Page 1 :

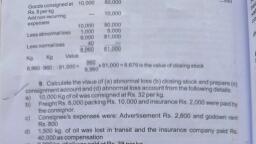

ASSIGNMENT -3, CONSIGNMENT ACCOUNT, , SECTION A, 1. What is over-riding commission?, 2.What is Account Sales?, 3.Who is consignee and consignor?, 4.Give the meaning and example for non-recurring expenses in consignment accounts., , SECTION B, 1. Mr. Akash sent goods worth Rs. 20,000 to Mr. Vikas and paid Rs. 1200 for Packing, and Rs. 1600 for Insurance., Me. Vikas took the delivery of the goods and paid Rs. 4,000 for cartage, Rs. 300 for, unloading, Rs. 1,200 for Godown rent and Rs. 1,600 for selling expenses., Mr. Vikas sold 3/4th of the goods for Rs. 28,000., Compute the value of closing stock., Solution:- 6,775, 2. Mr. A sent goods to Mr.B costing Rs. 1,00,000 on consignment basis. Mr. A incurred, freight Rs. 2,000, Loading charges Rs. 8,000, Octroi Rs. 4,000, Mr. B sold 75% of the goods for Rs. 80,000 and incurred carriage to Godown Rs., 2,000., Unloading charges Rs. 4,000, Godown Rent Rs. 10,000 and Selling Expenses of Rs., 2,000., Calculate the value of closing stock., Solution :- 30,000, 3. Calculate the value of Abnormal loss and value of closing stock from the following, details:, Goods sent on consignment – 800 boxes of Glasswares at Rs. 200 per box., Cosnignor Expenses Rs. 2,000, Goods lost in Transit 40 boxes, Consignee Expenses Octroi Rs. 1,400 and selling expenses Rs. 2,000, Goods sold by the consignee 680 boxes, Goods damaged at Consignees place 2% of the goods consigned., Solution:- 13,359, 4. From the following information calculate, a) Abnormal Loss, b) Value of closing stock

Page 2 :

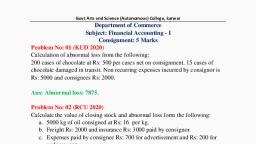

Oil supplied on Consignment 600kg at Rs. 18 per kg., Packing and forwarding charges paid by consignor Rs. 6,000., Oil Stolen in Transit 1000 Kg., Oil sold by Consignee 4,500 kg at Rs. 25 per kg., Loss due to evaporation during storage is 5%., Solution:- 4,043, , SECTION C, 1. Ramesh consigned 2,000 MT of Chemicals at a Cost of Rs. 800 per MT to John. Ramesh, , paid Freight and Insurance Charges of Rs. 20,000 of the above 500 MT of Chemicals were, destroyed by fire during transit. John cleared the balance of 1,500 MT of Chemicals and Sold, 1,000 MT at an Average Price of Rs. 1,000 per MT John incurred the following Expenditure:, Godown Rent, , Rs.5,000, , Insurance, , Rs.3,000, , Clearing Charges, , Rs.4,500, , Insurance Claim received against Fire Rs.4,00,000 after admitting the salvage value of stock, destroyed by fire at Rs.10,000. John was entitled to a Commission of 10% on sale proceeds., Prepare, (a)Consignment A/c =79,000(b) Consignee A/c=8,87,500, 2. Amit Oil Mills,Cochin consigned 2,500 kg. of castar oil to Madhu and Co., Varnasi in, April 1, 2018. The cost of oil was Rs.18 per kg. The consignor paid Rs. 900 towards carriage,, freight and insurance in transit. During transit 250 Kg.oil was accidentally destroyed in, transit for which the insurance company paid Rs.2,200 in full settlement of the claim directly, to the consignor., Madhu & Co. took delivery of the consignment on April 10,2018 and accepted, a bill drawn on by Deepak oil mills of Rs.5,000 for 2 months. On June 30,2018, Madhu &, Co. reports 1,750 Kg. were sold at Rs.25 per kg. The expenses of the consignee were Rs., 1,850 towards godown rent, advertisement and salaries of salesmen. Madhu & Co. further, reported a loss of 20Kg.leakage in the consignee godown. Prepare necessary ledger, Accounts., 1. Consignment A/c=7,294, 2. Madhu and Company A/c= 34,712, 3.Goods sent on Consignment A/c=45,000

Learn better on this topic

Learn better on this topic

Learn better on this topic

Learn better on this topic