34. Chintan, Ayush and Sudha were partners in a firm sharing profits and losses in the., 31st March, 2019, their Balance Sheet, , was as, , the ratio, , follows:, , of, , 5:3:2.0, , 60,000, 5,000, , 304A, , BALANCE SHEET OF CHINTAN, AYUSH AND SUDHA as at 31st March, 2019, Liabilities, , Assets, , Capitals:, , Plant and Machinery, 90,000, , Furniture, , Ayush, , 60,000, , Stock, , Sudha, Provident Fund, General Reserve, Creditors, , 40,000, , Chintan, , 1,90,000, , Debtors, , 30,000, , Less: Provision for Doubtful Debts, , 20,000, , Cash at Bank, , 10,000, , 55 0, 15 00, , 2,50,000, , Chintan retired on the above date and it was agreed that:, , (a) Debtors of T 5,000 were to be written off as bad debts and a provision of 5% on debtors fne, for bad and, doubtful debts was to be created., , debtors, , (b) Goodwill of the firm, , on Chintan's retirement was valued at R 1,00,000 and, will be adjusted by debiting the Capital Accounts of Ayush and Sudha., , (c) Stock was revalued at, , Chintan's share of thee same, sa, , 36,000., , (d) Furniture was undervalued by T 9,000., , (e) Liability for Workmen's Compensation of 2,000 was to be created., (f) Chintan, , was to, , be, , paid 20,000 by cheque and, , the balance was to be transferred to his, loan account, Pass the necessary Journal entries in the books of the firm on Chintan's retirement., , [Ans.: Gain (Profit), 35., , (CBSE2020, , on, , Revaluation-7 10,250; Chintan's Loan-1,35,125, , Pankaj, Naresh and Saurabh are partners sharing profits in the ratio of 3: 2:1. On, retired and on that date, Balance Sheet of the firm was as, follows:, , Liabilities, , 1st April 2021, Naresh, , Assets, , General Reserve, , 12,000, , Sundry Creditors, Bills Payable, , Outstanding Salary, Provision for, , Less: Provision for Doubtful Debts, , 6,000, , Capital A/cs:, , Pankaj, , Debtors, , 12,000, 2,200, , Legal Damages, , Bank, , 15,000, , 7,600, , 6,000, 400, , 5600, 9,000, , Stock, Furniture, , 41,000, , Premises, , 80,000, , 46,000, 30,000, , Naresh, Saurabh, , 20,000, , 96,000, 143,200, , 1,43,200, Additional information:, (a) Premises have appreciated, by 20%, stock, be made 5%, by 10% and provision for dou, on debtors. Further, provisiondepreciated, for, to be brought up to T, legal damages is to be made, 45,000., ror, (b) Goodwill of the firm be, , debts wasto, , 1 , 2 0 0a, ., n dfurnitue, , valued, , at ?, , 42,000., , (c)26,000, from Naresh's Capital Account be, if, bank:, , required, necessary loan may, , be, , through, , transferred to his Loan Account and, Do, obtained from bank.

Page 10 :

6.63, , Chapter 6 Retirement of a Partner, aroit-sharing ratio of Pankaj and Saurabh is decided to be 5: 1., , dNew, profit-s, , necessary Ledger Accounts and Balance Sheet of the firm after Naresh's retirement, (NCERT, Modihed), , G v et h e, , IAns: Gain (Profit) on Revaluation- 18,000, Balances of Capital Accounts of Pankaj-R47.00, and of Saurabh- 25,000; Total Amount at credit in Naresh's Capital--R 54,000;, , Payment to Naresh- 28,000; Bank Loan- 20,400; Balance Sheet Total- 1,54,800, Hint:, , Cr., , BANK ACCOUNT, , Particulars, , Sgnk Loan, , 28,000, , By Naresh's Capital A/c, , 7,600, , Salancebld, , 20,400, 28,000, , A/c (Balancing Figure), , Yand Zare partners sharing, , 28,000, , profts in the ratio, , of 4:3:2.Their Balance Sheet as at 31st March,, , 2021, , stood as tollows:, , Assets, , 3,300, , Cash at Bank, , 24,140, , 3,045, , Sundry Debtors, EtalACS., , Less: Provision for Doubtful Debts, , 12,000, 9,000, 6,000, , 2,940, , 105, , 4,800, 5,100, , Stock, Plant and Machinery, Land and Building, , 27,000, , 15,000, 20,000, , Y's Loan, , 51,140, , 51,140, , Yretired on 1st April, 2021, , after giving due notice., , Following adjustments in the books of the firm, , were, , agreed:, , a)Landand Building be appreciated by 10%., b) Provision for Doubtful Debts is, , no, , longer necessary since all the debtors are good., , cd Stock be appreciated by 20%., mistake previously committed whereby Ywas credited, 6) Adjustment be made in the accounts to rectify a, in excess by, , 810, while X and Z were debited in excess of, , e) Goodwill of the firm be valued, , at, , 420 and, , 390 respectively., , the Capital, 75,400 and Y's share of the same be adjusted to, , ofXand Zwho were going to share future profits, , Accounts, , in the ratio of 2: 1., , Y's account immediately on his retirement., and (ii) Balance Sheet ofthe firm after Y's retirement., Prepare:() Revaluation Account; (i) Partners'Capital Accounts, Amount paid by Y to the firm on his retirement for, [Ans.: Gain (Profit) on Revaluation- 2,565;, , ) It was decided, , by X and Z to settle, , settlement of his account-9,155; Partners' Capital A/cs: X- 12,360; Z- 6,360;, Rectification Entry: Dr. Y's Capital Ac by 810;, Balance Sheet Total-42,860;, Cr. X's Capital A/c by 420 and Z's Capital A/c-7 390.], , A, Band Care, , partners sharing, , profits and, , losses in the ratio of 4: 3:3. Their Balance Sheet, , as at, , 31st March, 2021 is:, , ifies, , Assets, , 7,000, , AS Payeble, , 3,000, , kePrves, apital Alcs., , 20,000, , Land and Building, Plant and Machinery, , 36,000, , Computer Printer, , 8,000, 20,000, , 28,000, , Stock, Sundry Debtors, , 32,000, , Less: Provision for Doubtful Debts, , 24,000, , 20,000, , 76,000, 1,06,000, , Bank, , 14,000, 2,000, , 12,000, 2,000, 1,06,000

Page 11 :

6.64 Double Entry Book Keeping-CBSE XII, On 1st April, 2021, B retired from the firm on the following terms:, , (a) Goodwill of the firm is to be valued at 7 14,000., (6) Stock, Land and Building are to be appreciated by 10%., , (c) Plant and Machinery and Computer Printer are to be reduced by 109%., , (d) Sundry Debtors are considered to be good., (e) Provision for legal charges to be made at 2,000., (f) Amount payable to B is to be transferred to his Loan Account., Prepare Revaluation Account, Partners' Capital Accounts and the Balance Sheet of A, , Cafter, , B's retirement., , [Ans.: Gain (Profit) on Revaluation, , A-, , 2,000; B's Loan-34,800; Partnerc', , 38,400;, , CR 24,800;BalanceSSheet Total-Capital A, 1,10,0, , 38. Followingisthe Balance Sheet of X, Yand Z as at 31st March, 2021.They shared profits in the ratin né Liabilities, , 3:2, , Assets, , Sundry Creditors, General Reserve, , Cash at Bank, , 2,50,000, 80,000, , Bills Receivable, , Partners' Loan A/cs:, X, , Debtors, , 50,000, 40,000, , Less: Provision for Doubtfui Debts, Stock, , 90,000, , Capital A/cs:, X, , Fixed Assets, , Advertisement Suspense A/c, , 1,00,000, 60,000, , Y, , 80,000, 4,000, , 76,00, 1,24,00, 3,00,000, 16,000, 4,000, , Profit and Loss A/c, , 50,000, , 50,000, 60,000, , 2,10,000, , 6,30,000, , 6,30,000, , On 1st April, 2021, Y decided to retire from the firm on the following terms:, , (a) Stock is agreed to be valued at 1,12,000., (b) Provision for Doubtful Debts to be increased, , to, , 6,000., , (c) Fixed Assets be appreciated by 10%., , (d) Goodwill of the firm, valued, , at, , X's and Z's Capital Accounts., , 80,000 and the amount due to the retiring partners be, , adjusted in, , Prepare Revaluation Account, Partners' Capital Accounts and the Balance Sheet to, give effect to the above, [Ans.: Gain (Profit) on Revaluation- 16,000; Y's Loan A/c, 1,58,500; Partners' Capital, , Accounts:, , XR1,10,500;2-7 57,000; Balance Sheet Total--6,26,000, , 39. X, Yand Z are partners sharing, profits and losses in the ratio of 3:2:1. Balance Sheet of the hrm as a, 31st March, 2021 was as follows:, , Liabilities, , Assets, , Creditors, Workmen Compensation Reserve, Investments Fluctuation Reserve, Capital A/cs:, , 21,000, , 12,000, 6,000, 68,000, , 32,000, 21,000, , Debtors, Less: Provision for Doubtful Debts, , 38,000, , 30,000, , Investment (Market Value 17,600), , 15,000, , Machinery, , Goodwill, , 1,60,000, , 40,000, 2,000, , Stock, Patents, , 1,21,000, , 5,750, , Cash at Bank, , Advertisement Expenditure, , retired on 1st April, 2021 on the, following terms:, (a) Goodwill of the firm is to be valued at, 34,800., (b) Value of Patents is to be reduced by 20% and, that of, (c) Provision for doubtful debts is to be @ 6% on, Z, , machinery to 90%., , debtors., , 10,000, 50,000, , 6,000, , 5,250, 1,60,000

Page 12 :

Chapter 6 Retirement of a Partner 6.65, d, , at market value,, the investment, to, e LiabilityforWorkmen Compensa, t, , o, , A, , c, , liability, , ofR, , cluded, , 4,000 inct, , zZ, , the extent of R 750 is to, be created., in creditors is not to, to be, be pai, paid., , to be paid as, , follows;:, to, due to, ount, 7 immediately, 50% of the balance within one year and the balance by a draft for 3 Months., due, , Amount, , ial, , ntris, acsary Journal, Journal eentries, for the treatment of goodwill, prepare Revaluation Account, Capital Accounts, , necessary, , give, , the Balance, , Sheet of the new firm., , [Ans.:Loss on Revaluation- 800; Partners', Capital Accounts: X- 67,120; ana, , R31,413; Z's Loan-2,500; Balance Sheet TotalR 1,21,283.], , arnal Entries for Goodwil:, , () Dr. X's Capital A/c- 3,000; Y's Capital A/c7 2,000 and, Z's, , Capital A/c-T 1,000; Cr. Goodwill A/c-6,000., , (i) Dr. X's Capital A/c--7 3,480 and Y's Capital A/c-{ 2,320;, Cr. Z's Capital A/c-F 5,800.], ent of Loan Account of the Retiring Partner, , hok Bhaskar and Chaman were in partnership sharing profits and losses equally,.'Bhaskar' retires from, m After adjustments, his Capital Account shows a credit balance of R 3,00,000 as on 1st April, 2018., alance due to Bhaskar is to be paid in three equal annual instalments along with interest @ 10% p.a., pDare Bhaskar's Loan ACCOunt until he is paid the amount due to him. The firm closes its books on, , Prepare, 31st March every year., , (Ans.: Interestfor 2018-19=R 30,000. 1stinstalment paid on 3 1st March, 2019=7 1,30,000;, Interest for 2019-20 =R 20,000. 2nd instalmentpaid on 31st March, 2020 =7 1,20,000;, , Interestfor 2020-21 =R 10,000. 3rd instalment paid on31st March, 2021 =71,10,00., 41, Rakesh retired from the hrm. The amount due to him was determined at 90,000. It was decided to pay, , the due amount as follows:, On the date of retirement-7 30,000, , Balance in three yearly instalments--First two instalments being of, 26,000, including interest; and, Balance amount as last instalment., , Interestwas payable @ 10% p.a. Prepare Retiring Partner's Loan Account., , Ans.: Interest payable at the end of ear 1-7 6,000; Year 2- 4000;, Year 3 - 1,800; Last instalment- 19,800.], 2. Ram, Manohar and Joshi were partners in a firm. Manohar retired and his claim including his capital and, , shareof goodwill was, , 1,80,000. There was an unrecorded furniture estimated at, , 9,000, half of which, , Wasgiven for an unrecorded liability of 18,000 in settlement of claim of 9,000 and remaining half was, taken by Manohar at a discount of 10% in part satisfaction of his claim. Balance of Manohars claim was, discharged by bank draft. Pass necessary Journal entries to record the above transactions, , Ans.: Loss on Revaluation--7 4,950. For Payment to Manohar: Dr. Manohar's Capital A/c byR 1,78,350;, Cr. Furniture A/c by 4,050 and Bank A/c by 1,74,300.], , Hint: No accounting entry will be passed for settlement of unrecorded liability with unrecorded asset.], , justment of Capitals, nen Total, ., , Capital of the New Firm is given, X,Y and, u Zare, are partners in a firm sharing profits in the, p, , ratio of 3:2:1.On 1st April, 2009, Y retires from the, , nand Zagree that the capital of the new firm shall be fixed at R 2,10,000 in the proft-sharing ratio. The, andCCOunts of X and Z after all adjustments on the date of retirement showed balance of 1,45,000, , 0 0 0 respectively. State the amount of actual cash to be brought in or to be paid to the partners,, , (AI 2010), [Ans.: New Capitals: X--R 1,57,500; ZR 52,500; Cash brought in by X-T 12.500:, , Cash withdrawn, , by Z-- 10,500.]

Page 13 :

6.66 Double Entry Book Keeping-CBSE XI, 44., , the ratio, , Lisa, Monika and Nisha were partners in a firm sharing profits and loSses in the ratio of, , of, , 31st March, 2019, their Balance Sheet was as follows:, , BALANCE, , SHEET OF LISA, MONIKA AND NISHA, , as, , 2:2:1.On, , at 31st March, 2019, , Assets, , Liabilities, 1,60,000, 2,44,000, 76,000, , Trade Creditors, Bills Payable, Employees' Provident Fund, , Land and Building, , 10,00 000, , Machinery, , 12,00,0, , Stock, , 10,00.000, , Sundry Debtors, , Capitals:, 14,00,000, 14,00,000, 3,60,000, , Lisa, , Monika, Nisha, , 4,00,000, , Bank, , 40,000, , 31,60,000, 36,40,000, , 36,40,000, , On 31st March, 2019, Monika retired from the firm and the remaining partners decided to carry on, the, on he, business. It was agreed that:, , (0Land and building be appreciated byT 2,40,000 and machinery be depreciated by 10%., Gi) 509% of the stock was taken over by the retiring partner at book value., , Cii) Provision for doubtful debts was to be made at 5% on debtors., (iv) Goodwill of the firm be valued at 7 3,00,000 and Monika's share of goodwill be adjusted in the accounts, of Lisa and Nisha., (v) The total capital of the new firm be fixed at R 27,00,000 which will be in the proportion of the new proft, sharing ratio of Lisa and Nisha. For this purpose, Current Accounts of the partners were to be opened., Prepare Revaluation Account, Partners' Capital Acounts and the Balance Sheet of the reconstituted frm, on Monikas retirement., (CBSE20190, , [Ans.: Gain (Profit) on Revaluation, 1,00,000; Monika's Loan Account- 10,60,000; Partners, Capital Accounts: Lisa-- 18,00,000; Nisha-T 9,00,000; Partners' Current Account, Lisa-4,40,000 (Dr.J;Nisha-5,60,000 (Dr.); Balance Sheet Total-7 42,40,00, 45. On 31st March, 2021, the Balance Sheet of A, B and Cwho were sharing profits and losses in proportionto, their capitals stood as:, , Liabilities, , Assets, , Creditors, , 10,800, 5,000, , Bills Payable, Capital A/cs:, , Debtors, , 10,000, , Less: Provision for Doubtful Debts, Stock, , 45,000, 30,000, , 15,000, , 13,000, , Cash at Bank, , 200, , 24,000, , Machinery, 90,000, , 50,000, , Freehold Premises, , 1,05,800, , 1,05,800, B retired, , on, , (a) Out, , of the amount of insurance premium debited to Profit and Loss Account, 1,000 be cat, , 1st, , April,, , 2021 and, , 9,800, 9,000, , following adjustments were agreed to determine the amount pay, , le to b, forward, , as prepaid Insurance., , (b) Freehold Premises be appreciated by 10%., , (c) Provision for Doubtful Debts is, , brought up to 5% on Debtors., , (d) Machinery be reduced by 5%., , (e) Liability for Workmen Compensation to the extent of, 1,500 would be created., (f) Goodwill of the firm be fixed at 18,000 and B's share of the same be, adiusted into the, of Aand Cwho will share future profits in the ratio of 3/4th and 1/4th., , unts, , Capi

Page 14 :

Retirement, , Chapter 6, , of a Partner, , 6.67, , Panital of the firm as newly constituted be fixed at 7 60,000 between A and C in the proportion, or, 1/4th after passing entries in their accounts for, ie., actual cash to be paid, , 10hand, , adjustments,, , o3, f /4th, , cor, continuing, brought in by, , partners as the case may be., , be, to, be, , aid 7 5,000 in cash and the balance be transferred to his Loan Account., , Bbe paid, , Prepare, , Capital, , Accounts, , ofit), Ans: Gain(Profi, , of, , artners and the, , Balance Sheet of the firm of A and C., , on Revaluation- 3,000; B's Loan- 32,000; Partners' Capital Accounts: A-745,000;, , C15,000; Cash brought in by A-R 3,000 and C-71,000; Balance Sheet Total- 1,09,300, uand Z were in, , partnership sharing profits in proportion to their capitals. Their Balance Sheet as on, , AYar, , 31ct March, 2018, , was as, , follows:, , Assets, 4UIES, , 9,000, , wAnen's Compensation Fund, , Cipitals, , 21,000, 19,000, , 58,000, , Machinery, Building, , 90,000, 60,000, , 19,600, , (1,400), , Less: Provision for Doubtful Debts, Stock, , 6,000, , ereralReserve, , 15,000, , Cash, Debtors, , 16,600, , Sndty, CTreditors, , 1,00,000, , 1,80,000, , 30,000, , 11,600, , 2,11,600, Onthe above date, Yretired owing to ill health. The following adjustments, , were, , agreed upon for calculation, , of amount due to Y:, 10% of Debtors., la) Provision for Doubtful Debts to be increased to, the Capital, b) Goodwill of the firm be valued at R 36,000 and be adjusted into, , Accounts of X and, , Z, who, , will share profits in future in the ratio of 3: 1., , ic) Included in the value of Sundry Creditors, , was, , 2,500 for, , an, , outstanding legal claim, which, , will, , not arise., , d), , XandZalso decided that the total capital of the new firm will be, Actual cash to be, , e Yto be paid, , brought in, , or, , to be, , paid off as the case, , 1,20,000 in their profit-sharing ratio., , may be., , 9,000 immediately and balance to be transferred to his Loan Account., , repare Revaluation Account, Partners' Capital, Ys retirement., , Accounts and Balance Sheet of, , new, , firm after, , (CBSE Sample Paper 2019), , Ans.: Gain (Proñt) on Revaluation- 1,800; Y's Loan A/c, , X-, , the, , 68,600; Partners' Capital Accounts:, , Sheet of New Firm-2,02,700.], 90,000; Z-7 30,000; Total of Balance, , New Ratio, Whene, total capital of remaining partners is to be in, existing, of, , Unt Balan, , and Chander, , were, , ECEvely. Chander retired, etrement was as follows:, , on, , profits in the proportion 1/2, 1/3 and 1/6, Sheet of the hrm on the date of Chander's, Balance, 2014. The, , partners in, 1st, , April,, , a, , firm sharing, , Uablies, , R, , Assets, , ndry Creditors, , 12,600, , roident Fund, , eral Reserve, , aphal Alcs. Amit, Balan, , Chander, , 3,000, , Debtors, , 9,000, , Less: Provision, , Stock, , 40,000, , Investments, , 36,500, , 20,000, , 96,500, , Patents, , Machinery, , 1,21,100, , 4,100, , Bank, , 30,000, 1,000, , 29,000, 25,000, 10,000, 5,000, 48,000, , 1,21,100

Page 15 :

6.68 Double Entry Book Keeping-CBSE XII, , It was agreed that:, , () Goodwill will be valued at, , 27,000., , (i) Depreciation of 10% was to be provided on Machinery., , (ii) Patents were to be reduced by 20%., iv) An old photocopier previously written off was sold for 600., , (v) Chander took over Investments for, (vi) Amit and Balan decided, , to, , 15,800., , adjust their capitals, , in, , proportion, , of their, , profit-sharing ratio by, , ano, , Current Accounts., , Prepare Revaluation Account and Partners' Capital Accounts, , on, , Chander's retirement. (Delhi, 2015. Modit.., , odifhed), , Ans.: Gain (Profit) on Revaluation- 600; Chander's Loan Alc-3 10,300; Partners', Capital Accon, Ounts:, Amit-48,000; Balan-7 32,000. Current Accournts: Amit- 5,900 (Dr.};, Balan- 5,900(Cein, Hint: Adjusted Old Capital of Amit 7 42,100;, , Adjusted Old Capital of Balan, Total, , 48., , 37,900;, , of New Firm 80,000., J,Hand Kwere partners in a firm sharing profits in the ratio, of 5:3:2. On 31st March, 2015, their Balance, Sheet was as follows:, Capital, , Liabilities, , Assets, , Creditors, , 42,000, 20,000, 80,000, , Investment luctuation Fund, Proft and Loss Account, , Capital A/cs: J, , 1,00,000, 80,000, 40,000, , H, , K, , Land and Building, , 1,24,000, , Motor Vans, , 40,000, 38,000, , Investments, , Machinery, , 24,000, 30,000, , Stock, , 2,20,000, , Debtors, Less: Provision, , 80,000, 6,000, , Cash, , 3,62,000, On the above, , ), , Goodwill, , (i) There, , date, H retired and Jand, , 74,000, 32,000, 3,62,000, , Kagreed to continue the business on the, following terms:, , of the firm was valued at 1,02,000., , claim of R 8,000 for workmen's, compensation., (ii) Provision for bad debts was to be, reduced by 2,000., Giv) Hwill be paid 14,000 in cash, and the balance will be, transferred in his Loan Account which, paid in four equal yearly instalments, willD, together with interest @ 10% p.a., (v) The new, profit-sharing ratio between J and, profit-sharing ratio. The capital adjustments willKwill be 3: 2 and their capitals will be in tne new, be done by, opening Current, was a, , Accounts., Prepare Revaluation Account, Partners', Capital Accounts and Balance Sheet of the, (Al 2010), new, firm, Ans.: Loss on, Revaluation-R 6,000; H's Loan, A/c- 1,24,800; Partners' Capital Accoounts:, 1,05, 120; K- 70,080; J's Current, A/c- 31,680 (Cr.); K's, Current A/c-R 31,0o0, , Balance Sheet Total- 3,81,680

Page 16 :

Chapter 6, were partners, artners in., in a, Sheet, , Retirement, , of a Partner, , 6.69, , firm sharing profnts and losses in proportion of 1/2, 1/6 and 1/3 respectively, , ofthefirm, , 31st, , as at, , March, 2017 was as follows, , Balanc, , pe, , BALANCE SHEET OF N, S AND Bas at 31st March, 2017, , Assets, , 40,000, , Freehold Premises, , 30,000, 30,000, 28,000, , 30,000, , Machinery, , 12,000, , Furniture, Stock, Sundry Debtors, Less: Provision for Bad Debts, , 88,000, 12,000, 12,000, 18,000, , 22,000, , 20,000, 1,000, , 19,000, 7,000, , Cash, , W F, UAditors, , 1,30,000, , 1,30,000, date and the partners, , hired from the business on the above, to, AFreehold premises and stock were, were to, Machinery and furniture, , Provision for bad, , iv, , debts, , The continuing, , be depreciated, , by 20% and, , if any, in, retirement of B. Surplus/deficit,, , respectively., , 21,000., ratio after, , capitals in their new profit-sharing, through, their Capital Accounts was to be adjusted, , adjust, , to, , 15%, , following:, , by 10% and 7% respectively., , of the firm was valued at, , partners,decided, , to the, , by F 1,50o., , to be increased, , was, , On B's retirement goodwill, , be appreciated, , agreed, , their, , Current Accounts., , Prepare, , Accounts and the Balance Sheet, Revaluation Account, Partners' Capital, , of the, , reconstituted, , to B's Loan, , N-48,730;, , S's Current, , ena, Madan and, , Naresh, , On31st March, 2015,, , were, , partners in, , their Balance Sheet, , Alc (Cr., a, , was as, , S-, , Balance)-15,000; Balance, , firm sharing, , profits, , firm., , (CBSE 2019), , 5,960; Amount transferred, [Ans.: Gain (Profit) on Revaluation16,243; N's Current A/c (Dr., , Partners'Capital Accounts:, , their, , A/c-, , 40,987;, , Balance)-15,000;, , Sheet TotalF 1,50,960.], , and losses in the ratio, , of 2: 2, , 3., , follows:, , 31st March,, BALANCE SHEET as at, , 2015, , Assets, , oe Creditors, , 1,60,000, , wOverdraft, snAen Debts, oyees Provident Fund, , nals. Leena, Madan, , 44,000, 4,00,000, , 76,000, , 5,00,000, , Machinery, , 7,00,000, , Furniture, , 2,00,000, , Investments, , 8,00,000, , Closing Stock, , 12,50,000, 8,00,000, , Naresh, , 10,00,000, , Land and Building, , 4,00,000, , Sundry Debtors, , 80,000, 31,00,000, , 10,50,000, , Bank, , 1,00,000, , Deferred Advertisement Expenditure, , 37,80,000, 37,80,000, remaining, and the, from the firm, under:, 2 0 1 5 , Madan retired, liabilities as, , On 31st March,, business. was decided to, , Land a, ), , u, , lue, , assets, , and, , Building be appreciated by, , 50% of Investments, estments, , were taken, , over, , and, 7 2,40,000, , by the, , parthers, , decided, , depreciated, Machinery be, , at, retiring partner, , book value., , to carry on the, , by 10%.

Page 17 :

6.70 Double Entry Book Keeping-CBSE XII, , (ii) An old customer Mohit whose account was written off as bad debt had, r, had promised to, to pay R, , settlement of his full debt of, , promised, , 10,000., , 7,000 in, , iv) Provision for Doubtful Debts was to be made at 5% on debtors., (v)Closing Stock will be valued at market price which is 7 1,00,000 less than the book value, , (vi) Goodwill of the firm be valued at, , 5,60,000 and Madan's share of goodwill be adiusted, , accounts of Leena and Naresh. Leena and Naresh decided to share future profits and lossec, , ratio of 3:2., (vii) The total capital of the new firm will be, , the, in the, , 32,00,000 which will be in the proportion of the nuae, , rofit, , sharing ratio of Leena and Naresh., , (vii) Amount due to Madan was settled by accepting a Bill of Exchange in his favour payable after 4mant, hs., Prepare Revaluation Account, Partners Capital Accounts and Balance Sheet of the firm after Mara, ans, , retirement., , Al 2016 C, , Ans.: Gain (Proft) on Revaluation R 70,000; Bils Payable Alc-8,51,429; Capital Accounts: Leena19,20,000; Naresh- 12,80,000; Cash brought by:, Leena--78,54,571, Naresh-T 2,26,858; Balance Sheet Total47,31,4291, Note:, , Adjustment No. (l), an old customer Mohit whose account was written off as, , bad debt has promised to, 7,000, is not to be treated as debtors. If this promise was in writing, it could be treated as debtors, , pay, , and revaluation, , profit would have increased by 7,000. However, amount of Provision for Doubtful Debts, , would have increased by 350.Thus, net increase in revaluation profit would be T 6,650., There is another view that, , debtors be increased, , promise, , by 7,000. As, , to pay be, a, , recognised, , as, , income (Bad Debts, , Recovered), , result, Provision for Doubtful Debts will increase by, , and, , 350., , When Mohit is considered as debtor (Adjustment ii), Answer will be as follows:, Gain, , (Profit), , on, , Naresh's Capital, , Revaluation:, , A/c-, , 76,650; Partners' Capital Accounts: Leena's Capital A/c-R 19,20,000;, 12,80,000. Balance Sheet, Bills Payable (Madan)7853,329., , TotalR47,33,329., , When Total Capital of New Firm is, , equal to Total Capital before Retirement of a Partner, Following is the Balance Sheet of Kusum, Sneh and Usha as on 31st March, 2021, who have, agreed to share, , 51., , profits and, , losses in, , propórtion, , of their, , capitals:, , Liabilities, , Assets, , Capital A/cs:, Kusum, , 4,00,000, 6,00,000, 4,00,000, , Sneh, , Usha, , Employees' Provident Fund, Workmen Compensation Reserve, , 14,00,000, 70,000, 30,000, , Sundry Creditors, , Land and Building, , 4,00,000, , Machinery, , 6,00,000, , Closing Stock, , 2,00,000, , Sundry Debtors, Less: Provision for Doubtful Debts, Cash at Bank, , 2,20,000, , 20,000, , 2,00,000, , 2,00,000, , 1,00,000, , 16,00,000, , 16,00,000, , On 1st April, 2021, Kusum retired from, the firm and the, remaining partners decided to carry on the D, It was agreed to revalue the assets, and reassess the liabilities on that, date, on the following Dasi, (a) Land and Building be, 30%., appreciated by, , (b), (c), , Machinery be depreciated by 30%., There were Bad Debts, of 35,000.

Page 18 :

Chapter 6, , gainst Workmen, Theclaim agains, , Retirement, , 6.71, , of a Partner, , Compernsation Reserve was estimated at 15,000., , was valued at, 2,80,000 and Kusum's share of goodwill was adjusted against, ofthe firm, nts of the continuing partners Sneh and Usha who have decided to share future, , e l Goodwil, , the Capital Accounts, , 4 respectively., , of 3:, profits in the, hrm in total will be the same as before the retirement of Kusum and will be in the, new, of the, Capital, nital oft, ratio, , ft-sharing ratio of the continuing partners., , new profit-s, , mount due to Kusum, , Amo, , Account, , Loan, , be settled, , which will, , by paying, , 1,00,000 in cash and balance by transferring, , paid later on., , Revaluation Account, capital Accounts of Partners and Balance Sheet of the new firm after, , enare, repa, , to her, , Kusum's, , (AI 2012 C, Modifhed), , r e t i r e m e n t ., , Sneh-6,00,000;, Ans.: Loss on Revaluation- 75,000; Kusum's Loan- 3,62,857; Capital Accounts:, , Usha-7800,.00; Balance SheetTotal- 19,47,857; Cash at Bank-R 6,22,857], , Hints:, , 1., , ForBad Debts:, Bad Debts A/c, , ..Dr., , 735,000, 35,000, , To Sundry Debtors A/ce, , Provision for Doubtful Debts A/c, , ..Dr., , Revaluation A/c, , ...Dr., , 20,000, 15,000, 35,000, , To Bad Debts A/c, , 2. Usha is a gaining partner, so she will contribute towards Kusum's share of goodwill.], , When the Retiring Partner is to be paid from cash brought by the remaining partners, ina manner to make their Capitals Proportionate to New Ratio, a Lal, Bal and Palare partners sharing profits in the ratio of 5:3:7. Lal retired from the firm. Bal and Pal, , decided tosharefuture profits in the ratio of 2:3.The adjusted Capital Accounts of Bal and Pal showed, balances ofT 49,500 and 7 1,05,750 respectively. The total amount to be paid to Lal is, , 1,35,750. This, , amount is to be paid by Bal and Pal in a manner that their capitals become proportionate to their new, , profit-sharing ratio., Calculate the amount to be brought or to be paid to partners., , [Ans.: Balbrings 66,900 and Pal brings 68,850., 3.Balance Sheet of X, Yand Z who shared profits in the ratio of 5:3:2, as on 31st March, 2021 was as follows:, , LDNitIes, , Assets, , Swnrdry Creditors, gioyees Provident Fund, , 39,750, , 5,250, , Wskmen Compensation Reserve, , 22,500, , ajtal Aics., , Bank (Minimum Balance), , 15,000, , Debtors, , 97,500, 82,500, , Stock, Fixed Assets, , 1,87,500, , 1,65,000, 84,000, 3,15,000, , 66,000, , 3,82,500, , 3,82,500, , Y, , retired on 1st April, 2021, , and it, , was, , agreed that, , Oodwill ofthe firm is valued at 1,12,500 and Y's share of it be adjusted into the Capital Accounts of, and Zwho are going to share future profits in the ratio of 3:2., , Fixed Assets be, , by 200, Stock be reducedappreciated, to 75,000.

Page 19 :

6.72 Double Entry Book, , Keeping-CBSE XI, , 2, brought by X and, (iv) Y be paid amount, , sharing ratio., , Prepare, , Revaluation, , sO as to make, , their capitals proportin., , ionate to their, , Accounts of all partners and the Balance Sh, Account, Capital, , ney, , of the NewFir, , : Gain (Proft) onRevaluation- 30,000; CopitalAccounts:X- 2,20 S, FiFirm., Amount Paid to Y- 1,33,500; Balance Sheet Total- 4,12.500. G, 00; Gaining Ratio-i,, X, , ;2-147, , Pays-40,500; ZPays--, , 3,00, , Retiring Partner is to be paid from cash brought by the remainiag partners, in a manner to make their Capitals Proportionate to New Ratio and also leav Parthe, When the, , Iso leave a, , Cash/Bank Balance, , desirireded, , 54. Sushil, Satish and Samir are partners sharing profits in the ratio of 5:3:2. Satish retires on, , from thefirm,on which date capitals ofSushil,Satish and Samir after all adjustments are 71 0 E, and 26,880 respectively. The Cash and Bank Balance on that date was9,600, 500. Satishisisto, to be, be paid, paidtt, amount brought by Sushil and Samir in such a way as to make their capitals, proportionate to thoi., 1eir, profit-sharing ratio which will be Sushil 3/5 and Samir 2/5. Calculate the amount to be paid ors, brought by the continuing partners if minimum Cash and Bank balance of 7,200 was to hem to be, , 680, 8734, , intained, , and pass the necessary Journal entries., 55. A,, , [Ans.: Sushil and Samir will bringR25,920 and, , Band Care partners in a firm sharing profits and losses in the ratio of 3:2:1.Their, , 31st March, 2021 is:, , Liabilities, , 59,520 respective, BalanceSheet as t, , Assets, , Creditors, Bills Payable, , General Reserve, Capital A/cS:, 4, , 40,000, 40,000, 30,000, , 30,000, , Cash in Hand, , 16,000, 12,000, , Debtors, , 18,000, 25,000, , Less: Provision for Doubtful Debts, Stock, , 3,000, , 18.00, , Furniture, , 1,10,000, , 30,0, 70,000, 10,00, , Machinery, Goodwill, , 1,68,000, B retired, , on, , 1st, , April,, , 2021, , on, , the, , 22.000, , 1,68,.00, , following terms:, , (a) Provision for Doubtful Debts be, raised by 1,000., (b) Stock to be reduced, 10%, and Furniture, by, by 5%., (c) There is an, outstanding claim of damages of 1,100 and it is, to be provided for., (d) Creditors will be written, back by 6,000., (e) Goodwill of, the firm is valued at 22,000., (f) B is paid in ful with the, cash, in by A and C in, such a manner that tneu, proportion to their proft-sharingbrought, ratio and Cash in, Hand, remains, Prepare Revaluation, at 10,000., , Account, Partners' Capital, Accounts and the Balance Sheet, of Aand, Ans.: Gain (Profit) on, Revaluation- 600; For, 1,833; Cr. Bs Capital A/c-R, Goodwill: Dr. A's Capital A/c-T, 7,333; Balances of, Capital A/cs after adjustments:3,A, C28,600; Capitals, Cash withdrawn by CRearranged: A- 78,450; C- 150; Cash brought by, 2,450; Cash Balance, 26,150, , are in, , Foreign2003, Modihe, , - 4 8 2 0 0, , e, , 10,000 (i.e., 18,000 +R42,050, , -F4263, , F2450, , B a l a n c e S h e e tT o t a l - 1 4 5

Page 20 :

Chapter 6, , Retirement, , of a Partner 6.73, , The, , Balance Sheet of Asha, Deepa and Lata who were sharing profits in the ratio of 5:3:2as at 31st March,, 2021 is as follows:, Assets, , iabilities, , 40,000, , Creditors, , 50,000, , Employees' Provident Fund, , 10,000, , Cash at Bank, Sundry Debtors, , Proft and Loss A/c, , 85,000, , Stock, , 80,000, , Fixed Assets, , 60,000, , Capital A/cs:, Asha, , 40,000, , Deepa, , 62,000, , Lata, , 33,000, , 1,00,000, , 1,35,000, , 2,80,000, , 2,80,000, , Asha retired on 1st April, 2021 and Deepa and Lata decided to share profits in future in the ratio of 3 :2, , respectively., The other terms on retirement were:, , (a) Goodwill of the firm is to be valued at, , 80,000., , (b) Fixed Assets are to be depreciated to 7 57,500., (c) Make a Provision for Doubtful Debts at 5% on Debtors., , (d) A liability for claim, included in Creditorsfor, , 10,000, is settled at, , 8,000., , The amount to be paid to Asha by Deepa and Lata in such a way that their Capitals are proportionate to, , their profit-sharing ratio and leave a balance of T 15,000 in the Bank Account., , Prepare Revaluation, , Account and Partners' Capital Accounts., , [Ans.: Loss on Revaluation- 5,500; Payment to Asha- 1,19,750;, Partners' Capital Accounts: Deepa-{ 1,18,500; Lata-~ 79,000.], [Hint: Shortage of Cash/Bank to be brought by Deepa and Lata in order to make payment to, Asha = 7 1,02,750.], , EVALUATION QUESTIONS: QUESTIONS WITH MISSING VALUES